A more prudent solution for a cash-strapped government would be to sell its stake in PSBs.

The financial position of India’s public sector banks (PSBs) has deteriorated sharply over the past financial year.

The financial position of India’s public sector banks (PSBs) has deteriorated sharply over the past financial year.

As Table 1 shows, gross non-performing assets (NPAs) rose to 9.5 per cent of total advances in 2015-16, up from five per cent the year before.

As Table 1 shows, gross non-performing assets (NPAs) rose to 9.5 per cent of total advances in 2015-16, up from five per cent the year before.

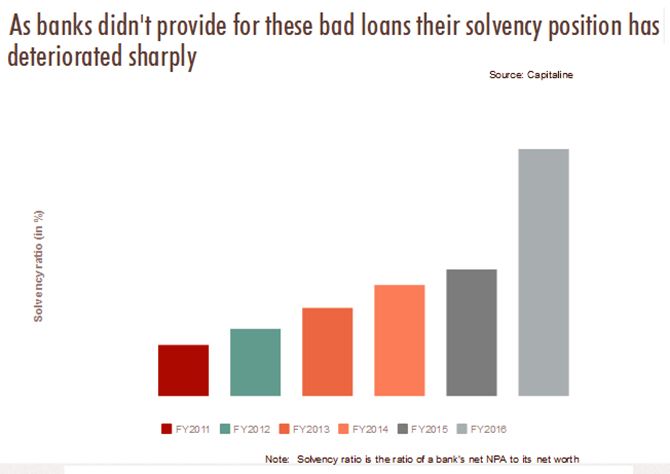

But as most banks didn’t adequately provide for these loans, it has put pressure on their solvency position.

If PSBs were to currently provide for all their bad loans, it would erode 66 per cent of their total net worth, as shown in Table 2.

If PSBs were to currently provide for all their bad loans, it would erode 66 per cent of their total net worth, as shown in Table 2.

At the aggregate level, PSBs reported a loss of Rs 17,672 crore in 2015-16, down from a profit of Rs 36,350 crore in 2014-15, as shown in Table 3.

As a result, their stock prices have tanked, eroding crores of rupees in market capitalisation.

As a result, their stock prices have tanked, eroding crores of rupees in market capitalisation.

The Nifty PSU Bank Index declined from a high of 4,419.25 in January 2015 to 2,913 on July 20, 2016.

Many analysts fear the current capital levels of PSBs are simply not enough to cover the actual extent of bad loans in the system.

Many analysts fear the current capital levels of PSBs are simply not enough to cover the actual extent of bad loans in the system.

As shown in Table 5, United Bank, Syndicate Bank, Indian Overseas Bank (IOB) and UCO Bank have the lowest Tier-I capital ratios, ranging from 7.6 to 7.9 per cent.  And while the government has budgeted to provide Rs 25,000 crore in 2016-17 for bank recapitalisation, it ended up giving Rs 19,950 crore in 2014-15, as shown in Table 6.

And while the government has budgeted to provide Rs 25,000 crore in 2016-17 for bank recapitalisation, it ended up giving Rs 19,950 crore in 2014-15, as shown in Table 6.

Analysts fear that this amount may not be enough.

A more prudent solution for a cash-strapped government would be to sell its stake in PSBs.

A more prudent solution for a cash-strapped government would be to sell its stake in PSBs.

While this is politically a difficult move, lowering stakes in the biggest loss-making PSBs such as IDBI, IOB, Bank of India, Punjab National Bank and Bank of Baroda to 51 per cent might be politically more acceptable.