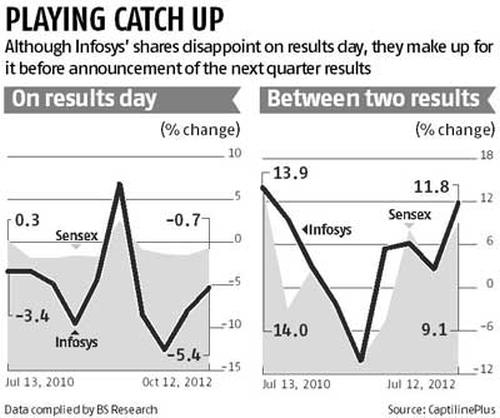

It seems Infosys Technologies investors go by the adage 'one swallow doesn't make a summer'. Though the Infosys stock has regularly tanked on days the company's results are announced, it has made up for the losses before the announcement of the next results.

According to an analysis by the Business Standard Research Bureau, in nine of the last 10 quarters, Infosys shares have seen a sharp fall on the day its results are announced. However, on most occasions, the stock outperformed the market before its next quarterly results.

According to an analysis by the Business Standard Research Bureau, in nine of the last 10 quarters, Infosys shares have seen a sharp fall on the day its results are announced. However, on most occasions, the stock outperformed the market before its next quarterly results.

For instance, on April 13, after the results for the quarter ended March were announced, the Infosys stock tanked 13 per cent after the company, which earns most of its revenue from exports to the US, forecast muted revenue growth in dollar terms for 2012-13. But the stock outperformed the Bombay Stock Exchange (BSE) benchmark Sensex in the run-up to the results for the quarter ended June, announced on July 13.

A similar story played out during the announcement of the results for the quarter ended June. The stock fell about 8 per cent on July 12, after the company's results and guidance again disappointed investors. However, between July 12 and October 12 (the day it announced its September quarter results), the stock rallied about 12 per cent, outperforming the Sensex, which gained nine per cent during the period.

On October 12, Infosys disappointed the Street by cutting its full-year (2012-13) revenue guidance further, both in rupee and dollar terms. Following this, the stock, after crashing more than seven per cent in intra-day trade, closed 5.4 per cent lower.

Since then, however, the stock has moved in line with the market in four trading sessions, though there is a fair chance the stock may again outperform the market before the December quarter numbers are announced.

Broking firms seem to be positive on the stock. Thirteen brokerage houses have a 'buy' or 'accumulate' rating on the company stock, with target price of Rs 2,520-2,900 in the next twelve months, an rise of 6-20 per cent, compared to current levels.

On Thursday, Infosys shares closed at Rs 2,375.80 on the BSE, up 0.34 per cent.

Domestic brokerage Prabhudas Lilladher is bullish on the stock, with a price target of Rs 2,900. "The management has retained its 2012-13 revenue guidance. The asking compounded quarterly growth rate for the second half of FY13 is 3.7 per cent. The October-March period is seasonally weak, but the management was confident of attaining the guidance on an organic basis. The deal wins, client budget and bottoming-out ramp-downs have been key reasons for the management's confidence," Prabhudas Lilladher analyst said in a report.

"After the performance in the first half of FY13, the company requires at least 3.5 per cent quarter-on-quarter growth in the next two quarters to achieve its 2012-13 dollar revenue growth guidance, which, in the current scenario, looks a bit stretched. The company can achieve 5-5.5 per cent year-on-year revenue growth in 2012-13, including revenue from Lodestone," Angel Broking said in a report.