People are interested in the strength of India's economy, the country's stability, and the opportunities, says Stuart Tait, regional head of commercial banking, Asia-Pacific at HSBC.

At a time when the chances of a US-China trade deal look slim and the global economic growth is tepid, intra-Asia trade is increasing, driven by Chinese consumption, according to Stuart Tait, regional head of commercial banking, Asia-Pacific at HSBC.

In an interview with Anup Roy, Tait says Indian companies are most optimistic about trade and economic growth.

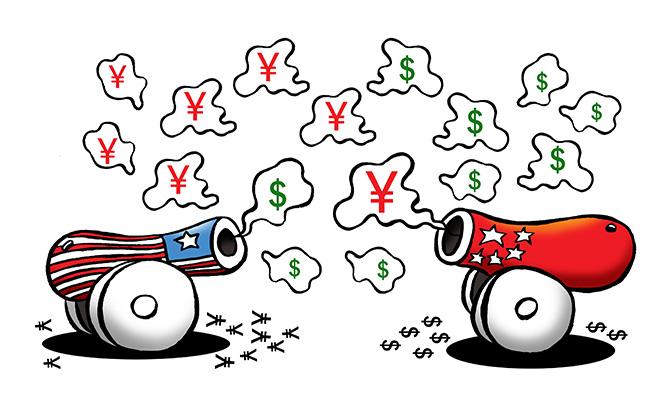

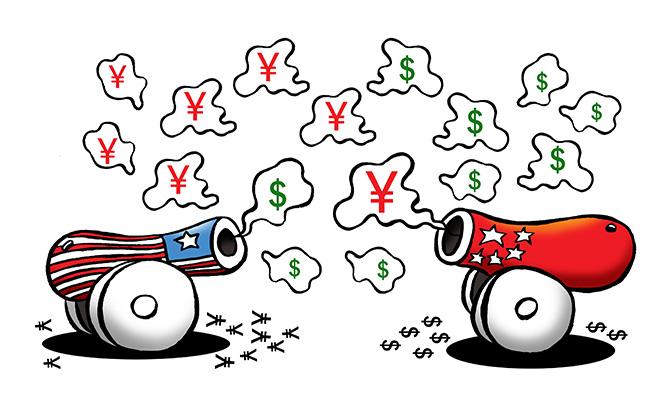

How is the US-China trade tension panning out in Asia?

As far as our customers are concerned, trade within Asia remains strong. Companies continue to invest, but inevitably they are looking more closely at supply chains and how they manage, where they are producing, and where they are selling.

Are the Asian economies increasing trade between themselves because of trade tensions?

I think what's becoming more apparent is that Asian trade is actually freeing up.

It's because of some agreements that have been put in place... we look at the dynamism of the Association of Southeast Asian Nations (Asean) region.

The fact is China still drives intra-Asia trade and Asia is a more important market than Europe and North America.

Our customers are active and we are active in supporting intra-Asia trade.

China continues to buy strongly and consumer consumption is the real driver in Chinese economy.

It's not just China exporting to the rest of the world, it's also about imports and consumer confidence going up in Asia.

What is driving this intra-Asia trade?

There is urbanisation, wealth creation, population growth... And so the future prospects for consumption and growth remain strong in Asia.

Trade volumes in Asia were $12 trillion in 2017 and we expect them to go to $29 trillion by 2030.

Image: Stuart Tait, regional head of commercial banking, Asia-Pacific at HSBC. Photograph: Courtesy Stuart Tait/LinkedIn

How is India positioned in this Asian trade scene?

We have got a team here which is particularly busy right now. The focus is on providing on-the-ground support in India for companies that are headquartered around the world.

How we are distinguished here is that we not only do this for large companies, but also for small companies.

There's real interest in India right now. People are interested in the strength of the economy, the country's stability, and the opportunities.

In case of outbound deals, we support companies across sectors. We have worked with many Indian pharmaceutical companies, auto-component makers, textiles, IT companies and others.

But India's growth rate has also slowed recently.

We did a survey of over 8,000 companies for our HSBC Navigator report (released in November 2018).

So the time when people were well aware of the trade tensions, 96 per cent had a positive outlook on global trading environment.

The global average was 78 per cent. Of the Indian respondents, 97 per cent were optimistic about India's growth prospects, the global average was 76 per cent.

Two-thirds of the Indian firms expected industry- or sector-specific free trade agreements to have a positive impact.

One area that stood out the most is that Indian businesses were the most confident about the positive impact of India's free trade agreement with Asean.

So the India-Asean connection is particularly strong.

Much of the trade in Asia is being driven by development finance banks...

Commercial banks have a role to play too. There is a trade gap of $1.5 trillion in the world that isn't met by the world's leading trade finance banks (Asia is about 40 per cent of this).

We are trying to digitise trade to help make it more accessible, quicker and cheaper. Blockchain is one element of that. We undertook the world's first blockchain finance last year.

The second transaction was with Reliance Industries in India. It will take three to five years to build a scale because so many parties are involved.

But it has been proven beyond a concept. We handle a 100 million pieces of papers a year for trade finance, so we are as keen as anybody to digitise and then use blockchain as much as we can.