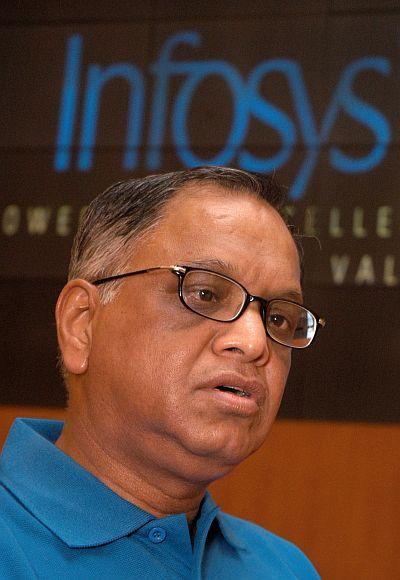

After the third-quarter numbers of Bangalore-based Infosys, equity analysts have been touting the firm’s stock but executive chairman N R Narayana Murthy and sector analysts agree the current set of numbers are more a reflection of the cost-cutting it has done.

Based on the results of the previous two to three quarters, many have begun to assume the company is back to growth but a closer look shows the recent gains are about cost initiatives.

Murthy, during an analysts’ call, acknowledged this. “In my AGM (annual general body meeting) speech, I did say cost optimisation is one of the initiatives that will yield results earlier (six to 18 months) than the other two. Sales effectiveness will take nine to 21 months and delivery effectiveness between 12 and 36 months,” he said.

…

A look at the December quarter (the third one or Q3) numbers tells the story. The start performer was margin improvements, which saw the impact of cost cutting.

Gross margins improved 79 basis points (bps) on a sequential basis, led by tailwinds from cost rationalisation efforts.

At 25 per cent, earnings before interest and taxes (Ebit) margins improved 142 bps quarter on quarter, led by a 90 bps reduction in sales and marketing expenses over the earlier one.

“The services industry has six to seven levers by which they can improve margins. In the case of Infosys, Murthy has increased the focus on increasing the offshoring component. Even a few points of changes in the offshore ration mix can bring huge margin gains,” said a senior banker, on condition of anonymity.

…

In Q3, the company's onsite effort reduced to 24.6 per cent from 25.6 per cent in the previous one. Sources within the company say Murthy has been pulling all strings possible to reduce the cost overhang.

This has even meant small steps like no gym facility available after 8 pm; those working late or after 8 pm also need manager approval to do so (ensuring employee productivity is high).

“Unbilled employees onsite are being called back immediately. Over the last few years, people who were onsite and not billed could stay on for a few more weeks but that is not the case any more,” said an employee, on condition of anonymity.

However, all the decisions are not going well. “During the recent annual event called STRAP, Murthy said onsite (costs) will come down, as they want more to be offshored.

…

This was the longest issue discussed, as employees were not too happy. But Murthy said this is an industry trend and the changes will happen here, too,” said another employee.

Perhaps one reason for the continued high attrition. Analysts believe the cost rationalisation measures being implemented, which have starting showing results in the company's margins, are likely to prove of much more importance over the next few quarters.

For, these should help it gain an advantage against competitors in getting new orders.

…

Catch-up still

Yet, all agree the real turnaround will come when Murthy’s impact is evident on sales and delivery.

“Though he has cracked the cost effectiveness nut, sales and delivery effectiveness will take time. He is still working on how the sales team can increase productivity and outcome,” said a senior analyst.

For every success in cost rationalisation the company reported during the quarter, it had equal numbers of areas of concern.

For instance, sales and marketing expenses dropped to Rs 644 crore from Rs 757 crore in the quarter ending September 30.

…

Volume growth was a mere 0.7 per cent and there was a fall in revenue from the top five clients by 4.5 per cent. Revenue from North America was down 0.8 per cent.

“The decline in top-five client revenue cannot be explained by the offshorisation argument alone. The decline possibly captures the impact of furloughs, pricing decline or, possibly, loss of share of business,” said Kawaljeet Saluja, Rohit Chordia and Shyam M of Kotak Institutional Equities Research.

Despite a salary rise, staff attrition continues to be high, at 18.1 per cent. Peers Tata Consultancy Services and Cognizant have nine-10 per cent attrition.

…

“With client budgets starting to get allocated, we are puzzled by the decline in billable headcount. We are also surprised that S&M (sales and marketing) employee costs are almost back to levels seen in the first quarter. Management does not seem concerned on this account and have promised to ramp up investments in sales personnel at the bottom of the pyramid. We are also puzzled by this approach, as we would have expected senior hires from MNC competition to accommodate the new focus on large deals,” said a report from Centrum.

Murthy’s role in getting the delivery effectiveness in place will be crucial, as the company has been losing its edge over demand forecasting. Employee costs at Infosys ballooned due to poor demand forecasting in 2010-12.

…

A high focus on discretionary revenues had reduced visibility, while a lack of a reasonably large contract base adversely impacted utilisation, as bench strength rose sharply, said Bhuvnesh Singh of Barclays Equity Research in a report.

“This has also impacted the project level forecasting. No one in the industry is perfect but Infosys has to work more on this to come out as one of the best yet again,” said an analyst.

Murthy in control

A big positive that both employees and analyst concur Murthy is now in control of the operations.

“I think with Murthy moving out of day-to-day operations, we all felt a bit lost; our morale was low. He has a huge impact on employee morale,” said a staffer with the company for seven years.

…

“NRN has shaken the pillars of complacency at the company and has set a clear benchmark of ‘perform or perish’ for all. He has conveyed a ‘grow or throw’ policy, which is benefiting the company a lot. The best part is this witch-hunting is happening at the top of the pyramid, which gives a clear message to everyone at the company and even those outside,” said an analyst with a foreign brokerage, on condition of anonymity.

According to research analysts, there are mainly three parameters where the company has seen improvement since NRN’s return - expectation management, doing away with complacency and cost cutting.

…

"We have always known Infosys for its crystal-clear communication with analysts and investors, but it had faded in the middle. However, the company has regained its best in class communication and there is much more clarity about the company now than before," said Shashi Bhusan, research analyst at Prabhudas Lilladher.

Murthy has a lot of work at Infosys before it play catch-up to TCS or Cognizant. “They are nowhere near where TCS or Congnizant is in terms of performance. TCS has gone way to ahead,” said an investment banker.

T R Madan Mohan, managing partner, Browne & Mohan sums it all well. “What Murthy brings back is founder's passion and hunger to succeed in the second inning, which is also an important element in turnaround.”