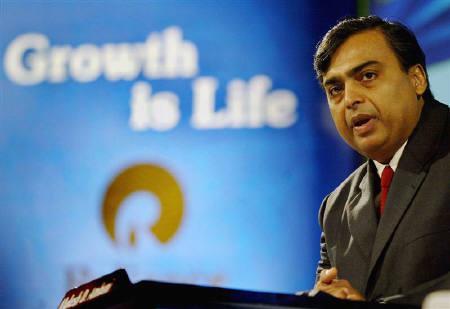

Convicted hedge fund founder Raj Rajaratnam wanted former Goldman Sachs director Rajat Gupta to ask Indian industrialist Mukesh Ambani if his company Reliance Industries was planning to 'aggressively' get into the solar business, information federal prosecutors want to include as evidence in Gupta's ongoing insider trading trial.

In court documents submitted on Monday, prosecutors said they want to offer as evidence an April 3, 2008, email from former McKinsey executive Anil Kumar to Gupta to demonstrate the 'close' relationship between Gupta and Rajaratnam, particularly the 'mutual trust' between them.

In the April 2008 email, labelled 'urgent', Kumar told Gupta that Rajaratnam wanted him to ask whether "Reliance Industries Limited would be getting into the solar business aggressively because, if so, there would be implications for supplier companies."

. . .

According to the email, Kumar said, "When with Mukesh on portfolio question. . . 2 things to explore: A) Raj wants to know if they will get into the solar biz aggressively and when (there are implications for supplier companies etc)."

(sic) The email was sent to Gupta around the time he was scheduled to meet Ambani.

Ambani has not been accused of any wrongdoing in the case.

Kumar has pleaded guilty to insider trading and is cooperating with prosecutors.

He is scheduled to take the witness stand in Gupta's trial, which began on May 21.

"The proffered testimony of Kumar is relevant to demonstrate the nature of the relationship between Gupta and Rajaratnam, particularly the mutual trust between them and that their relationship was so close that Rajaratnam was willing to confide in Gupta, the former worldwide head of McKinsey, about his illicit activities with Kumar in violation of McKinsey policies and US tax laws," the prosecutors said.

. . .

US District Judge Jed Rakoff, presiding over the case, has not yet decided whether to allow the email into evidence.

The government alleges that Kumar received money from 2004 through 2006 in exchange for providing Rajaratnam with material, non-public information.

Kumar received approximately $125,000 every 3 months in 2004 and 2005, as well as a bonus of one million dollars in late 2006 after providing Rajaratnam with material, non-public information.

During a July 29, 2008 call between Gupta and Rajaratnam, the Sri Lankan founder of the Galleon hedge fund told Gupta that he was 'giving him [referring to Kumar] a million dollars a year for doing literally nothing.'

In the July 29 call, Rajaratnam also cites the name of Ambani's younger brother industrialist Anil Ambani as he discusses with Gupta how a telecom fund can be set up.

. . .

The names are cited as an example, with Gupta saying meetings with them will be 'completely different' as opposed to meeting other businessmen in relation to the telecom fund.

Gupta has pleaded not guilty to the charges that he provided secret company information, particularly those he received in his capacity as board member, to Rajaratnam, who has been found guilty of insider trading and is currently serving an 11-year prison sentence.

The trial of Gupta, who is charged with conspiracy and securities fraud, is into its second week.

Gupta's lawyers used their cross-examination of Proctor and Gamble Chief Finance Officer Jon Moeller to suggest to the jury that there could have been people other than Gupta who supplied confidential company information to Rajaratnam, particularly about P&G's 2008 sale of its Folgers Coffee unit.

. . .

Defense attorney Gary Naftalis questioned Moeller about who were the other company officiuals who were aware about Cincinnati-based P&G's plans to sell the coffee unit to J M Smucker Co.

Gupta is accused of passing information he received during the board meeting about P&G's plan to sell the coffee unit as well as company earnings in January 2009 to Rajaratnam.

Moeller said employees in nearly half-dozen departments at P&G as well as J M Smucker and bankers and lawyers were aware of the deal weeks before it was announced.

"And all these people were working on the transaction, in addition to the Smucker people?" Naftalis asked Moeller in Manhattan federal court. "Yes, that's true," Moeller said.

. . .

Taking the witness stand after Moeller, former Galleon portfolio manager Michael Cardillo told jurors he bought Smucker stock in June 2008 after being told by Rajaratnam's brother R K Rajaratnam that Smucker would buy Folgers.

Cardillo said Rajaratnam's brother told him that "the information was coming from Rajaratnam's guy at P&G."

Cardillo bought 75,000 Smucker shares for RK Rajaratnam on June 2, 2008 and 17,000 shares for himself the next day, the first time he had bought the stock.

Prosecutors showed as evidence instant messages and emails in which R.K. Rajaratnam told Cardillo to buy Smucker stock.

. . .

Last week, Cardillo testified that he was told by R.K. Rajaratnam that the part of P&G's earnings known as 'organic growth' wasn't as high as expected.

Rajaratnam's brother said the information came from his 'guy' on the P&G board, Cardillo said.

Cardillo has pleaded guilty to insider-trading charges and is cooperating with prosecutors.

He will continue to be crossed examined later today by Gupta's defense team.

Gupta's defense team has argued that Rajaratnam had other sources, who gave him insider information and the prosecution has no hard evidence that it was Gupta who passed on company secrets to the Sri Lankan hedge fund founder.