'I have been investing Rs 60K per month since 2020. I need to create a corpus of Rs 50 lakhs in next five years.'

Omkeshwar Singh, head, Rank MF, (external link) a mutual fund investment platform, answers your queries:

Gautam Gaurav: Hope you're doing well. I am new to mutual funds. I have a capital of Rs 20 lakhs. I am 21 years old. I want to grow my capital to Rs 1 crore in the next 10 years.

Can you suggest mutual funds for the same?

Also please mention the mode of investment -- lumpsum or SIP.

Omkeshwar Singh: Opt for SIPs or STP from debt fund to equity fund.

A few funds that may be considered are as under:

Navneet Mehta: I am 41 years old and work in a private sector company. I will retire at the age of 58 years.

I have been making SIP investments as listed below.

My object is long term fund accumulation.

In my family I have parents, my wife and two kids (12 and 6 years).

Please guide for any further addition in SIPs upto Rs 8K to Rs 10K. Also advise if I should stop any of the SIPs.

I have also made one time investment in the funds listed below. Please guide for any switching.

I also want to invest an additional Rs 80K to Rs 1 lakh. Please guide.

Omkeshwar Singh: Your portfolio has too many funds, it's over-diversified.

Lumpsums can be continued.

In SIPs, you may continue with 1, 2, 5, 8 and 11.

Vivek Bhargava: We have made these investments in our family portfolio.

We would like to continue to invest for 15 years but want to reduce the number of funds.

Could you please suggest which ones we should stop and which ones we should keep investing in?

Apart from Mirae Bluechip, the others are relatively new. Should we close or hold for three more years?

Omkeshwar Singh: There are too many funds in your portfolio. However, most of the funds are decent. You may continue for three years.

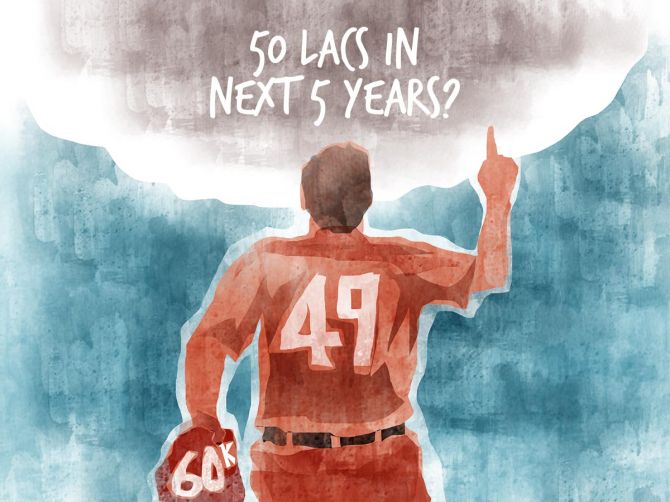

Sanjeev Talwar: I am an investor since 2005. I am 49 years old and am working.

I have been investing Rs 60K per month since 2020. I need to create a corpus of Rs 50 lakhs in next five years.

I have been following a 2-step strategy -- SWP and SIP, ie taking out money on a monthly basis and re-investing it back into new different schemes. This is on since June 2020, when the market was at a low.

Following are SWP schemes, units and amount.

Please advise if I am going in the right direction to achieve my target or if some changes are required.

Omkeshwar Singh: SIP and SWP will not be required if good funds are selected for investment and you remain invested in the same schemes for a longer duration.

SWP will have exit loads and the STCG component that may reduce the total returns.

Himanka Goswami: I have the following questions:

1. It has been historically said that to create a good corpus, the investment horizon has to be 10-15 years. But we keep seeing advice to switch to different schemes when a downturn is there.

What should be the correct way?

Do we keep investing in the same scheme or actually switch?

2. If we switch, then how will the long horizon of 10-15 years be achieved?

3. After having switched (if done), is the old scheme to be monetised immediately or kept as it is?

Omkeshwar Singh:

1. The main consideration for selecting mutual funds is the quality of the portfolio and the margin of safety. If these are fine, there is no need to change the schemes or switch.

2. The total investment horizon remains the same. Markets have cycles and if the investment horizon is 10-15 years, it is important to stay invested for the entire duration.

3. Ideally, it should be monetised and switched to better funds.

Manoj Gupta: I am 54 years old. My risk profile is growth/aggressive.

I have surplus of Rs 35 lakhs which I want to invest for five years. I'm okay with lumpsum or STP/SIP.

Please suggest a good MF scheme. I have shortlisted a few below:

Omkeshwar Singh: These are good funds. Please continue. It's better to opt for SIP or STP route.

Adish Pillai: I am 38 years old and have been investing in equity mutual funds since 2012.

These are my investments in equity till date. I have stopped my SIPs this month, except for Mirae Emerging Bluechip.

I also have life insurance (Rs 38,634 per annum) and Mediclaim (Rs 19,000 p a).

1. I want to invest an additional lump sum of Rs 1 lakh and start 3 new SIP of Rs 2,500 per month.

Can you suggest where I should invest -- in the funds I am already invested in or in any new category?

2. I have not been able to make up my mind on debt investment since I am not sure about gains (4-8 per cent) and then pay capital gains tax from debt investment, compared to money parked in a savings account (interest at 3.5 per cent).

These are my current investments. Your response would be appreciated.

Omkeshwar Singh:

Answer 1.

Answer 2. You may consider short duration funds, corporate bond funds and banking and PSU funds for debt investments

Aurobindo Saha: What is your advice for rebalancing asset allocation in the situation below?

In a Rs 1.1 crore portfolio, I have 87 percent equity (Rs 97 lakhs, mostly MFs) and 13 per cent (Rs 15 lakhs) debt. I want to bring it to 60 per cent equity and 40 per cent debt. I have identified six mutual funds which currently have Rs 35 lakhs long term profit.

Selling equity MFs for profit booking at one go has tax implications and may not be the right strategy. But if I can move this Rs 35 lakhs profit to debt funds, it will help to balance my asset allocation.

What is the most tax efficient and sensible way to do the rebalancing?

I am making future investments in SIP mode in conservative funds such as Mirae Asset Hybrid Equity. I have a 10 year investment horizon.

Omkeshwar Singh: Rebalancing would require you to exit equity and get into debt or hybrid funds.

LTCG on equity funds are taxed at 10 per cent; the trade-off is between saving taxes and a potential drop in value if the markets correct. It is advisable to book profits and pay 10 percent taxes and do the rebalancing.

Additionally, you may consider taking advice from a tax expert.

If you want Mr Singh's advice on your mutual fund investments, please mail your questions to getahead@rediff.co.in with the subject line, 'Ask MF Guru', along with your name, and he will offer his unbiased views.

Disclaimer: This article is meant for information purposes only. This article and information do not constitute a distribution, an endorsement, an investment advice, an offer to buy or sell or the solicitation of an offer to buy or sell any securities/schemes or any other financial products/investment products mentioned in this QnA or an attempt to influence the opinion or behaviour of the investors/recipients.

Any use of the information/any investment and investment related decisions of the investors/recipients are at their sole discretion and risk. Any advice herein is made on a general basis and does not take into account the specific investment objectives of the specific person or group of persons. Opinions expressed herein are subject to change without notice.

Feature Presentation: Ashish Narsale/ Rediff.com