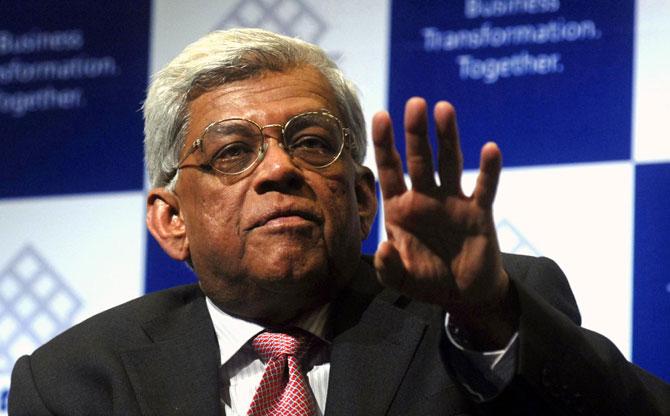

Noted banker Deepak Parekh on Thursday pitched for simpler corporate governance norms that focus more on trust than just compliance, saying economics and ethics are not trade-offs but complementary.

Behind each financial crisis there is a governance failure but it is the entire system that gets impacted, because an eruption of a corporate or financial crisis almost always means a tightening of rules and regulations and increased compliance for all, he said.

The HDFC chairman, who was addressing a seminar on corporate governance organised by former Sebi chairman M Damodaran's advocacy Excellence Enablers in Mumbai, stressed that the ultimate objective should be that corporate governance systems must become simpler and not more complicated.

Corporate governance norms must rely more on trust and ethical behaviour rather than compliance, Parekh said, adding that "we keep getting tied up in knots when it comes to corporate governance because it is all about people and varying levels of integrity".

He noted that there can be nothing more value destructive for an organisation than the loss of a good and strong value-based culture.

This would be "possibly the biggest corporate governance sin and a clear failure of the role of the board.

"Therefore growth with governance must be non-negotiable.

"Economics and ethics are not trade-offs but complementary," he pointed out.

It is the short-termism that impacts corporate behaviour because organisations survive long term business cycles when they have leaders and teams who enjoy their work, feel excited about working in teams and instinctively feel and think like they are owners and genuinely care about the business, he said.

Calling for delegation of powers from one person to a larger number of leadership teams, Parekh said most often companies fail when they fail to ensure that all the power is not vested in one person.

According to him, good leaders are not afraid of hiring smarter people because they keep their insecurities aside and look for the best outcomes.

As companies get more diversified it becomes more important for a leader to strike a fine balance of giving the confidence to allow businesses to run independently.

The best way out is to follow the golden rule which is "delegate, just shy of abdication", he added.

After the 2008 financial crisis, increased compliance requirements were put in place by various regulators.

"At the crux was mismanagement of risk or as they say, it was all about the over-50s not knowing what the under-30s were doing in the derivatives market. In return, the system got saddled with humongous compliance through the Sarbanes Oxley Act of the US, which continues even today," Parekh said.

The same applied to instances of siphoning of funds through multi-layer companies, he said and argued that because of a few miscreants and all companies now have to comply with very stringent related party transaction disclosures and this places considerable onus on audit committees as well.

Noting that whenever there is any governance failure involving financial impropriety, it is the regulators who inevitably first get a drubbing and get blamed for being asleep at the wheel, he said, retaining the trust of a regulator is paramount, because the bottom line is that the regulated entities ultimately get what they deserve.

If regulated entities want light touch regulation, they have to demonstrate and earn it at a system level, he said.

Photograph: Reuters