Multiple triggers such as asset sales, pickup in energy cash flows, increased traction in omni-channel retail, and rise in ARPUs could further drive the stock.

Reliance Industries hit a record high of Rs 1,647.85, advancing 2 per cent, on the BSE on Tuesday.

So far in financial year 2020-2021 (FY21), the stock has outperformed the S&P BSE Sensex by surging 46.5 per cent till Monday, as against a 13 per cent rise in the benchmark index, ACE Equity data shows.

The rally has been sharper at 80 per cent from the recent low in March 2020 and has been fuelled by the firm’s ability to garner 10 foreign investments in its subsidiary Jio Platforms for a whopping Rs 1.04 trillion, from leading global investors.

The rally might not be over just yet.

According to Morgan Stanley, multiple triggers – asset sales, pickup in energy cash flows, increased traction in omni-channel retail, and rise in telecom average revenue per user (ARPUs) – could further drive the stock.

“One-year forward price-to-earnings (P/E) and price-to-book (P/B) are now near peak cycle levels, but return on equity (ROE) and earnings growth are significantly higher than history and peers,” said Mayank Maheshwari, equity analyst at the firm, along with Parag Gupta and Sulabh Govila, in a report.

Future drivers

Monetisation of the remaining assets, after the sale of nearly $14 billion of assets and Rs 53,000 crore rights issue, would cut net debt to near zero, says Maheshwari.

“We see potential debt reduction of nearly $22 billion in the next nine months given the completion of sale of a 50 per cent stake in retail fuel stations to BP; completion of stake sale in Jio Platforms and tower InViT stake sale; positive free cash flows (FCF) generation from steady energy utilisation and slowing investments.

"The on-track sale of stake… to Saudi Aramco and remaining rights issue proceeds should also further reduce liabilities,” he adds.

While the Street is discounting-in debt reduction on the digital side, the analysts believe, it is not factoring-in a demand recovery after Covid-19 in consumer retail domestically and refined products globally.

This, they say, is the second trigger, and are expecting RIL to garner $2-2.5 billion in free cash flow in FY21.

The third trigger, is RIL’s focus on small and medium enterprises, which might look at digitisation.

According to Morgan Stanley, the partnership with Microsoft, a memorandum of understanding (MoU) with Facebook, and its offline retail infrastructure will not only raise revenues for digital, but also support retail business.

Analysts at Goldman Sachs peg the firm’s grocery retail gross merchandise value at $83 billion by FY29, up from $5 billion in FY20 due to continued store expansion-driven market share in the offline grocery, and rapid expansion of the total available market in online grocery.

Moreover, they expect retail business Ebitda growth of 5.6x between FY20-29.

CLSA, too, remains bullish on the stock and suggests success in e-commerce, closure of the InvIT stake sale, more stake sales of Jio, and progress in the Aramco deal are the triggers.

“Recent partnerships with Facebook-owned WhatsApp for JioMart will only help in increasing monetisation opportunities by increasing the convenience and reach of consumers,” wrote Vikash Kumar Jain and Surajdev Yadav of CLSA in a May 26 note.

Morgan Stanley maintains an ‘overweight’ on the stock with a target price of Rs 1,801, while Goldman Sachs has ‘buy’ call with a 12-month target price of Rs 1,755.

That said, Maheshwari says higher cash burn as RIL ramps up online retail sales, potential holding company discount affecting multiples, and slower recovery in refining margins might act as risks to potential upside.

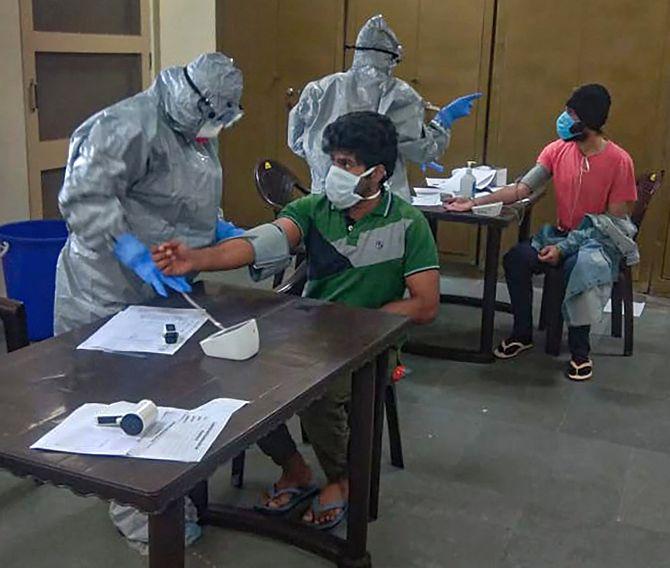

Photograph: Mitesh Bhuvad/PTI Photo