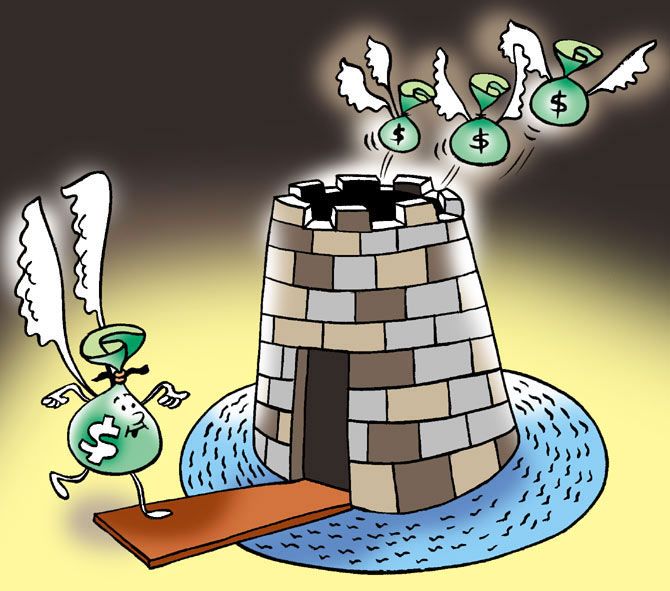

This is the worst start to a year when it comes to sell-off from foreign portfolio investors (FPIs).

After a brief respite at the year’s start, FPIs have dumped shares worth more than $5.7 billion (Rs 42,596 crore), taking the cumulative net outflows since October to $10.5 billion (Rs 78,466 crore), and adding to the volatility on the bourses.

The figure would have been a lot worse had it not been for net purchases to the tune of $5.7 billion in the primary market from October to date.

“FPIs seem to be gearing up for a number of eventualities,” said U R Bhat, co-founder and director at Alphaniti Fintech.

“Interest rates are set to rise in the backdrop of inflationary pressures in developed markets and elsewhere.

"Depending on how fast the US Fed raises rates, the impact on emerging market equities is likely to be negative.”

The huge sell-off by FPIs is due to a switch from risky assets to bonds given the change in risk-reward dynamics, say analysts.

With the US 10-year Treasury yield nearing 2 per cent, overseas funds are selling equities and buying bonds, they say.

The move comes ahead of the widely anticipated rate hike by the US Federal Reserve next month.

The surge in crude oil prices and heightened geopolitical tensions between Russia and Ukraine have also added to the uncertainty.

Global crude oil prices have risen more than 20 per cent this year to more than $90 per barrel, prompting Saudi Arabia to raise oil prices for customers in Asia, the US, and Europe.

“Given faster-than-expected tightening by the Fed, an overall de-rating for global equities, including India, cannot be ruled out,” said Jitendra Gohil, analyst at Credit Suisse Wealth Management, India, in a January 20 note.

“We expect selling pressure from FPIs to continue given faster tightening by the Fed and surging oil price environment. Nevertheless, we believe the equity market could largely remain supported and may find buying interests on corrections given marked improvement in India’s macro fundamentals.”

“Indian equities have had a good run for some time now and FPIs may see this as a good time to book profits,” added Bhat.

India’s benchmark indices have retreated 0.7 per cent in the year-to-date period, and have outperformed most other emerging markets.

What has cushioned the blow is the sustained buying from domestic institutional investors (DIIs), especially mutual funds, and retail investors.

MFs shopped for equities worth about $9 billion between October and January.

DII holding in the Nifty500 firms climbed 20 basis points (bps) in Q3 even as FPI holding declined 60 bps during this period.

“There is enough liquidity in the market to absorb the selling by FPIs as mutual funds and retail investors have stepped up their purchases.

"This is also the reason why the impact cost on FPI sales would have been minimal. Had this quantum of selling happened before March 2020, the markets would have crashed,” said Bhat.

Credit Suisse’s Gohil does not anticipate India’s valuation premium to materially de-rate in the near term given marked improvement in its macro fundamentals and strength in corporate balance sheet.

This along with healthy earnings momentum over the next couple of years could keep investors' interest high, Gohil said.

Indian equities continue to be expensive as measured by a number of yardsticks.

Currently, the MSCI India Index is trading at a 12-month forward PE of 23.6 times, representing over 90 per cent premium versus the MSCI Emerging Markets, as against the 10-year average of 44 per cent.

Half of the Nifty constituents trade at a premium to the historical averages.

India’s market capitalisation-to-GDP ratio is at 116 per cent based on FY22E gross domestic product numbers, above its long-term average of 79 per cent and at its highest level since CY07.

India’s share in the world m-cap stands at 3 per cent, which is the highest since January 2011.