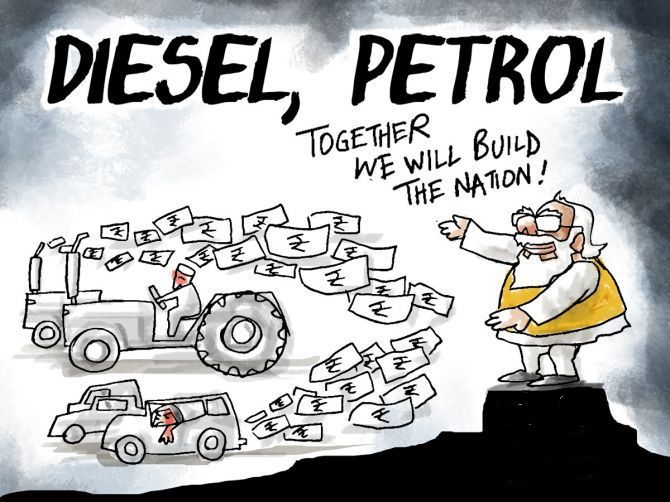

The government on Friday slapped an export tax on petrol, diesel and jet fuel (ATF) while also joining nations like the UK in imposing a windfall tax on crude oil produced locally.

A Rs 6 per litre tax on export of petrol and ATF and Rs 13 per litre tax on export of diesel is effective from July 1, finance ministry notifications showed.

Additionally, a Rs 23,250 per tonne tax was levied on crude oil produced domestically.

The export tax is to deter companies such as Reliance Industries and Rosneft-based Nayara Energy from preferring overseas markets over domestic supplies.

The levy on crude, which follows record earnings by state-owned Oil and Natural Gas Corporation (ONGC) and Oil India Ltd (OIL) and private sector Cairn Oil & Gas of Vedanta Ltd, alone will fetch the government over Rs 7,000 crore annually on about 30 million tonnes of crude oil produced domestically.

A windfall tax is a one-off tax on companies that have seen their profits surge extraordinarily not because of any clever investment decision they've taken or an increase in efficiency or innovation, but simply because of favorable market conditions.

Recently, the UK levied a 25 per cent tax on "extraordinary" profits from North Sea oil and gas production to raise $6.3 billion to help fund its support package.

The Indian government had cut excise duty on petrol and diesel to ease inflationary pressure.

This move had cost the government Rs 1 lakh crore.

The export tax follows oil refiners particularly Reliance Industries and Rosneft-backed Nayara Energy making a killing in exporting fuel to deficit regions such as Europe and the US in the aftermath of Russia's invasion of Ukraine.

They are said to have processed Russian crude oil available at a discount after it was shunned by the West and exported fuel produced from it to Europe and the US.

The government also framed new rules requiring oil companies exporting petrol to sell in the domestic market, the equivalent of 50 per cent of the amount sold to overseas customers, for the fiscal year ending March 31, 2023.

For diesel, this requirement has been put at 30 per cent of the volume exported.

These restrictions on export are also aimed at shoring up domestic supplies at petrol pumps, some of which had dried up in states like Madhya Pradesh, Rajasthan and Gujarat as private refiners preferred exporting fuel to selling locally.

Exports were preferred as retail petrol and diesel prices by dominant PSU retailers have been capped at rates way lower than the cost.

This meant that private retailers, who control less than 10 per cent of the market share, either sell fuel at loss or lose market share if they were to sell at a higher cost.

Later, the finance ministry in a statement said crude prices have risen sharply in recent months which has benefited domestic producers who sell oil to domestic refineries at international parity prices.

"As a result, the domestic crude producers are making windfall gains.

"Taking this into account, a cess of Rs 23,250 per tonne has been imposed on crude," it said.

"Import of crude would not be subject to this cess."

This new levy, which is equivalent to almost 40 per cent of the price oil companies realise, will be in addition to the royalty and the oil industry development cess that companies such as ONGC and Cairn pay.

"Further, small producers, whose annual production of crude in the preceding financial year is less than 2 million barrels will be exempt from this (new) cess," the ministry said.

"Also, to incentivise an additional production over the preceding year, no cess will be imposed on such quantity of crude that is produced in excess of last year's production by a crude producer."

The ministry said while crude prices have increased sharply in recent months, the prices of diesel and petrol have shown a sharper increase.

"The refiners export these products at globally prevailing prices, which are very high.

"As exports are becoming highly remunerative, it has been seen that certain refiners are drying out their pumps in the domestic market," it said without naming any company.

In view of this, cesses equal to Rs 6 per litre on petrol and Rs 13 per litre on diesel have been imposed on their exports.

These cesses would apply to any export of diesel and petrol from the country.

"These measures would not have any adverse impact on domestic retail prices of diesel and petrol.

"Thus, domestic retail prices would remain unchanged.

"At the same time these measures will ensure domestic availability of the petroleum products," it said.

A special additional excise duty (SAED) of Rs 6 per litre has been imposed on exports of Aviation Turbine Fuel (ATF).

Like diesel and petrol, the international prices of ATF have risen sharply and so an additional duty has been imposed.