The Reserve Bank of India has room to cut interest rates and revive growth without having to fret about capital flight, says Andy Mukherjee.

The Reserve Bank of India (RBI) has already cut rates twice this year. Traders are expecting an equal number of reductions by the end of 2015, according to current consensus forecasts.

The Reserve Bank of India (RBI) has already cut rates twice this year. Traders are expecting an equal number of reductions by the end of 2015, according to current consensus forecasts.

However, that won't be enough. To be effective, the RBI may need to be at least twice as bold.

It surely has the room. The rupee's relative stability means the monetary authority can cut borrowing costs without having to worry about capital flight.

The Indian currency is down eight per cent against a strong dollar over the past year. But there is little alarm in the marketplace about a sudden slide.

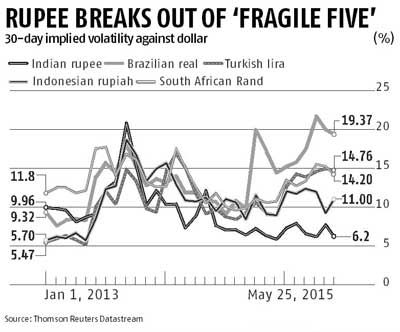

Implied volatility, a measure of traders' expectation of near-term exchange-rate swings, is far lower for the rupee than it is for the Brazilian real, Turkish lira or South African rand.

The current calm stands in sharp contrast with the squalls of two summers ago, when the United States Federal Reserve's decision to wind down its asset purchases set off an emerging-market tempest.

At the time, Morgan Stanley bracketed India with Indonesia, South Africa, Turkey and Brazil, as a member of the "Fragile Five", the dubious club of countries that the investment bank judged to be most vulnerable to capital exodus. Even with the Fed on course to raise interest rates this year, investors aren't pulling out of India this time.

Foreigners have purchased almost $13 billion of Indian equities and bonds so far this year.

The inflows would have been even higher if India's finance ministry hadn't spooked overseas investors by slapping them with an unexpected tax bill.

More than $2 billion has left Indian shares and bonds this month.

The authorities are now in damage control mode. Though the tax dispute will linger, the finance ministry has at least dumped its plan to clip the central bank's wings by taking away its power to supervise the government bond market.

Meanwhile, the more dangerous idea of subjecting the RBI's regulatory decisions to judicial review has been put in cold storage.

With risks to the central bank's credibility receding, Governor Raghuram Rajan has a chance to answer his critics by doing more to support output and investment.

Manufacturing production and non-farm credit are barely growing.

Manufacturing production and non-farm credit are barely growing.

With inflation at 4.9 per cent in April - well below the RBI's January 2016 target of six per cent - further easing is warranted. All this points to another rate cut on June 2, when the RBI next reviews its policy.

But that alone won't be enough. The two quarter-percentage point cuts the central bank has pushed through so far this year have had limited impact because banks have not passed on the benefit to borrowers.

Lenders are using the gains from lower funding costs to repair their stressed balance sheets. With the government in no mood to spend taxpayers' money on a meaningful recapitalisation of state-run banks, the RBI will have to push harder at the monetary levers. Another reason for Governor Rajan to be more aggressive is a sharp drop in federal spending.

The government hit the brakes on expenditure in the three months to March in an effort to keep its annual Budget deficit at four per cent of gross domestic product (GDP) - below the target of 4.1 per cent.

With a new fiscal year starting from April 1, the finance ministry could once again start signing cheques. Yet the fiscal squeeze won't fully end.

That's because New Delhi is pushing more expenditure decisions to India's 29 states.

Their share of the combined tax pool has been bumped up to 42 per cent, from 32 per cent earlier.

While devolving spending authority is a good thing in the long run, many sub-national governments might end up saving the windfall this year.

The RBI needs to offset this fiscal contraction. The final reason for cutting rates boldly is the currency.

Though the rupee is stable, it is gaining ground against a basket of trading partners' currencies.

That's problematic. Global trade volumes are weak and India's exports are sputtering.

Governor Rajan is resisting overvaluation by selling rupees: he has added more than $100 billion to India's foreign exchange reserves over the past year and a half - a time when other emerging markets have been forced to sell dollars to prevent their currencies from slumping against a resurgent greenback. Reserve accumulation is making it harder for speculators to bet against the rupee.

That, too, helps explain the Indian currency's steadiness. The window for rate cuts might close if global oil prices recover further, pushing up India's current account deficit.

Widespread crop damage because of a likely El Niño weather pattern this year could also reignite domestic inflation.

Besides, Governor Rajan's job might become a lot tougher if the finance ministry fails to pass a crucial goods and services tax (GST) Bill in Parliament, or ends up conceding to the states' demand for an impractically high 20 per cent plus rate for the proposed tax.

The tax, which is expected to replace many existing sub-national levies on movement of goods from April next year, is a once-in-a-generation chance for India to unify its fragmented markets and engineer a bout of benign disinflation, not dissimilar to what China witnessed after joining the World Trade Organization in 2001.

If the GST is a damp squib, investors might lose faith in Prime Minister Narendra Modi's pledge to make India a manufacturing nation.

They may demand higher interest rates to hold Indian bonds.

Before any of those risks come home to roost, Governor Rajan may as well make use of the calm rupee and give the struggling economy a chance.

Andy Mukherjee is the Asia economics columnist at Reuters Breakingviews in Singapore.; these views are his own