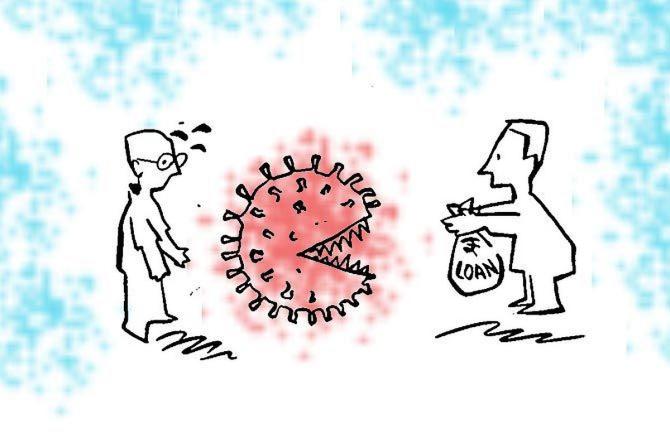

There has been a "sharp decline" in collection efficiencies in retail asset pools across asset classes in May due to the second wave of the pandemic, with microlenders witnessing a dip of up to 20 per cent, a report said on Monday.

"ICRA has observed a sharp decline in the collections of its rated securitisation transactions in April 2021 (i.e. May 2021 payouts), following the rise of COVID-19 cases and imposition of lockdowns/movement restrictions which has impacted the operations and collection activities of the NBFCs and HFCs," the report from domestic rating agency ICRA said.

A major part of the country was undergoing localised lockdowns till May-end in the second wave, which saw new cases top 4.14 lakh and resulted in over 4,500 deaths daily at its peak.

The rating agency said it expects the situation to improve from June, once the unlock measures result in reopening of the economy and the beginning of activity.

It said the microfinance entities have witnessed the highest decline in collection efficiencies, pointing out that repayments of advances and overdue collection were lower by 20 per cent for April when compared with March.

The agency added that collections for SME loan pools and commercial vehicle loan pools also fell significantly from the heights achieved in March 2021.

Housing loans and loans against property have remained the least impacted and most resilient as was seen last fiscal given the association of the borrower with the underlying collateral and the priority given by borrowers to repay such loans, it said.

Its head for Structured Finance Ratings Abhishesk Dafria said, "Collections would have declined further in May 2021, especially for microfinance pools where the entities have a high share of cash collections."

Accordingly, the delinquencies for the retail loan pools that had seen gradual reduction in Q4 FY2021 are now again expected to reach elevated levels, he added.

Securitisation volumes in the first quarter of 2021-22 are expected to remain weak as a result of the disruption caused by the second wave of the pandemic and resurgence of wariness among investors regarding the asset quality and future cash flows, the agency said.

"We expect the securitisation volumes in FY2022 to be higher than the previous fiscal with a majority proportion of securitisation happening in the second half of the fiscal," its sector head for Structured Finance Ratings Mukund Upadhyay said.

He added that declining COVID-19 cases and increasing focus of the government to vaccinate a major share of population over the next six months would help improve economic/business activities and lend support to overall securitisation volumes in future.