Defending the timing of Yes Bank's moratorium, Reserve Bank of India governor Shaktikanta Das on Friday assured swift resolution to the issues concerning the beleaguered lender.

“The resolution (to Yes Bank) will be done very swiftly, it will be done very fast. 30 days which we have given is the outer limit. You will see a very swift action from RBI,” Das told reporters in Mumbai.

The decision on Yes Bank was taken at a larger level, not only to deal with the problem in an individual entity, but also to maintain stability and resilience of the Indian financial and banking sector, he said.

“Let me assure you that our banking sector continues to be sound and safe," Das said, adding that RBI was ready to effectively deal with the challenge ahead.

"We stand committed to maintaining stability of financial and banking sector,” he said.

On the timing of the action on Yes Bank, he said there is always debate over RBI acting prematurely or taking too long to act.

“A market-led and bank-led resolution of the problem is always preferable. You have to give time to the bank management to take step and efforts. And the bank did take efforts. When we found that we cannot wait and should not wait any longer, we decided to intervene.

“I think the timing is appropriate. I can assure you that RBI will come out with a scheme very shortly,” Das said.

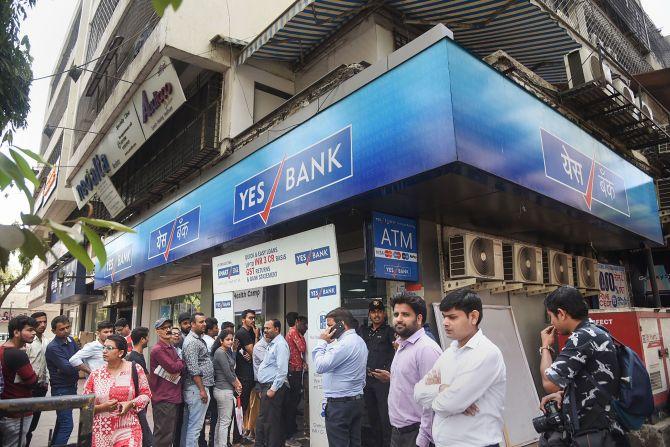

Yes Bank was on Thursday placed under a moratorium, with the RBI capping deposit withdrawals at Rs 50,000 per account for a month and superseding its board.

The bank will not be able to grant or renew any loan or advance, make any investment, incur any liability or agree to disburse any payment.

For the next month, Yes Bank will led by the RBI-appointed administrator Prashant Kumar, an ex-chief financial officer of SBI.

Depositors’ money safe: CEA

Chief Economic Advisor Krishnamurthy Subramanian on Friday said all options are under consideration for restructuring Yes Bank and assured that depositors' money was safe.

His remarks come a day after the cash-starved lender was placed under a moratorium, with the RBI capping deposit withdrawals at Rs 50,000 per account for a month and superseding its board with immediate effect.

"The RBI has taken right steps. Yes Bank depositors' money is safe," he told reporters after meeting Finance Minister Nirmala Sitharaman.

Asserting that the interest of Yes Bank customers will be protected, Subramanian said all options are under consideration for restructuring Yes Bank.

With the RBI superseding Yes Bank board, the troubled lender will not be able to grant or renew any loan or advance, make any investment, incur any liability or agree to disburse any payment.

The board of country's largest lender State Bank of India has given "in-principle" approval to invest in Yes Bank.

Yes Bank has been struggling to execute a capital raising plan for the last six months. Its core equity tier-I ratio has slipped to 8.7 per cent as of September. The bank has also delayed its December quarter results.

Problem bank-specific: SBI chairman

A day after the RBI superseded the board of India's fourth-largest private sector lender Yes Bank, State Bank of India chairman Rajnish Kumar on Friday said the problem at hand is lender-specific and not sectoral.

On Thursday, the SBI board gave its "in-principle" approval to exploring investment opportunities in Yes Bank.

"The RBI has said they will come out with a restructuring plan (for Yes Bank)," Kumar told reporters after meeting Finance Minister Nirmala Sitharaman.

The resolution will come "very shortly," he said without elaborating.

The Reserve Bank on Thursday placed Yes Bank under a moratorium and imposed limits on withdrawals.

"This is not a sectoral problem. It is a bank-specific problem," he said. "The RBI will take all steps to ensure financial stability."

On SBI picking up a stake in Yes Bank, he said the lender already has an in-principle approval for doing so.

"If SBI has to pick up a stake in Yes Bank, we have an in-principle approval for that," he said.

The RBI has capped withdrawals from Yes Bank at Rs 50,000 for the next one month and imposed strict limits on operations after the cash-starved lender faced "regular outflow of liquidity" after an effort to raise new capital failed.