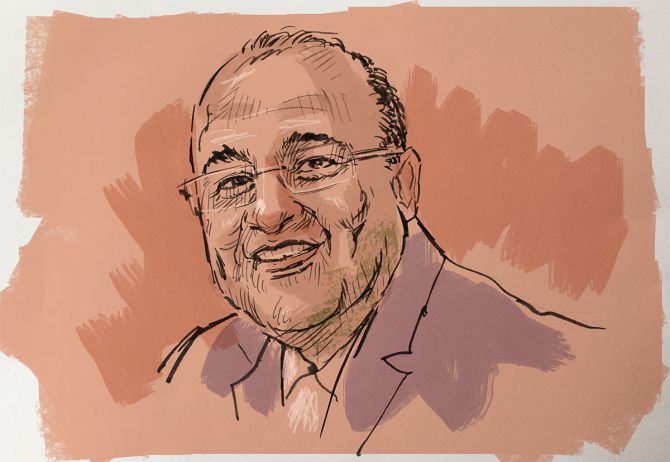

Sashidhar Jagdishan, managing director and chief executive officer of HDFC Bank, the largest private-sector lender of the country, has just completed his first term.

The period October 2020-October 2023 was a roller coaster, and the second one, which started on October 27, could be more interesting as the lender absorbs the impact of the merger of HDFC, which was integrated on July 1, and moves to the next growth phase.

Soon after he took over the reins from Aditya Puri on October 27, 2020, the Reserve Bank of India (RBI) debarred HDFC Bank from enrolling new credit card customers and launching new products under the Digital 2.0 programme due to repeated outages on its mobile-banking and internet-banking platforms.

HDFC Bank was the largest issuer of credit cards, and continues to be so.

The ban was a big blow to it.

HDFC Bank under Jagdishan took the challenge head on and went on a war footing to plug the gaps.

Subsequently, first in August 2021 the ban on credit cards was lifted, and then in March 2022, the RBI withdrew the restrictions on Digital 2.0.

When the pandemic struck, HDFC Bank was quick to re-strategise, which saw the retail-wholesale loan share flipping in favour of the latter as business loans were seen as less risky then.

The pre-pandemic proportion has now been restored with the merger of HDFC.

During the three years under Jagdishan, HDFC Bank’s balance sheet more than doubled.

The loan book size increased by 127 per cent and deposits by 77 per cent, and the bank added around 4 million credit cards.

The merger with HDFC, completed in record time, showcased HDFC Bank’s execution capabilities, Jagdishan says.

It was not an easy one, and was expected to have an impact on the financials.

There are two areas that HDFC Bank was always conscious about — net interest margin (NIM) and asset quality. HDFC Bank never allowed the NIM to drop below 4 per cent and its asset quality remained the best in class even throughout the second half of the last decade when banking sector gross non-performing assets (NPAs) went through the roof to hit 11.5 per cent in March 2018.

Gross NPAs as percentage of gross advances went up to 1.34 per cent as on September 30, 2023, from 1.17 per cent on June 30, 2023.

On the day of the merger, that is July 1, the ratio was at 1.41 per cent, coming down due to net reductions.

“I think the company maintained the return on assets (RoA) at around the 2 per cent mark and the return on equity (RoE) at 16.2 per cent. So top line growth and profitability have been intact and will only improve,” Jagdishan told analysts.

In a report titled “Out of form but not out of class”, brokerage JP Morgan said: “Notably, to our and likely street surprise — despite NIM pressures — the bank has held on to the 2 (per cent) (RoA) handle and we think it has enough levers on non interest to continue the same over the next 2 years before merger synergies take over.”

Growth in deposits was impressive.

The second quarter saw deposit accretion of Rs 1.1 trillion, of which around 85 per cent is retail.

“HDFC Bank has made a good beginning, and given a huge pace of capacity building, we believe that there are levers in place to sustain this momentum in business growth.

"Margins are likely to recover gradually, which, along with improved operating leverage, should improve return ratios,” broking firm Motilal Oswal said.

Jagdishan, who says a new HDFC Bank could be created every four years with the kind of capabilities it poses, is aware this is just the beginning.

“We wanted the teams to settle down and slowly but surely start to energise themselves and galvanise the home loan disbursement momentum,” he said.

Disclaimer: This article is meant for information purposes only. This article and information do not constitute a distribution, an endorsement, an investment advice, an offer to buy or sell or the solicitation of an offer to buy or sell any securities/schemes or any other financial products/investment products mentioned in this article to influence the opinion or behaviour of the investors/recipients.

Any use of the information/any investment and investment related decisions of the investors/recipients are at their sole discretion and risk. Any advice herein is made on a general basis and does not take into account the specific investment objectives of the specific person or group of persons. Opinions expressed herein are subject to change without notice.