'Earnings will be the catalyst for markets to march higher from here on out.'

The markets are trading near record highs and are now looking forward to India Inc's 2023-2024 (FY24) April-June quarter (first quarter, or Q1) earnings season.

Andrew Holland, chief executive officer, Avendus Capital Public Markets Alternate Strategies LLP, tells Puneet Wadhwa/Business Standard in an e-mail interview that given the multiplier effect of government and private capital expenditure for the economy, he is confident that earnings upgrades will be forthcoming in the second half of the year, further enhanced by lower commodity prices.

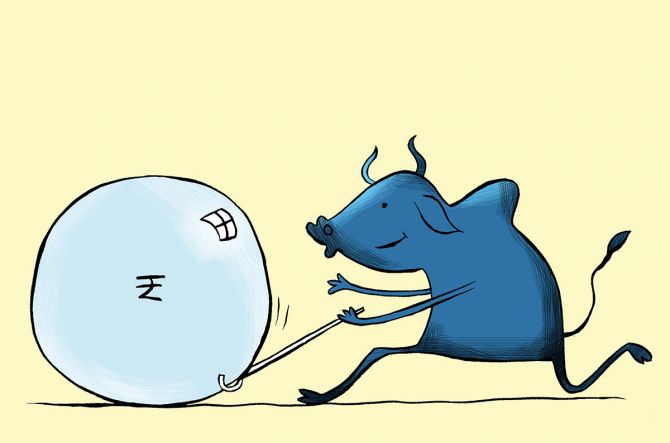

The markets have seen a sharp run these past few weeks. Irrational exuberance, you think?

While the markets have run up recently, we do not believe it to be an irrational exuberance bubble, as the year-to-date National Stock Exchange Nifty50 is up just short of 8 per cent and underperforming in contrast to other markets like South Korea and Taiwan.

Our long-term view has been that the emerging markets will perform well once the US Federal Reserve adopts a dovish stance on interest-rate hikes.

Although India may lag behind the 'exporting' countries in the short term, a catch-up is expected in the second half of the year.

Foreign investment flows may have also been more skewed towards India recently due to the economic slowdown in China and geopolitical problems with the US.

What do you think will drive the markets from here on out?

Earnings will be the catalyst for markets to march higher from here on out.

Given the multiplier effect of government and private capex on the economy, we are confident that upgrades in earnings will be forthcoming in the second half of the year, further enhanced by lower commodity prices.

Services will continue to power ahead as many industries witness an increasing move towards premiumisation.

Any downside risk is likely to arise from global factors and/or from a more accelerated economic slowdown in developed countries as interest rates may finally begin to impact spending.

This will likely lead to pressure on prices of commodities.

Stocks related to the commodity cycle may be vulnerable to downside risks.

IMAGE: Andrew Holland, CEO, Avendus Capital Alternate Strategies.

Photograph: Kind courtesy Andrew Holland/Twitter

What are your favourite sectors right now?

i. Defence spending and investments in renewable energy will continue apace;

ii. sectors where there is a global or local risk in the security of supply -- semiconductors and electronics; and

iii. local travel, hotels, and airlines.

Finally, the banking sector remains a key sector for us, given the robust growth story of India.

A new theme we are bullish on is beverages (alcohol and non-alcohol) as consumers move towards higher-end brands. This is the beginning of the move towards premiumisation.

Six months ago, we were more constructive on new-age stocks.

Since then, several new entrants and competitors have emerged, and therefore, we have become more neutral in the short term.

How comfortable are you with the overall market valuations at this stage?

Overall, we remain constructive on the market, as earnings growth is likely to accelerate further over the years, and valuations, albeit stretched in the short term, will begin to look more reasonable.

What has been your investment strategy these past few months? Has the uptrend in markets taken you by surprise?

We have been more surprised with the rise in global markets, notwithstanding all central banks actively stating that interest rates are likely to continue to increase, thereby dashing hopes of rate cuts by the US Federal Reserve by the end of the year.

Moreover, the fact that US markets have risen mainly due to five/seven technology stocks concerns us, as there is no real breadth to the market.

India has benefited from the tailwinds of global optimism as well as negative views towards China.

How do you see flows into EMs playing out in the next few months?

Our long-standing view, which has now reached a consensus, is that once the Fed goes on hold, investors will look for growth, and EMs will become the asset class of choice.

In the first half of the year, flows into EMs will be particularly directed towards exporting countries such as China, South Korea, Taiwan, etc, at the expense of India; although, we will see inflows, given our weighting in the Indices.

The second half may see inflows accelerate as economic growth begins to gather pace in India and earnings upgrades start to materialise.

What are your expectations from Q1FY24 results of India Inc?

We expect a solid quarter of earnings growth.

All eyes will be on the information technology sector as a barometer for any sign of pick-up in new orders, and equally on the banking sector for the continuation of strong loan growth.

Elsewhere, it will be the relative performance of companies within their respective sectors.

We think the outlook around the monsoons and El Nino may also have a bearing on several sectors.

Feature Presentation: Rajesh Alva/Rediff.com