Despite the benefits of hybrid technology, a lack of government backing and few launches have kept the segment from gaining ground.

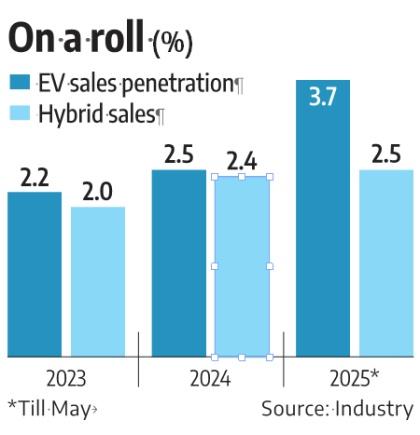

Centre and state incentives have doubled the share of passenger electric vehicles (EVs) in India -- from 2.2 per cent in 2024 to 4.4 per cent now -- but hybrids remain stuck between 2 and 2.5 per cent.

Automakers point out that despite the benefits of hybrid technology, a lack of government backing and few launches have kept the segment from gaining ground.

According to industry data based on wholesale dispatches, EV penetration, which was roughly 2.2 per cent in calendar year (CY) 2024, crossed 4.4 per cent in May 2025 (and has averaged 3.7 per cent so far in 2025), thanks to a wave of new models and aggressive marketing by Tata Motors, JSW MG Motor India, Mahindra & Mahindra, and Hyundai Motor India.

Meanwhile, hybrid penetration rose from about 2 per cent in 2023 to just 2.5 per cent so far in 2025.

The strong hybrid segment is dominated by three original equipment manufacturers (OEMs) -- Toyota Kirloskar Motor, Maruti Suzuki India, and Honda Cars India -- with offerings like the Innova Hycross, Vellfire MPV (multipurpose vehicle), Urban Cruiser Hyryder, and Camry Hybrid from Toyota; Maruti’s Invicto MPV and Grand Vitara midsize SUV (sport utility vehicle); and Honda’s City e:HEV.

“EV penetration in India was 2.5 per cent in CY 2024 and has doubled to 4.4 per cent in May 2025,” said Tarun Garg, whole-time director and chief operating officer, Hyundai Motor India.

“This is primarily due to new launches like the Creta Electric, more EV offerings from other OEMs, and the PM E-DRIVE (Electric Drive Revolution in Innovative Vehicle Enhancement) scheme. The rise in penetration is a testament to growing consumer confidence, government policy clarity, and the development of charging infrastructure driven by a wave of new models, including our own mass-market Creta Electric.”

Analysts agree that the momentum stems from fresh launches that have captured consumer interest.

Hemal Thakkar, senior practice leader and director–consulting, Crisil Market Intelligence & Analytics, said new EV offerings have created a strong buzz in the market.

Others point to the steep disparity in taxes -- EVs attract just 5 per cent goods and services tax, while hybrids bear an overall rate of 43 per cent -- as another key factor.

The state of play changes where incentives favour hybrids. In Uttar Pradesh, an order last year waived the 8–10 per cent registration tax for strong and plug-in hybrids, cutting on-road prices by as much as ₹4 lakh. Yet this came at the cost of EV adoption.

“In one state that offered hybrid subsidies, EV penetration remained stuck at 1.5 per cent, compared to the national average, which nearly doubled from 2.5 to 4 per cent over the same period,” said Shailesh Chandra, managing director, Tata Motors Passenger Vehicles and Tata Passenger Electric Mobility.

“Some state policies have done this, and it has suppressed EV penetration. When you subsidise a technology that has no natural barriers to adoption, you artificially skew its competitiveness and slow down the shift towards electrification.”

Chandra argued that Tata Motors is against using public funds to incentivise a self-sufficient technology.

“We already have CAFE (Corporate Average Fuel Efficiency) norms that drive investment in cleaner technologies. So why dilute incentives for EVs -- a technology still grappling with ecosystem hurdles? If the government must spend, it should focus on the destination technology,” he said.

He added that measuring success purely by volumes is misguided. What truly counts is the relative penetration of different powertrains -- and in that race, EVs are gaining ground, one launch at a time.

Feature Presentation: Rajesh Alva/Rediff