'Is my portfolio good for retirement purpose, daughter's education, her marriage, buying a flat, etc?'

Omkeshwar Singh, head, Rank MF, (external link) a mutual fund investment platform, answers your queries:

anurag aggarwal: I am 43 years old. I making following investments in Mutual Funds:-

- Mirae Asset Large Cap Fund Regular Plan Growth 2500/- PM

- Axis Focused 25 Fund Growth 5000/- PM

- Axis Blue chip FundGrowth 2500/- PM

- Kotak Flexi Cap Fund Regular Plan Growth 2500/- PM

- ICICI Prudential Blue chip Fund Growth 2500/- PM

- Motilal Oswal Flexi Cap Fund-Growth 2500/- PM

- Nippon India Small Cap Fund-Growth 2500/- PM

- ICICI Pru Life Time Classic 5000/- PM

- ICICI Pru Signature 150000/- PA

- ICICI Pru Savings 100000/- PA

- HDFC Life ProGrowth Plus 30000/- PA

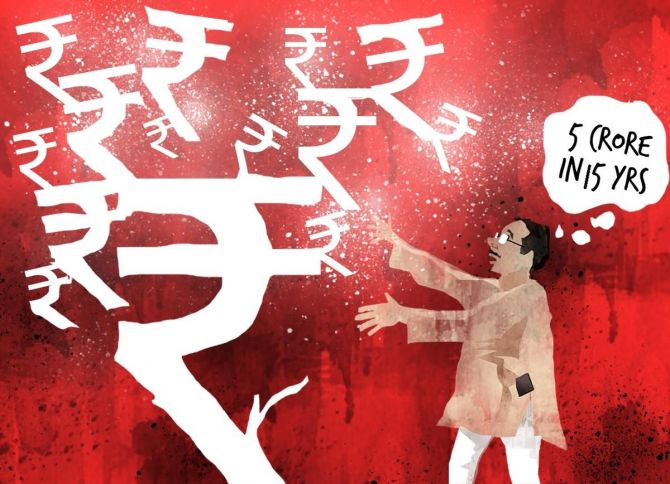

Please advise changes in above portfolio if required. I want to build a corpus of Rs 3-5 crore in next 10-15 years.

Omkeshwar Singh: To build a corpus, Equity funds are suitable and Insurance should be used for life protection and cover

I want to start SIP of Rs. 10000/- PM via Direct Plan method, please suggest suitable Mutual Funds.

I want to invest for at least 4-5 years and as such no hesitation in extending them as well.

My objective is wealth creation and not fulfilment of any specific objective.

Omkeshwar Singh: To create a corpus of 3 to 5 crs in 10 to 15 years an investment of Rs. 1.5 lakhs to Rs. 2 lakhs per month is required.

The funds that may be considered are ;

- Samco Flexi Cap fund Growth

- Motilal Oswal Focused 25 fund Growth

- Axis ESG Equity fund – Growth

- DSP Quant fund - Growth

Deepak Mathew: Please examine my portfolio and let me know if any changes have to be made so that I am able to reach my goals as per the timelines given.

My goals and the details of my portfolio are given below..

Omkeshwar Singh: Please continue; no changes required

Sarvotham Salvankar: I am investing through monthly SIP @ Rs 5500/- since last 10 years on the following MF.

1. SBI Contra Fund Regular Plan - Dividend

2. SBI Contra Fund Regular Plan - Growth

3. SBI Equity Hybrid Fund Regular - Growth

4. SBI Focused Equity Fund Regular - Dividend

5. SBI Focused Equity Fund Regular - Growth

6. SBI Magnum Global Fund Regular Plan - Growth

Please suggest whether same portfolio may be continued or any changes required.

Omkeshwar Singh: You may consider the below;

- Samco Flexi Cap fund Growth

- Motilal Oswal Focused 25 fund Growth

- Axis ESG Equity fund – Growth

- DSP Quant fund - Growth

Rushabh Shah: I am 37 years only and investing in the below Mutual fund with monthly sip amounts.

1. Kotak Emerging Equity Scheme- 5000 Rs

2. Mirae Assest Large Cap Fund-3000 Rs

3;- Canara Robeco Emerging Equities -Direct Plan- Growth- 3000 Rs

4. Axis Long Term Equity Fund- Direct Plan- Growth.

5. Aditya Birla Sun life Dynamic Bond Fund-

6. HDFC Housing Opportunities Fund - Growth.

7. SBI Equity Hybrid Fund - Direct Growth.

8. SBI Blue Chip Fund- Direct Growth.

09. ICICi- Prudential All season Bond Fund- Direct Growth.

10. Mirae Assest Emerging Bluechip Fund- Direct Growth.

11. Invesco India Growth opportunities Fund- Direct Growth.

13. UTI Midcap Fund Growth Option.

12. IDBI India Top 100 Equity Fund.

13. SBI Magnum Gilt Fund- Direct Growth.

14. Axis Blue Chip Fund Direct Plan- 5000 Rs

15. SBI Magnum Midcap Fund- Direct Growth

16. SBI Equity Hybrid Fund - Regular Growth.

17. SBI Magnum Midcap Fund- Regular Growth

18. ICICI Prudential All seasons Bond Fund - Direct Plan Growth.

19. UTi- Flexicap Fund -Growth Option- Direct.

20. ICICI Prudential Value Discovery Fund - Growth

Sip for fund from Sr no (4 to 13 and 15 to 20) has been discontinued.

Request your valuable guidance on the following.

1. How much mutual fund should I keep in my portfolio.

Omkeshwar Singh: 4 to 6 funds are sufficient

2. I want to diversify my portfolio hence from above fund list kindly suggest which funds to continue and which funds need to switch&you may recommend new funds if require

Omkeshwar Singh: Funds that may be considered are

- Samco Flexi Cap fund Growth

- Motilal Oswal Focused 25 fund Growth

- Axis ESG Equity fund – Growth

- DSP Quant fund - Growth

3. Please suggest whether sip amount is sufficient or need to increase and how much sip amount should I invest in case of switching of funds.

Can u tell us any specific mutual fund which I can invest for my kids’ education and kids’ marriage which can generate 12 to 16% returns? I am planning to invest monthly month amount of 20, 000 to 30, 000 and want to create long term wealth of 2cr for span of 5 to 10 years. Please suggest good funds.

Omkeshwar Singh: For Rs 2 crore corpus in 10 years Rs. 80000 per month need to be invested

Sandeep Kochana Shivanand: I am 37 years old. Below is my current investment portfolio:

SIP - For the past 6 months:

- L&T Balanced Advantage Fund - 4k

- Mirae Asset Hybrid Fund - 4k

- Motilal Oswal Multi Asset Fund - 4k

- PGIM India Midcap Opportunities - 4k

- Kotak Small Cap Fund - 4k

- Axis Small Cap Fund - 4k

- Quant Active Fund - 4k

- SBI Small Cap Fund - 4k

- Parag Parikh Flexi Cap Fund - 2k

- ICICIPrudential Value Discovery Fund - 2k

Policies

- Max Life Life Perfect Partner Super - 1.5LPA. Since 2016, 20 years premium paying term

- Max Life Shiksha Plus Super - 1.5LPA, Since 2016, 18 years premium paying term

- Jeevan Anand(Plan-149) - 48K PA, Since 2011, 12 years premium paying term

Home Loan

1. Outstanding 1.13 CR - EMI 1.02L (Commenced from 2018, 20 years term)

2. Outstanding 1.25 CR - EMI 1.1L (Commenced from 2018, 20 years term)

Monthly Expenses - 35000/-

Income

Salary - Net 3 L/month

Annual bonus - Net 8 LPA

RSUs - Net 7 LPA

I am looking for an aggressive investment plan which helps me to close out my home loans in the next 5-7 years. Please let me know what additional investment or modifications in my current portfolio do I need to make to achieve this target.

Omkeshwar Singh: You would need an Investment of 80,000 per month to retire the loans in 10 years.

Some funds that can be considered are:

- Samco Flexi Cap fund Growth

- Motilal Oswal Focused 25 fund Growth

- Axis ESG Equity fund – Growth

Ram Gunta: Please suggest the following for my daughter who has just started working and she has good amount of savings from her one year work.

1. Mutual funds for long term through SIP.

Omkeshwar Singh:

Samco Flexi Cap fund – Growth

UTI Flexi Cap Fund - Growth

2. Debt funds with better returns than Bank FD.

Omkeshwar Singh:

- HDFC Short Term Debt fund – Growth

- Nippon India Short Term Fund-growth Plan - Growth Option

If you want Mr Singh's advice on your mutual fund investments, please mail your questions to getahead@rediff.co.in with the subject line, 'Ask MF Guru', along with your name, and he will offer his unbiased views.

Disclaimer: This article is meant for information purposes only. This article and information do not constitute a distribution, an endorsement, an investment advice, an offer to buy or sell or the solicitation of an offer to buy or sell any securities/schemes or any other financial products/investment products mentioned in this QnA or an attempt to influence the opinion or behaviour of the investors/recipients.

Any use of the information/any investment and investment related decisions of the investors/recipients are at their sole discretion and risk. Any advice herein is made on a general basis and does not take into account the specific investment objectives of the specific person or group of persons. Opinions expressed herein are subject to change without notice.