The National Company Law Tribunal on Thursday, January 12, 2023, approved the merger of multiplex operators PVR and Inox, the two chains said in separate filings to the stock exchanges.

Advocates said it could take some more days for the detailed order to be made available. After that it would be filed with the registrar of companies and disclosed to the stock exchanges.

On Thursday the NCLT, Mumbai bench, delivered a verbal order, wherein the merger ratio of three shares of PVR for 10 shares of Inox was approved, persons in the know said.

On March 27, 2022, PVR and Inox, the country's largest and second-largest cinema chains, had announced that they proposed to come together, which would result in a network of over 1,500 screens.

The proposal was subject to approvals from the NCLT, stock exchanges, the Securities and Exchange Board of India as well as shareholders and creditors.

While stock exchanges, Sebi, shareholders and creditors approved the proposal over the past few months, the NCLT's approval was pending.

A non-profit organisation called CUTS had moved the Competition Commission of India against the merger, and approached the National Company Law Appellate Tribunal after its petition was dismissed by the CCI.

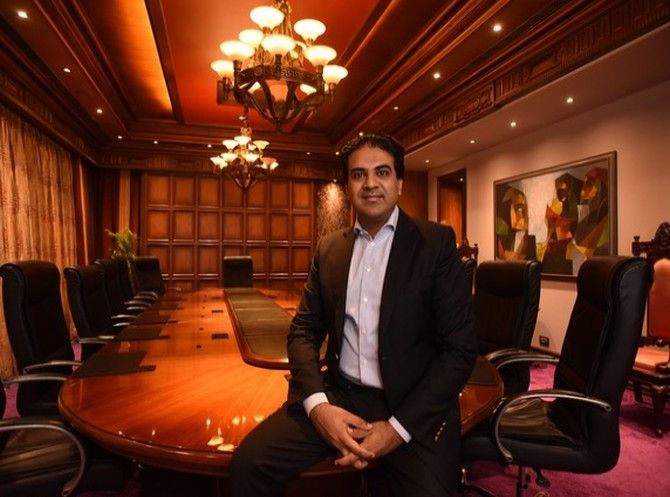

In a conversation with Business Standard last month, Siddharth Jain, director of the Inox group, said the NCLAT had listed the matter for February 9.

PVR is likely to issue shares to Inox shareholders in the next few weeks, after the NCLT's detailed order is received, said persons in the know.

The combined entity will be named PVR Inox, with the branding of existing screens to continue as PVR and Inox. New halls opened after the merger will be branded as PVR Inox, the companies had said last year.

After the merger, the promoters of Inox will become co-promoters in the merged entity, along with the existing promoters of PVR. PVR promoters will have a 10.62 per cent stake, while Inox promoters will have a 16.66 per cent stake in the combined entity.

PVR Joint Managing Director Sanjeev Bijli said the combined entity would have 3,000 to 4,000 screens in five years. For this, the merged entity would tap newer cities, which were unserved and had huge potential, he said.

In particular, markets in the southern and eastern parts of the country would be on their radar to improve penetration, Biji said.

"We would love to have more players entering the market because that is how the business will grow," Siddharth Jain, director of the Inox group, told Viveat Susan Pinto/Business Standard in an earlier interview.

What will be your role in the merged entity?

I will be a non-executive director on the board while my father (Pavan Kumar Jain) will be the chairman.

Ajay Bijli will be the managing director and his brother Sanjeev Bijli will be an executive director.

With CUTS approaching the NCLAT against the proposed merger, do you see the merger process getting delayed?

CUTS first approached the Competition Commission of India against the proposed merger a few months ago. The plea was dismissed by the latter.

They have now approached NCLAT against the CCI's order. NCLAT will hear CUT's application on February 9. Let's see what happens.

The point about consolidation and appreciable adverse effects on competition due to the merger is a concern in a few quarters. How do you respond to this?

Consolidation in the domestic film exhibition business has been going on for a while now.

However, if you look at the market, in the past ten years, you've had new cinema chains stepping into the fray.

We would love to have more players entering the market because that is how the business will grow.

Inox Air Products is a leading producer and supplier of industrial and medical gases in India. During the second Covid wave, you were amongst the key suppliers of medical oxygen to hospitals.

How do you see the situation unfolding in India with this new variant spreading fast in China and other parts of the world?

The government is on high alert and monitoring the situation carefully.

So far, the requirement for medical oxygen similar to the second wave has not emerged. But we remain vigilant.

Where do you see Inox Air Products five years from now?

We started the business in 1963. Back then, we did not have a tie-up with the US-based Air Products.

The joint venture with Air Products happened in 1999. It has been 24 years since the JV was established. It is also amongst the longest-running Indo-American joint ventures in India.

At this stage, we have a top-line of Rs 2,500 crore (Rs 25 billion). Five years from now, we hope to double this turnover.

Producing and supplying industrial and medical gases is a capital-intensive business. What is the capex you have lined up for next year?

In 2021, we had earmarked a capex of Rs 2,000 crore (Rs 20 billion

We have finished round one of this capex and should conclude the second round in the next few months.

Meanwhile, we are already looking at a new round of capex of Rs 1,000 crore (Rs 10 billion).

All of this will be utilised to grow the business.

We have factories in 17 states and supply gases to some of the top companies in sectors like steel, pharmaceuticals and other manufacturing industries.

InoxCVA is the country's largest maker of cryogenic equipment for oil and gas, and other sectors. With an IPO in the works, what is the plan for this company?

The transition to clean energy is a big area of focus.

Companies that want to make that transition will need cryogenic equipment.

We are working towards clean energy initiatives in LNG, liquid hydrogen and fusion energy.

The proposed IPO should help us, as we are looking to set up a new plant in Gujarat and expand further into markets such as the US and Europe.

Feature Presentation: Rajesh Alva/Rediff.com