Consumption of petrol and diesel will contribute more than half of the Centre's exclusive share in GST in FY20, reports Abhishek Waghmare.

Finance Minister Nirmala Sitharaman raised special additional excise duty and road and infrastrsucture cess - each one by Rs 1 per litre -- on petrol and diesel in her maiden Budget on July 5.

Prices at fuel stations rose by a higher degree, by Rs 2.5 and Rs 2.3 per litre, respectively, a day later.

Retail prices are near their 2019 peak at the moment (Chart 1).

The effective tax on petrol now stands at 105 per cent, or Rs 35.5 per litre, and excise duties contribute a healthy Rs 20 per litre (Chart 2).

The tax on diesel is a bit lower at 67 per cent.

This will give a boost of nearly Rs 30,000 crore to the Union government, and a relatively smaller gain to the states.

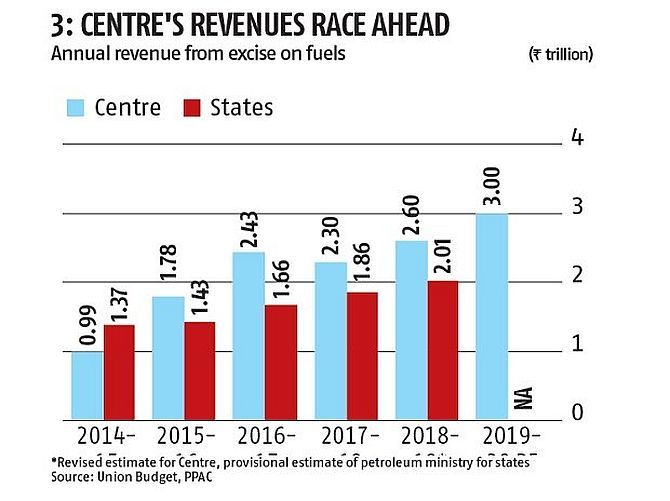

The reason: the Central government has earned incrementally more from fuel taxes in recent years (Chart 3) as most of it has been levied as a cess, and not basic excise duties (BED).

While BED is shared with states, cess revenue is not (Chart 4).

Interestingly, consumption of petrol and diesel will contribute more than half of the Centre's exclusive share in GST in FY20 (Chart 5).

The leeway to raise duties came from softening oil price (Chart 6), which the Economic Survey expects to remain stable over FY20.

However, even this revenue boost is dependent on strong economic growth.

A slowdown in March quarter of 2018-19 witnessed a slowing fuel consumption (Chart 7).

Compiled by BS Research Bureau