Tech Mahindra was the top loser in the Sensex pack, shedding over 3 per cent, followed by NTPC, IndusInd Bank, Kotak Bank and Reliance Industries.

NSE Nifty fell 185.60 points to 17,671.65.

Equity benchmarks spiralled lower for the third session on the trot on Friday as relentless selling by foreign funds and weakness in global markets sapped risk appetite.

A mixed earnings scorecard and unsustainable valuations in some pockets further weighed on market mood, traders said.

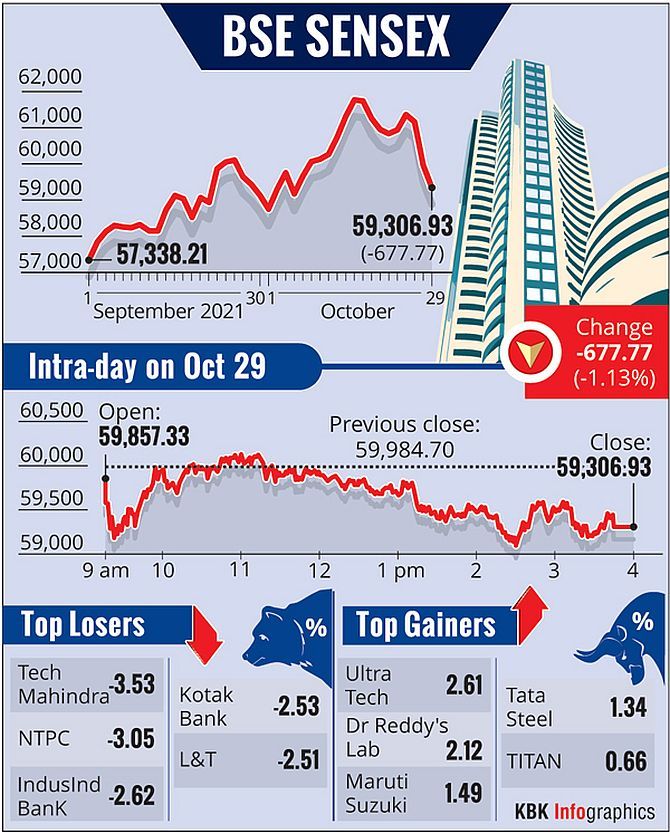

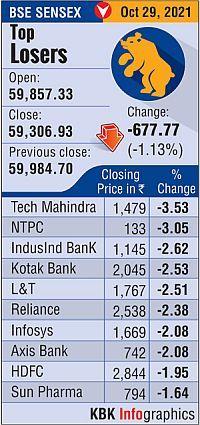

Opening lower after the previous session's heavy selloff, the 30-share BSE Sensex managed to cross the 60,000-mark in late-morning trade, but failed to sustain the momentum.

It finally closed 677.77 points or 1.13 per cent lower at 59,306.93.

Similarly, the broader NSE Nifty plunged 185.60 points or 1.04 per cent to end at 17,671.65.

Tech Mahindra was the top loser in the Sensex pack, shedding 3.53 per cent, followed by NTPC, IndusInd Bank, Kotak Bank, L&T and Reliance Industries.

On the other hand, UltraTech Cement, Dr Reddy's, Maruti, Tata Steel, Titan and ICICI Bank were among the gainers, spurting as much as 2.61 per cent.

On the other hand, UltraTech Cement, Dr Reddy's, Maruti, Tata Steel, Titan and ICICI Bank were among the gainers, spurting as much as 2.61 per cent.

"The domestic market continued to witness selling as energy and private bank stocks remained under pressure following dull global sentiments.

“European markets opened weak even as the ECB decided to keep policy rates unchanged despite the inflationary pressure.

"US futures are trading in red following slow GDP growth and disappointing earnings from tech giants.

“Decisions of the Fed in its meeting next week will be a major factor that will drive global equities in the coming days," said Vinod Nair, head of research at Geojit Financial Services.

On a weekly basis, the Sensex tumbled 1,514.69 points or 2.49 per cent, while the Nifty lost 443.25 points or 2.44 per cent.

"The equity markets trended lower for the week owing to selling pressure from FIIs.

“The FIIs have been net sellers to the tune of more than Rs 20,000 crores for the month of October.

“The valuation risks have been one the main concerns for foreign investors, triggered by the downgrading of Indian equity markets from 'overweight' to 'neutral' by key global brokerages.

"The valuation risks are specifically coming to the fore now as few sections of the markets expect growth momentum to slow in the wake of sticky inflation," said Joseph Thomas, head of research, Emkay Wealth Management.

Sectorally, BSE energy, IT, teck, bankex, finance and utilities indices fell up to 1.90 per cent on Friday, while basic materials, realty, healthcare and auto closed with modest gains.

Broader BSE midcap index ended 0.16 per cent higher, while the smallcap gauge dipped 0.38 per cent.

World stocks largely remained under pressure amid lacklustre US GDP data and concerns over inflation and economic recovery.

Elsewhere in Asia, bourses in Shanghai and Tokyo ended with gains, while Hong Kong and Seoul were in the red.

Meanwhile, international oil benchmark Brent crude advanced 0.23 per cent to $83.85 per barrel.

The rupee gained 4 paise to close at 74.88 against the US dollar on Friday as IPO-related inflows supported the local unit.

Foreign institutional investors were net sellers in the capital market on Thursday as they offloaded shares worth Rs 3,818.51 crore, as per exchange data.

Photograph: Danish Siddiqui/Reuters