'When the country is jobless, why should I pay through my nose to feed these people who want some perks in office?'

'Let them also join India's unemployed.'

'Let them also taste the bitter medicine of being jobless.'

"The government closed down all these ministries in 2014, the economy would have been robust today," M R Venkatesh, the well known chartered accountant, lawyer and political commentator, tells Shobha Warrier/Rediff.com in the concluding part of the interview.

They say the role of the RBI is that of a watchdog of all banks. Has the RBI been watching or curbing the proper functioning of the banks?

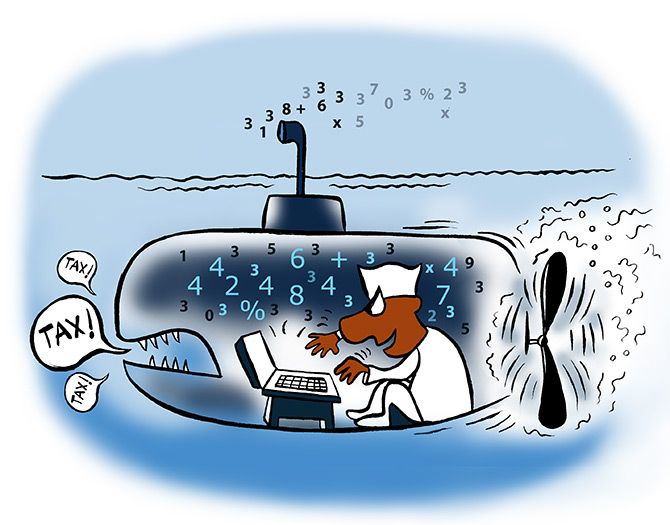

I don't know what role the RBI is playing. I think the RBI has more or less become a redundant organisation.

For example, in the case of any fraud involving a bank, the RBI is like the police of the 1970s Hindi movies and arrives only in the last scene! I guess there must be a serious introspection on the RBI's role.

An expert committee must look into what the RBI should do and what it should not.

The RBI governor said the pandemic would lead to higher NPAs and capital erosion.

This is a no-brainer because the economy is down and people don't have income.

Obviously, NPAs will rise as people might not have paid the EMI for the last 3 to 5 months because jobs are lost.

Until the economy is revived, people will not have the money to repay the EMIs of house loans too.

House loans are supposed to be one of the safest, and that itself is in doldrums now. So, NPAs will rise at every level.

What is the solution? Instead of coming out with a solution, he is coming out with a diagnosis.

(RBI Governor) Shaktikanta Das must write a prescription for the disease, but he is acting like a lab technician and handing out a diagnosis.

Many economists say what we are going to see is not just a recession but an economic depression which independent India has not seen.

I don't think there will be an economic depression.

Technically we may be down in growth, we may even go in negative growth. But in the Indian context and given the fact we are facing the Covid lockdown, this is just a passing phase.

And it is expected as each one of us is sitting at home doing nothing.

We cannot expect the entire population to be in their homes and the economy to boom. So, this is the outcome of the lockdown.

When the lockdown is over -- I do not know when it will happen -- but when the lockdown ends we will bounce back quickly.

But the economy was in a bad shape even before the pandemic.

It was not robust, I agree. But you will have to also consider the fact that the growth I am talking about is going to happen without the government. Or outside of the help of the government.

I am of the view that this time the growth will happen on our own initiative. I see little or no help from the government, Centre or state.

I am certain the economic policies of the government are not focussed on wealth creation and helping entrepreneurs.

So, economic growth will be despite the Government of India, and not because of the Government of India.

Are you not being optimistic?

I am optimistic because the entrepreneur of India is a very optimistic, and a sincere and hardworking guy. That gives me this optimism.

I am rooting my optimism on the hard work and sincerity of the Indian entrepreneur, and not on the economic policies of the Government of India.

What will happen to the MSMEs which contribute 80% of India's businesses but are in real bad shape?

After the new classification, the new calculations suggest that 98% to 99% of business entities now come under the MSME sector.

After the new classification, the new calculations suggest that 98% to 99% of business entities now come under the MSME sector.

The government has to do two things. One is to see that the NPA norms are relaxed. You can't declare 99% of your businesses as NPAs. It will be foolish to do so.

It also means the entire country or 99% of the business in the country will be an NPA! You cannot declare India to be an NPA.

The RBI must act with great alacrity, which means there is no point for the RBI governor to do breast-beating at a conference now and then. He can jolly well declare that the NPA norms are relaxed because of what is happening right now.

Some sort of relief has to happen without diluting the overall discipline of repayment.

Unfortunately, the RBI is not even in a mood to think about it.

The problem with the RBI is none of them has ever run a business. None of them has ever been in commercial banking. None of them knows commercial borrowing. And yet they are given all powers and consequently pontificate ceaselessly.

RBI people are mere theoreticians, and they need to take a crash course on reality.

Unless there is a practical approach, we will find ourselves in a major soup.

In the document you sent the government, you want the government to close down 20 ministries and 100 departments. You want these ministers and bureaucrats to be jobless?

When the country is jobless, why should I pay through my nose to feed these people who want some perks in office?

So, let them also join India's unemployed.

Let them also taste the bitter medicine of being jobless.

Anyway, they already have no job, and there is no need for several ministries and several departments. Most of them survive at the cost of the entrepreneurial talent of India.

Had the government closed down all these ministries in 2014, the economy would have been robust today.

Unnecessary regulations, unnecessary laws and unnecessary legislations are binding India to where she is now.

Free India from bureaucratic excesses and then you will see India's entrepreneurial soul get liberated.

Ultimately, we can only prescribe the medicine. If the patient refuses to take it, what can we do? We can't force-feed the medicine.