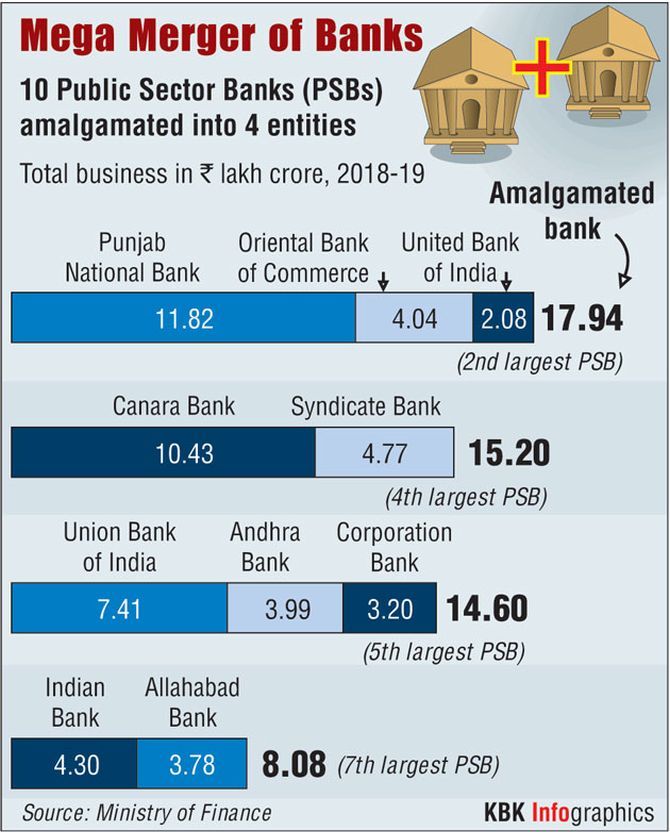

Finance Minister Nirmala Sitharaman on Friday announced the mega merger of public sector banks.

Here’s how the move will affect the banks’ customers.

Deposit, lending rates: No change. However, if you have a marginal cost of funds-based lending rate or MCLR-linked rate, it will change after the reset period.

Deposit, lending rates: No change. However, if you have a marginal cost of funds-based lending rate or MCLR-linked rate, it will change after the reset period.

Also, if you book a new fixed deposit or take a fresh loan, the rate will be decided by the merged entity. Similarly, the savings account interest rate may change

Cheque book/debit card: You can continue using your cheque book and debit cards. The bank will issue new ones in a year

Home branch: There may now be a branch that’s closer/farther to you, depending the merged entity's decision

Account number: This will not change immediately. But if your bank has been merged with a bigger bank, there could be a change eventually and you could be allotted a new account number/customer id

Third-party details: If you have been allotted new accounts or IFSC codes, they have to be updated with various third-party entities: Tax department for refunds, insurers to get maturity proceeds, mutual funds to get the redemption amount and National Pension System, etc

EMIs/ECS mandate: You may have to submit new forms online or through branches