The biggest headwind to the consumption story in FY23 is a sharp decline in government subsidies on food, fertiliser and fuel, and overall decline in revenue expenditure net of interest payments.

This, analysts say, will adversely impact purchasing power of households at the lower end of the income pyramid, translating into lower spending on consumer goods and services.

The 2022-23 fiscal year could be tough for companies in consumer demand-related sectors, such as fast-moving consumer goods (FMCG), consumer durables and automotive, because of multiple headwinds, including cut-back in subsidies, higher oil prices, and rising interest rate.

The biggest headwind to the consumption story in FY23 is a sharp decline in government subsidies on food, fertiliser and fuel, and overall decline in revenue expenditure net of interest payments.

This, analysts say, will adversely impact purchasing power of households at the lower end of the income pyramid, translating into lower spending on consumer goods and services.

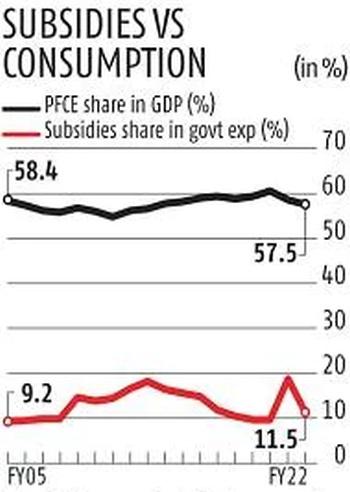

The Union Budget for 2022-23 has proposed a 26.6 per cent year-on-year decline in subsidy on food, fertiliser, and petroleum to Rs 3.18 trillion in FY23, from Rs 4.33 trillion in FY22.

Besides, Finance Minister Nirmala Sitharaman has also decided to cut the allocation for the rural employment guarantee scheme by 25.5 per cent in FY23 to Rs 73,000 crore from revised spending of Rs 98,000 crore during FY22.

"The impact of Budget measures will be felt the most in rural areas where subsidies are a key component of household cash income.

"A cut in food and fertiliser subsidies and lower allocation for the employment guarantee scheme will hit per capita income in rural areas, resulting in lower demand for staples and low-end consumer items, such as two-wheelers," says Dhananjay Sinha, MD and chief strategist JM Institutional Equity.

Because of these austerity measures, the Union government’s overall revenue expenditure will grow by only 0.9 per cent in FY23 -- the slowest in at least 52 years.

In fact, excluding the interest payment on public debt, the central government net revenue expenditure will decline 4.2 per cent year-on-year in FY23 to a three-year low of Rs 22.54 trillion.

This will be the first time since 1971-72 that there will be a decline in revenue expenditure net of interest expenses.

A cut in subsidy in FY23 comes on the back of an equally sharp cut in FY22.

The Centre’s total spending on food, fertiliser, and petroleum subsidy is projected to fall 33.24 per cent YoY in FY22 to Rs 4.33 trillion.

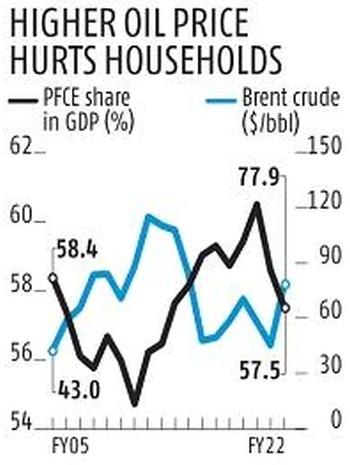

The impact is already visible in the private final consumption expenditure (PFCE) -- the sum of all expenditure on private consumption in the economy.

The PFCE share in India’s gross domestic product is expected to decline to a nine-year low of 57.5 per cent in FY22.

Historically, a rise in subsidy and higher expenditure on welfare schemes, such as Mahatma Gandhi National Rural Employment Guarantee Act (MGNREGA), has supported PFCE, especially during the time of macroeconomic distress like a spike in energy prices.

A cut in subsidy is coming at a time when households face higher cost of living because of a sharp rise in fuel and commodity prices.

The average price of Brent crude oil is up 71 per cent in FY22 over FY21, leading to higher energy and transport cost.

The rise in crude oil price also pushes the cost of fertilisers and farm inputs.

"The recent rise in crude oil prices will lead to higher inflation, forcing households to defer discretionary spending as they save cash to pay for essentials, such as food, travel, and utilities. This will further depress the share of PFCE in GDP," says Madan Sabnavis, head economist, Bank of Baroda.

Last time when there was a big rise in oil prices in the FY10-14 period, the government cushioned the blow by drastically raising petroleum subsidy. There is no such cushion this time.

Feature Presentation: Rajesh Alva/Rediff.com