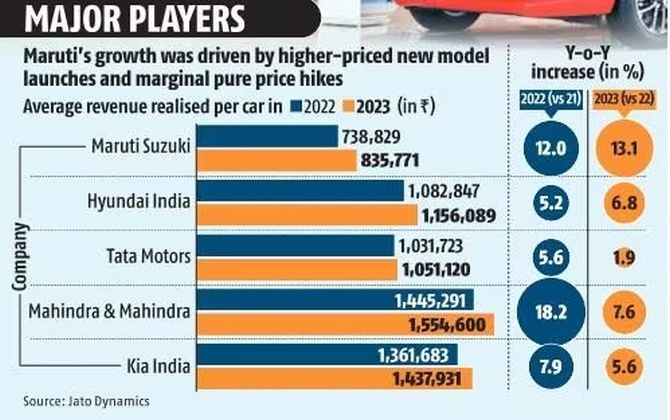

Maruti recorded a 13.12% year-on-year surge in average revenue earned per car in 2023 compared to M&M's 7.56%, Hyundai's 6.76% and Tata Motors' 1.88%.

Maruti Suzuki India (MSIL) in 2023 experienced a 13.12 per cent year-on-year (Y-o-Y) surge in average revenue earned per car, the highest among major car companies in India.

This was driven by higher-priced new model launches, increased Grand Vitara sales, elevated sales of high-end variants, and marginal pure price hikes, according to Jato Dynamics' data reviewed by Business Standard.

In 2022, MSIL had experienced an 11.98 per cent Y-o-Y increase in average revenue per car, according to the data.

"Our sales ratio in the higher-end car segment has increased, particularly in the SUV (sport utility vehicle) market where our share has grown within a higher price range. This shift in the model mix impacts average revenue per car for the company," Shashank Srivastava, senior executive officer (marketing and sales), MSIL, told Business Standard.

"Similarly, changes in the variant mix -- where higher variants of a model outsell lower variants -- also contribute to an increase in average revenue earned per car. Additionally, the introduction of new models throughout the year and pure price hikes further influence the average revenue per car," he added.

In 2022, Mahindra and Mahindra witnessed an 18.16 per cent Y-o-Y increase in average revenue per car, the highest among all car companies. However, in 2023, the company observed a 7.56 per cent Y-o-Y surge in average revenue per car.

"MSIL's growth in 2023 was a result of new model launches of high ticket size and substantial jump in Grand Vitara sales numbers. Mahindra, on the other hand, stabilised as compared to 2022 (no massive change in ticket size) though the Scorpio did quite well as compared to 2022," Ravi Bhatia, president, Jato Dynamics India, told Business Standard.

Hyundai, India's second-largest carmaker, experienced a 6.76 per cent Y-o-Y increase in average revenue per car in 2023 and a 5.2 per cent increase in 2022.

According to Bhatia, the rise in 2023 can be attributed to the launch of the Exter and Ioniq 5, which have high weighted average retail prices.

The Tucson and Verna witnessed a notably higher increase in sales volumes, he added, influencing the overall average revenue earned per car for the South Korean company.

Hyundai in 2023 increased the prices of its cars in the range 0 to 2.7 per cent, according to the data.

Tarun Garg, chief operating officer, Hyundai Motor India, told Business Standard that 2023 was a "remarkable" year for his company.

"During the year 2023, we revamped our almost entire product range, standardised six airbags across the entire product range (all models and variants) and introduced more models with ADAS (advanced driver assistance systems) safety technology. The increase in price is due to the above-mentioned factors," he added.

While the company strove to absorb cost escalations, the introduction of new products, technologies, and features, along with new emission, safety, and regulatory norms, had led to a significant rise in costs and only part of that cost led to a price increase.

Tata Motors, India's third-largest passenger vehicle maker, experienced a 1.88 per cent Y-o-Y increase in average revenue realised per car in 2023 and a 5.63 per cent increase in 2022.

According to Bhatia, this is due to a marginal pure price change done across the entire Tata Motors' model range in 2023.

"The weighted average price change was minimal for all higher selling models. Six of the total seven models observed a weighted average price change of less than 10 per cent in 2023. Only the Tiago had a slightly higher weighted average price change because of the entry of new variants in electric powertrain," he added.

[Average (arithmetic mean) treats all values equally, calculated by summing and dividing by the count. Weighted average considers the significance of each value, incorporating volumes for a more nuanced calculation.]

According to Jato Dynamics's data, MSIL increased the prices of its cars in the range 0 to 4.3 per cent in 2023.

Srivastava said price increases -- or increase in ex-showroom prices -- occurred for three main reasons.

"First, there is an increase in material costs due to rising commodity prices, constituting 75 to 77 per cent of the total cost structure in any OEM (original equipment manufacturer). If there is a substantial increase in material costs, they are then passed on to consumers," Srivastava said.

"Secondly, the addition of new features in models reflects changing consumer preferences, even in smaller cars like the Alto or S-Presso, where consumers seek advanced features such as a sophisticated infotainment system. For instance, in the new Baleno, Maruti has incorporated a heads-up display and a 360-degree camera, while the new Brezza features a sunroof, contributing to increased costs," he noted.

Thirdly, regulatory stringency, encompassing new safety and regulatory norms, necessitates changes in the engines of various cars (Eeco, Ignis, Alto, etc.) to comply with new emission norms, further raising costs, he said.

"The on-road price of a car is affected by the increase in road and registration taxes," he added.

"In the last couple of years, the majority of the states in the country have increased road and registration taxes."

Feature Presentation: Rajesh Alva/Rediff.com