Bankers hold lack of policy consistency as key reason for not cutting rates and disputing RBI rationale on the matter.

Worried over banks’ reluctance to cut interest rates, the Reserve Bank of India (RBI) had in February asked banks to factor in the deposit tenure with the largest concentration while calculating the deposit cost for base rate (BR) computation.

RBI had cut its policy rate in January, the first time since May 2013, and expected banks to follow suit.

The move took bankers by surprise, as the new formula actually increased their BR, they said.

HDFC Bank Managing Director Aditya Puri had told this newspaper in February: “But, according to the revised calculation, it is not coming down. Going by the old calculation, it will come as a reduction in my deposit cost; so, automatically, the BR will change. But in the revised guidelines, a majority of your deposit has to be considered; so, my cost does not come down.”

Marginal cost theory

Marginal cost theory

So, the banking regulator thought of again tweaking the formula. In this financial year's first bi-monthly policy review, the central bank prodded banks to use marginal cost of funds for BR calculation.

“BRs based on marginal cost of funds should be more sensitive to changes in policy rates. To improve the efficiency of monetary policy transmission, (we) will encourage banks to move in a time-bound manner to marginal cost of funds-based determination of their BR,” RBI had said.

While some of the larger banks reluctantly offered a token cut in their BR, most-particularly public sector ones, barring State Bank of India, are yet to change their BR.

The marginal cost theory has also been widely criticised by bankers. Earlier, they were taking the average cost to calculate the cost of funds, of which a significant part was current and savings account (Casa) deposits, which are low-cost. Most banks pay four per cent on savings account deposits, which are 20-40 per cent of a bank's total deposit.

“If marginal cost has to be taken, the full impact of rise or fall in cost cannot be captured. The incremental deposit will have a small portion of Casa deposits,” said a banker.

Mohanty panel

The theme of the committee formed to review the benchmark prime lending rate (BPLR) structure was that liquidity should be tight in both the inflexion points, when the interest rate cycle is turning.

The committee, headed by RBI executive director Deepak Mohanty, suggested abolition of the BPLR regime and replacing it with BR.

Bankers say the hypothesis that liquidity should be kept tight during inflexion points has not been supported by empirical evidence.

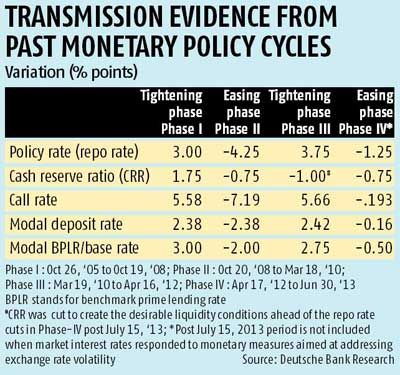

According to a Deutsche Bank study, in the earlier easing cycle (April 2012-June 2013), a 125-basis-point cut in the repo rate, along with a 75 bps cut in the cash reserve ratio rate (CRR, 200 bps cut if the period is extended to January 2012-June 2013), led to a bank BR reduction of only 50 bps.

Even during the interest rate rise cycle, between September 2013 and January 2014, when these were increased by 75 bps, the BRs of banks have not gone up.

Liquidity conundrum

The interpretation of liquidity, whether it is tight or comfortable, is interpreted differently by banks and RBI.

From the central bank’s point of view, banks should not complain about liquidity not having been adequate, as liquidity is pumped into the system via repo tenders.

However, from banks’ standpoint, liquidity injected via repo is not ‘clean liquidity’.

“We borrow from RBI by keeping government securities. Government securities ar e bought by deposits only. So, there is no fresh infusion of liquidity in that sense,” said a treasury official of a large bank.

During the monetary policy report issued earlier this month, RBI termed the liquidity situation as stable.

“Liquidity conditions remained stable and movements in the overnight call money rate were, by and large, anchored around the policy repo rate,” it had said. However, liquidity is still not in surplus now, when the rate cycle is turning, in line with the Mohanty committee hypothesis.

Bankers argue that liquidity conditions need to be eased, by way of a cut in CRR, to enable effective transmission.

“Clearly, more rate cuts and liquidity support measures would be needed to nudge banks toward lower rates in the coming months,” the Deutsche Bank report said.

Structural rigidities

There are structural issues, too. The high level of non-performing assets (NPAs) in the system is seen as one.

The more the rise in bad loans, the lower the interest earning assets, which in turn hits the margins. Lending rate cuts will further deplete their margins. Also, the rise in NPAs has made banks risk-averse to some extent, making them reluctant to cut price and fuel demand.

Banks’ reluctance to reduce lending rates is also because of their inability to reduce deposit rates beyond a point. They worry that a depositor might opt for the government’s small savings instruments if deposit rates are too low.

“There is competitive constraint in reducing deposit rates. If reduced lower than small savings rates, which are administratively fixed, there could be some deposit flight to small savings schemes providing a higher return,” the Deutsche Bank report said.

.jpg)