And only 38% of bank branches. Gets only 7.5% of total credit.

And only 38% of bank branches. Gets only 7.5% of total credit.

Historically, the banking system in India has been plagued by the problem of last-mile connectivity. And despite Jan Dhan’s success, questions over the adequacy of the banking infrastructure, especially in rural areas, continue to linger.

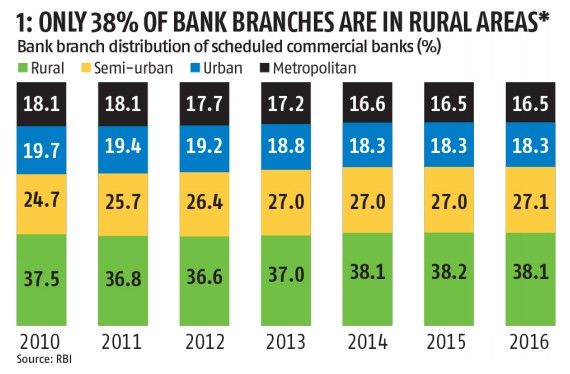

As Chart 1 above shows, only 38% of branches of scheduled commercial banks (SCBs) are in rural areas.

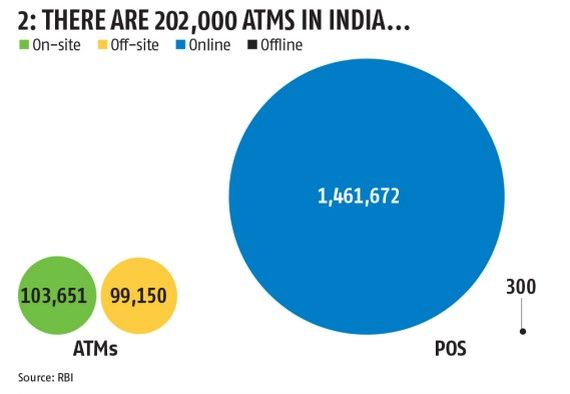

And, of the roughly 200,000 ATMs as shown in Chart 2 above...

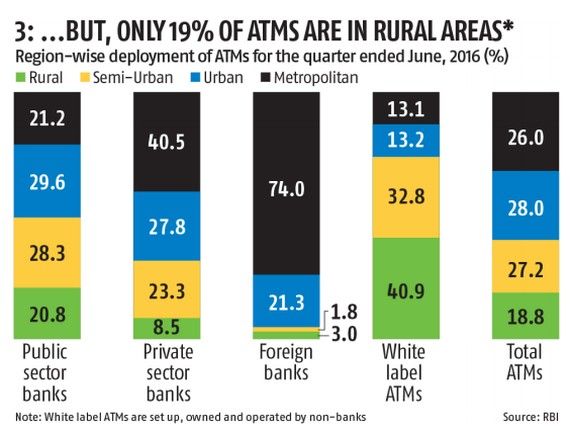

...Only 19% are in rural areas, as seen in Chart 3 above. Adjusting these numbers, roughly 70% of the population resides in rural areas, showing the glaring inadequacy of banking infrastructure.

Much of the rural economy relies on informal sources of finance.

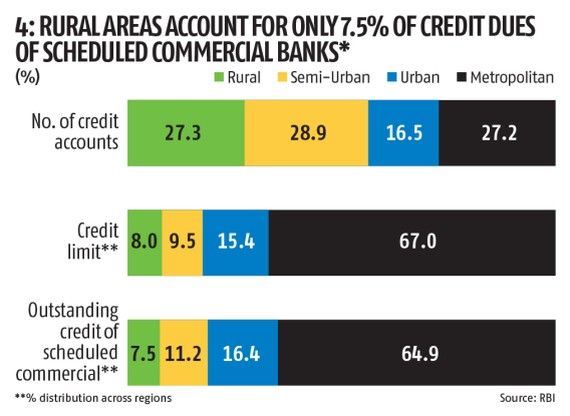

As Chart 4 above shows, only 7.5% of total credit dues of SCBs flow to rural areas.

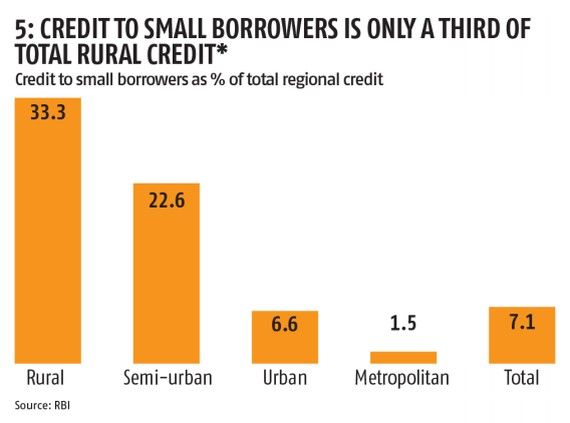

And, only a third of this credit flows to small borrowers, as shown in Chart 5 above.

This inadequacy pushes households to borrow from informal sources such as local money lenders or through microfinance institutions. But, as news reports have pointed out, many of these are currently struggling, implying credit flows to these small borrowers are likely to have suffered. The main concern is that even when the newly printed money does start flowing back into the economy, unless it reaches the local village lender, flows to small borrowers are unlikely to pick up.

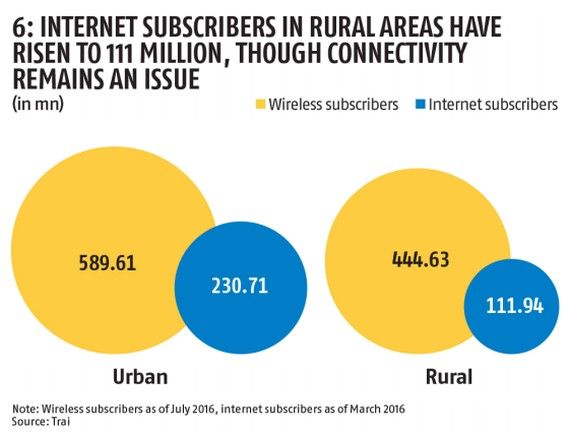

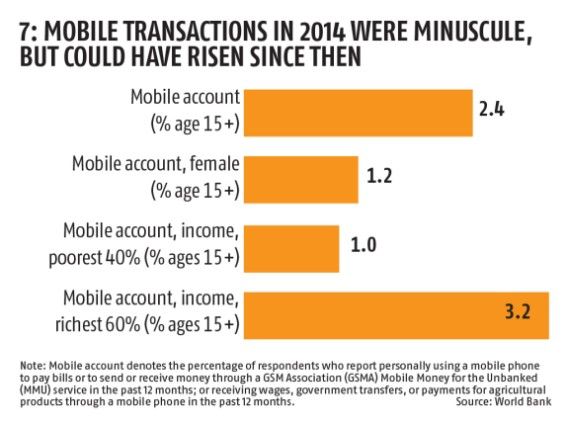

Many are advocating a shift to mobile-based transactions. And, while there are 112 million internet subscribers in rural areas, as shown in Chart 6 above, it is only a fraction of the overall rural population. Add concerns over internet connectivity in far-flung areas and the chances of a seamless transition are bleak. Data from the World Bank show only 2.4% of respondents aged 15 and above had mobile accounts in 2014.

Among the poorest 40%, it was one%, as shown in Chart 7 above. While these numbers are likely to have risen over two years, they are unlikely to be anyway near the current usage of cash as a medium of exchange.