Only those who stick to the old I-T regime will get this benefit, notes Bindisha Sarang.

Private-sector employees will not be deprived of the benefit of the Leave Travel Concession (LTC) tax voucher scheme.

The income-tax department has now extended the tax exemption available under this scheme to non-central government employees too.

Earlier this month, the department had announced that central government employees would be given cash vouchers this year in lieu of LTC fare.

No travel plans

LTC benefit has to be availed of by employees within a block of four years.

Balwant Jain, investment and tax expert working with ApnaPaisa, says, "Due to the pandemic and the lockdown, people have been reluctant to travel and make the most of their LTC. The government wants to provide a boost to consumer spending and has found a way to do so with this scheme."

Non-central government employees include employees of state governments, public-sector enterprises, banks, and the private sector.

They have to exercise an option for the deemed LTC fare in lieu of the applicable LTC in the block year 2018-2021.

How it will work

Gopal Bohra, partner, N.A. Shah Associates LLP, says, "The payment of cash allowance, subject to a maximum of Rs 36,000 per person as deemed LTC fare per person (round trip) to non-central government employees, shall be allowed tax exemption, subject to fulfilment of conditions."

The conditions listed out by the Central Board of Direct Taxes for benefiting from this scheme require the employee to spend a sum equal to 3x the value of the deemed LTC fare on purchase of goods or services which carry a goods and services tax (GST) rate of 12 per cent or more from GST-registered vendors or service providers through digital mode between October 12, 2020, and March 31, 2021, and obtain a voucher indicating the GST number and the amount of GST paid.

So, keep copies of invoices and bills safe.

Money can be spent on refrigerators, washing machines, mobile phones, bikes, cars, and electric vehicles.

Falling short

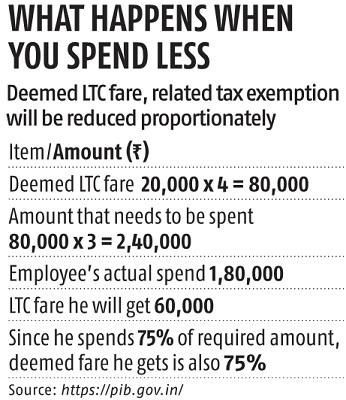

If you spend less than 3x the deemed LTC fare, you will not be entitled to receive the full amount of deemed LTC fare and the related tax exemption.

The amount of both shall be reduced proportionately.

Only those who stick to the old I-T regime will get this benefit.

Jain says, "An employee who has exercised the option to pay I-T under the concessional tax regime will not be entitled to this exemption."

Time frame

The expenses will have to be made within a specified period.

Naveen Wadhwa, deputy general manager, Taxmann, says, "The press release clarifies that the exemption will be available if the amount is spent between October 12, 2020, and March 31, 2021. It will not be available for purchases made between April 1, 2020, and October 11, 2020."

What should you do

If you really need an item or service, buy it and avail of this benefit.

But if you don't need something, don't spend just to avail of LTC benefit.

Jain says, "You still have one year left. Hopefully, the Covid situation will improve by then. If it doesn't, the government may extend the scheme till December 31, 2021."

Feature Presentation: Aslam Hunani/Rediff.com