The fiscal deficit target for 2020-2021 was originally set at 3.5 per cent of GDP.

But the government's revenues have collapsed and its expenditure burden will only increase over the Budget estimates.

With the government having already planned for an additional borrowing of over Rs 4 trillion, the fiscal deficit for the current year would be much higher than the Budget estimate, notes A K Bhattacharya.

Recent media reports suggest that the Union government is reviewing the Fiscal Responsibility and Budget Management Act in view of the adverse impact of the COVID-19 pandemic on its finances.

One of the proposals under study envisages the adoption of a flexible but range-bound fiscal deficit target, instead of a single number.

The 15th Finance Commission, whose final report would be out soon, is also credited with the view that setting a range of fiscal deficit targets is an idea whose time has come.

Hence, the expectation is that the Budget for 2021-2022 to be presented three months from now may well have a range of fiscal deficit targets, instead of a single number denoting the government's total borrowing requirement.

This number is expressed as a percentage of the economy's nominal gross domestic product.

India, like most other countries, has always set a single number as the government's deficit target.

The FRBM Act was notified in the early years of the noughties and obliged the Union government to follow the fiscal deficit targets set under its provisions.

The law was amended in 2018, by which a deviation of 0.5 percentage point was also allowed under certain circumstances.

Some years ago, there was a debate on whether the government's fiscal consolidation goals should be linked to its debt level.

But the Union government decided to opt for fiscal deficit as its primary target.

The government's performance measured by the fiscal deficit yardstick has been mixed in the last 10 years.

For instance, on as many as four occasions, the actual fiscal deficit figure turned out to be higher than the target set just before the start of the year.

The target was met in three years and bettered in three years.

The trajectory of fiscal consolidation over these 10 years, however, was slightly better.

Barring an increase in the fiscal deficit from 4.9 per cent of GDP in 2010-2011 to 5.9 per cent in 2011-2012, the Union government's deficit was steadily brought down in each of the following seven years.

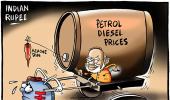

This reduction was largely due to a fall in oil prices and the government mopping up substantial revenues from this sector.

But in the last one year, the trajectory has once again taken a worrying direction, with the fiscal deficit rising from 3.4 per cent in 2018-2019 to 4.6 per cent in 2019-2020.

The situation prevailing in 2020-2021 is not a secret.

Fiscal consolidation will go haywire in the current financial year.

The fiscal deficit target for 2020-2021 was originally set at 3.5 per cent of GDP.

But the government's revenues have collapsed and its expenditure burden will only increase over the Budget estimates.

With the government having already planned for an additional borrowing of over Rs 4 trillion, the fiscal deficit for the current year would be much higher than the Budget estimate.

It is important to note that it is in this context of a sharp fiscal deterioration that the idea of flexible range-bound deficit targets has been mooted.

Devising a new mechanism for measuring the performance of the government's fiscal consolidation efforts should help shift the public debate to a new idea of a range-bound target.

The idea of, say, a fiscal deficit target of 3 per cent of GDP, with the flexibility of a two percentage points deviation either way would become a bigger event than the sharp fiscal slippage that the government's finances have experienced in the last two years.

In the event of a slippage next year, the debate could be easily guided to reflect on how the ceiling of 5 per cent has not been touched.

And yet, for the consumption of policy analysts and rating agencies, the 3 per cent target would be presented as what the government wanted to achieve.

At the same time, it would be argued that the deficit was contained within the broad range outlined in the fiscal consolidation path.

There would be no sleepless nights over the task of achieving a fiscal deficit target of 3.3 per cent in 2021-2022 or 3.1 per cent in 2022-2023, as projected in the government's latest Medium Term Fiscal Policy Cum Fiscal Policy Strategy Statement.

So, the timing of the shift to a range-bound flexible deficit targeting is more significant than the idea itself.

In principle, this may be an idea worth adopting.

But because of the timing, critics may see this shift more as a red herring and an expedient to divert attention away from the formidable challenges of fiscal consolidation and correction of the sharp slippages recorded in the previous two years.

The shift will also make comparisons of the government's fiscal performance with past years a little difficult.

How can you, after all, compare a range-bound target of next year with the fixed targets and their realisation in the previous years?

The chairman of the 15th Finance Commission, N K Singh, has argued that there is merit in looking at a range rather than a number, because it would then be in congruity with monetary policy targets and it would lead to 'less accounting engineering'.

Since 2016, the monetary policy reviews have been linked to achieving a retail inflation target of 4 per cent, with a permissible deviation of two percentage points either way.

The flexible retail inflation targeting has certainly worked in the case of monetary policy.

Ensuring uniformity in the manner in which inflation and fiscal deficit are targeted is also a good idea in principle, although the timing of the decision could be problematic.

But will it lead to less accounting engineering?

A key problem causing the Union government's fiscal slippages is its failure to correctly estimate the likely revenue mobilisation that it can garner in a year.

In as many as six out of the last 10 Budgets, the government's actual net tax collections were short of its preliminary estimate by as much as 4 to 18 per cent.

The slippage was recorded in seven out of the last 10 years with regard to non-tax revenues (3 to 33 per cent).

For divestment proceeds, the slippage was seen in eight of the last 10 years and the range of the shortfall was 14 and 55 per cent.

It's true that this problem of overestimating revenues has got worse in the last two years and will aggravate further, quite understandably, in the current year.

But this is not a problem of recent origin.

Since several years now, the overestimation of revenues has been primarily contributing to the government's failure to adhere to the promised path of fiscal consolidation.

Its ability to control revenue expenditure is limited.

And whatever squeezing can be done to capital expenditure has very little impact as the share of capital spending in the government's total expenditure is very low at 13-14 per cent.

Thus, there is a clear tendency to inflate the revenue projections at the time of presenting the Budget.

This is done in order to show a fiscal deficit target that is in conformity with the FRBM Act and also bolster the government's image as being fiscally prudent.

If the goal of a range-bound fiscal deficit targeting is to reduce 'accounting engineering', then making the internal finance ministry discipline of revenue forecasting more robust and realistic should yield quicker and more durable outcomes.

There will also be no need for keeping the deficit targets in a range.

The government can stay on with the current practice of projecting a single number to denote its fiscal deficit target.

Feature Presentation: Aslam Hunani/Rediff.com