In addition, he doubles as an economic analyst on MSNBC's Morning Show, contributes to The New York Times and for the Financial Times. No wonder, when he speaks, people listen.

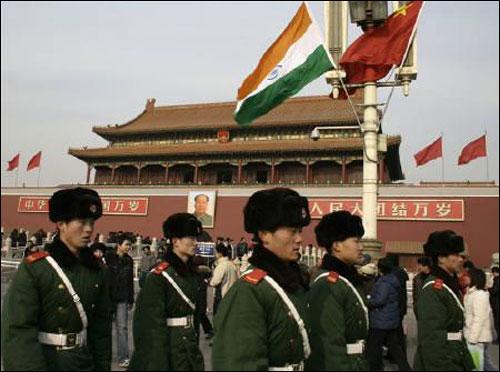

In a piece titled "India Is Losing the Race" in The New York Times (January 19, 2013) Rattner brilliantly analyses India versus China growth debate.

"As recently as 2006, when I first visited India and China, the economic race was on, with heavy bets being placed on which one would win the developing world sweepstakes," he writes and adds "Many Westerners fervently hoped that a democratic country would triumph economically over an autocratic regime."

Nevertheless, Rattner woefully concludes "Now the contest is emphatically over. China has lunged into the 21st century, while India is still lurching toward it."

China's gross per capita income of $9,146 is more than twice India's. And its economy grew by 7.7 per cent in 2012, while India grew at an uninspiring 5.3 per cent. Crucially, he points out that China's investment rate of 48 per cent of GDP exceeded India's at 36 per cent.

Rattner hits the nail right on the head when he states "But the impact of that spending can be hard to discern; on a recent 12-day visit to India, not many rupees appeared to have been lavished on Mumbai's glorious Victoria Terminus, also known as Chhatrapati Shivaji Terminus, since it was constructed in the 1880s."

Rattner goes on to add "Parts of Mumbai's recently built financial district - Bandra Kurla Complex - already look aged, perhaps because of cheap construction or poor maintenance or both. It's hardly a serious competitor to Shanghai's shiny Pudong."

Putting his finger where it hurts most, Rattner points out "China has 16 subway systems to India's 5. As China builds a superhighway to Tibet, Indian drivers battle potholed roads that they share with every manner of vehicle and live animal. India's electrical grid is still largely government controlled, which helped contribute to a disastrous blackout last summer that affected more than 600 million people."

Is Rattner suggesting infrastructure to be the only differential between Indian and China? Pointing out to a range of issues having a debilitating impact on the Indian economy, he opines that many of probably India may not even be a beneficiary of the promised and much hyped demographic dividend. Why?

In a stunning yet succinct analysis, he points out that India growth story has been deeply hurt by a suffocating bureaucracy and a workforce which according to him is "unskilled." And that is the crux of the issue.

All round failure

Rattner is not the lone voice in the wilderness. Moreover, the "race" with China merely provides a context to the discussion on hand. Forget the race, let us look at these issues in absolute terms.

The Time in an Article provocatively titled "Is India's Growth Story Over?" (June 14, 2012) quotes a report by Standard and Poor's released a few days prior to it and titled "Will India be the first BRIC fallen angel." This report reportedly cautions that India may become the first so-called "BRIC" country to lose its investment grade rating. Meanwhile, some economists are now talking of Indonesia replacing India in the BRIC group of countries!

Simultaneously, Soutik Biswas, the Delhi Correspondent of the BBC in a story titled "Is the India Growth Story Over?" on June 1, 2012 visualises a possibility of a return of the 1991 economic crisis, probably in a virulent form. Blaming India's fractured polity, he lays the blame on lack of political maturity amongst India's elected representatives. "A broken politics makes for broken economy" he concludes.

Likewise Nirvikar Singh in a Column titled "Is India's Growth Story Dead?" ([Financial Express - 6th December 2012) quotes Professor Dani Rodrik of Harvard who authored a paper titled "No More Growth Miracles," arguing that technical progress in manufacturing is becoming more skill and capital-intensive, and that there is less room to export for new entrants.

Hence, according to Rodrik growing through labour-intensive manufactured exports, is going to be difficult in future. The East Asian and Chinese miracle depended to a very large extent on creating a huge manufacturing base that allowed employment generation coupled with an export led growth possibilities. In short, according to him India has indeed missed the bus.

Nirvikar Singh in response points out that "improvements in income distribution, institutional quality, and the well-being of the poor in non-income-based measures such as basic health, nutrition and education may be the optimal path to follow" and adds "investing in people may actually make growth more sustainable."

Lest all this is dismissed as theoretical rants of some economists, analysts and columnists, let us not ignore the negative developments at the ground level.

At Davos, the annual pilgrimage destination for the world's rich and held last week, India is reportedly "getting the cold shoulder this year. It may not be out of place to mention that till recently India was hailed as an "emerging economic powerhouse" and was an "attractive investment destination." Of the 260 sessions there just one was focused on India.

But never mind - a full Indian Contingent went to Davos - of course for sight seeing!

Failure of UPA

A closer analysis of the views of various authors referred above demonstrates that one set believe that the macro-economic framework of the global economy has changed irrevocably. The days of labour intensive manufacturing and exports may well and truly behind us. But that partially explains our downturn.

It may be noted that while some economic managers within the UPA celebrated the unprecedented growth between 2004 and 2008 as the direct consequence of their management skills now blame the global economic crisis for the domestic downturn. So much for their understanding of Economics!

Another set blame it on the fiscal mismanagement by the UPA Government. Remember that we ran gargantuan fiscal and current account deficits continuously for several years now. Surely, years of economic mismanagement has taken its toll. But this too does not explain the downturn story fully. Yet another set blame our poor governance, which only provides partial explanation to this conundrum.

In short economists may disagree on what ails the India economy, but are near unanimous in their prescription - improve governance, make institutions work and invest in human capital - a point that is repeatedly missed by the economic managers of UPA.

But what is worse is that UPA managers refuse to believe that our Economy is under severe structural stress. Some believe that the downturn is a consequence of global economy catching cold and fervently hope that this too would pass. Possibly, if we return to a scenario of robust global growth (which at this point in time this looks extremely remote) India too may experience spectacular growth.

But global economic growth is one half of the problem. But what about skill enhancement? What about improving Human Development Index? How should we enhance our manufacturing, institution and governance? Put differently, what would be the legacy of the UPA Government? It could well be 2G, CWG and Coalgate and probably nothing positive.

This is where India needed and continues to need reforms. And this is where the UPA has been a spectacular failure. Readers may be shocked to note that the Human Development Index (HDI) for India in 2004 was 124 while in 2011 it was 131. In short, the spectacular economic growth under the UPA regime has meant very little for most in the absence of improvement of the HDI.

Wherever India has progressed - say for instance maternal mortality or in infant mortality rate - neighbouring countries like Nepal, Bangladesh, Bhutan and Sri Lanka have done equally well or even in some parameters, spectacularly better. Similarly, on the ease of doing business index or on corruption, India has either stagnated or has deteriorated in the UPA regime when compared to her global peers. On the overall confidence of doing business, the decade under UPA has been a lost cause.

No doubt, while there is a conspiracy of co-incidences at a global level, the fact remains that for the present downturn the UPA has to blame itself. When the going was good, the UPA indulged in fiscal profligacy. Assuming an eight per cent growth to be a new norm, these managers never thought of a rainy day.

This was the time for India to improve its infrastructure, reforms its tax and labour laws, bring about fiscal discipline, improve governance, set institutions in order, create employment, impart skills to its youth while seek to improve human development index. Frankly UPA lost the plot between 2004 and 2008, not now. Now is the time to lament.