'I would not suggest buying these stocks in the dip, as the upside in profit is dented without a safety net for a rainy day.'

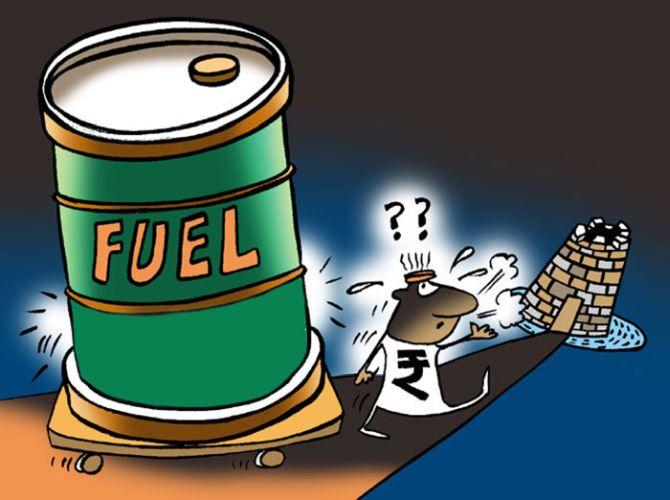

Shares of oil upstream companies, including Reliance Industries (RIL), ONGC, and Oil India, came under heavy selling pressure after the government imposed taxes on the export of petrol, diesel, and aviation turbine fuel (ATF), as it mandated exporters of these products to meet the requirements of the domestic market first.

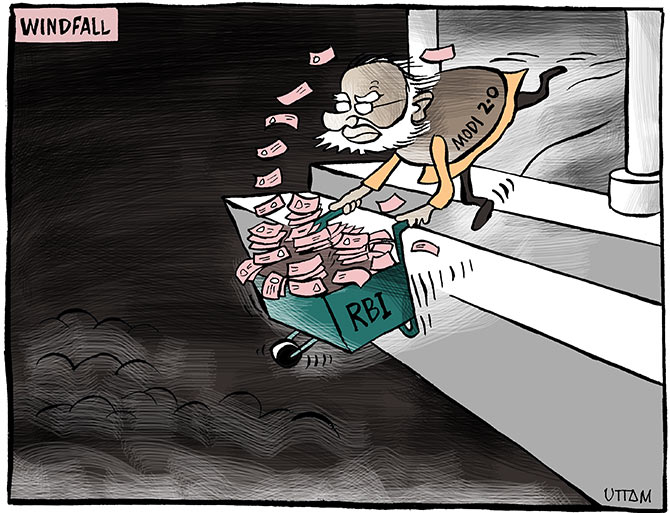

Besides taxing exports, the government also announced the imposition of windfall tax on gains made by domestic refineries due to a surge in crude oil prices.

A cess of Rs 23,250 per tonne on domestic crude production was also imposed.

Overall, India exported 42 per cent of its diesel and 44 per cent of its gasoline production in fiscal 2021-2022 (FY22), according to estimates.

The windfall gains tax, Ambareesh Baliga, an independent market analyst said, will continue to be the proverbial Damocles Sword hanging on most of the cyclical sectors, especially commodities; and the measures announced will set the precedence for such taxes going ahead.

"This is surely negative for oil refiners as well as explorers. A question which arises is that although the government can justify levying such taxes on windfall profits during euphoric times, how will the industry get compensated when the prices are not remunerative?", Baliga asked.

"I would not suggest buying these stocks in the dip, as the upside in profit is dented without a safety net for a rainy day," Baliga added.

Disadvantage RIL?

Export-oriented units like RIL, wrote analysts at Morgan Stanley in a note, will have to sell 30 per cent of diesel locally to not attract this tax.

Assuming the full impact of the regulations on both diesel and gasoline, they estimate $6-$8 per barrel hit on RIL's gross refining margin (GRM).

RIL currently via its petrochemical, B2B and retail fuel stations, sells about 40-50 per cent of its products locally.

'However, the sales are heavily naphtha-weighted and we still await details on RIL's diesel sales locally. Since most other refiners largely sell locally, the impact on earnings will be limited,' Morgan Stanley analysts said.

Higher cess on domestic crude production of $40 a barrel for ONGC and OIL, too, came in as a negative surprise, said analysts at Morgan Stanley, and should imply downside risks for the sector multiple over the medium-term.

The move, according to their estimates, will impact ONGC and OIL earnings for fiscal FY23 by 36 per cent and 24 per cent, respectively.

Among individual stocks, shares of RIL plunged nearly 9 per cent, ONGC 14 per cent, Oil India 16.5 per cent in intra-day trade on July 1 before recovering partially.

Over the past few weeks, most foreign brokerages including Bernstein, Morgan Stanley and Jefferies had upgraded RIL and expected the counter to move past the Rs 3,000 mark.

"The main focus of the government, it seems, is to increase the domestic supply of these products, which will help cool inflation. The excise duty on petrol and diesel was also cut recently for this. The July 1 development will also cap the benefit some companies are getting on the export of these products. Once the inflationary pressures recede, these taxes can be reversed," said Gaurang Shah, senior vice president, Geojit Financial Services.

The fall in RIL and ONGC, Shah believes, presents a good opportunity for long-term investors.

"GAIL is also on our 'buy' list. Other than a handsome dividend, there is nothing much government-owned oil refining and marketing companies have given to the shareholders. There is no charm to look at OMCs. BPCL, which was put on the divestment list, has also been put in cold storage," he added.