The interplay between domestic and foreign capital will shape India's equity markets.

In a significant shift, domestic institutional investors (DIIs), primarily mutual funds and insurance companies, have surpassed foreign portfolio investors (FPIs) as dominant shareholders in India's equity market.

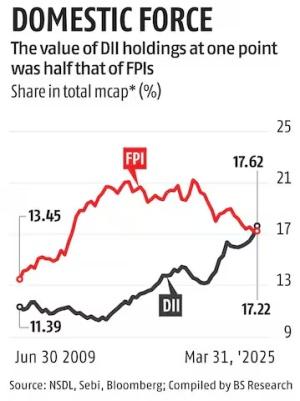

According to Prime Database, DIIs held a 17.62 per cent stake in companies listed on the National Stock Exchange, edging out FPIs at 17.22 per cent, as of March 2025.

This is the first time DIIs have overtaken FPIs since tracking began in 2009, with the value of DII holdings reaching ₹71.76 trillion, 2 per cent higher than that of FPIs.

A decade ago, FPIs dominated with lead of over 10 percentage points. DII holdings were worth half of FPIs' at that point.

This transformation signals a structural change in India's capital markets, driven by a surge in domestic retail participation -- both via direct equity investing and through the mutual fund systematic investment plan (SIP) route.

But what does this mean for markets, how does it compare globally, and do FPIs still matter?

A more resilient market

The rise of DIIs as the largest non-promoter shareholder category has fundamentally altered the dynamics of India's equity markets.

"Indians are putting money in equities -- something that they never used to earlier... Because of that, DIIs are getting money, and they are investing," says Jyotivardhan Jaipuria, founder and managing director, Valentis Advisors.

This influx, fuelled by retail investors channelling savings into mutual funds via SIPs (systematic investment plans), has made domestic money a stabilising force.

Unlike FPIs, whose capital flows are often volatile, domestic funds are "stickier", as Jaipuria notes, remaining invested through market cycles.

This stability was evident in recent months. "In the last six months, FPIs have sold quite a lot in the market, but the market fall was not very sharp, unlike in 2008," Jaipuria explains.

In October 2024, DIIs absorbed over ₹1 trillion in FPI selling, preventing a market rout, according to Trivesh D, chief operating officer, Tradejini.

The contrast with past crises, like the 2008 Lehman collapse when FPI selling triggered a sharp Sensex decline, is stark.

"In reality, this is a domestic retail investor boom because the retail investor money is powering the DIIs," says Chokkalingam G, founder, Equinomics.

The result is a market less prone to panic-driven crashes.

The growing influence of DIIs, alongside retail and high-net-worth individuals (HNIs), who collectively hold 27.1 per cent of the market as of March 2025, has reduced the market's dependence on foreign capital.

"For years, FPIs have been the largest non-promoter shareholder category with their investment decisions having a huge bearing on the overall direction of the market. This is no longer the case," says Pranav Haldea, managing director, Prime Database Group.

Domestic mutual funds, in particular, have hit a milestone, with their ownership reaching 10.35 per cent in the March quarter, a double-digit figure for the first time.

Global context: A unique position

India's shift toward domestic investor dominance sets it apart from many emerging markets, where FPIs often hold sway.

"In the last two decades or more, FPIs have pressed the sell button in all emerging markets, including India, whenever there was a crisis globally," points out Ambareesh Baliga, an independent equity analyst.

In contrast, India's DII-led market is increasingly insulated from global shocks.

"This pole position of DIIs makes our markets safer as they are backed by SIP flows, which are continuous and long-term in nature, unlike the fickle-minded FPIs," Baliga adds.

Globally, markets like the US or Japan also benefit from strong domestic participation, but India's trajectory is unique due to its demographic and economic profile.

"DII ownership will rise from here on as we have a young population, and they will continue to convert their savings into equities," notes an industry expert.

With India's economy projected to grow at 5 to 6 per cent annually, rising incomes and financial literacy are driving more savings into equities.

This contrasts with other emerging markets, where domestic institutional frameworks may be less developed, leaving them more exposed to FPI outflows.

However, India's high valuations have occasionally deterred FPIs. "Because India has become expensive, we have seen sales in India," Jaipuria observes. Yet, India remains a bright spot globally.

"FPIs can turn buyers in the future because they always look for stable and growing economies, and India is undoubtedly the buy spot," Baliga says.

India's relative attractiveness is enhanced by global trade dynamics, particularly if US tariffs target export-oriented economies like China.

"If tariffs are high against China and other export-oriented economies, then India can gain as an economy largely unaffected by US trade policy," an expert suggests.

The Enduring Importance of FPIs

Despite the uptick showed by DIIs, FPIs remain critical.

"FPIs are still important because they hold a significant number of shares in the market," Jaipuria emphasises.

Their 17.22 per cent stake, while slightly below DIIs', represents substantial capital.

FPIs also bring liquidity, global expertise, and signals of confidence to international investors.

"If foreign investors were to buy significantly, that could be a catalyst for markets as it would have two strong buyers," said the expert quoted earlier.

FPIs' role is particularly relevant in the short term, as they are currently underweight in India.

"In the short term, FPI ownership will rise as India is looking relatively attractive now," Jaipuria predicts. However, their participation hinges on valuations and global factors, such as US trade policies.

A favourable tariff environment could spark FPI inflows, potentially leading to "a shortage of paper and major bullishness," as Baliga suggests.

Yet, the long-term trend suggests further dominance by DIIs. "In the long run, DII ownership will go up as more domestic savings get channelised into equities," Jaipuria explains.

The steady rise in SIPs, which have forced mutual funds to deploy capital, underscores this shift.

"DIIs overtaking FPIs was bound to happen at some time as the SIPs were shooting up," Baliga notes.

This domestic resilience reduces the market's vulnerability to FPI exits, a recurring challenge in past global crises.

Looking ahead

Domestic household flows through SIP and the Employees' Provident Fund Organisation (EPFO) routes could be upwards of ₹3 trillion a year into equities each fiscal year, according to analysts.

This has already been playing out in recent years. In FY25, the net DII flows stood at almost ₹6 trillion, while in the preceding three financial years it was upwards of ₹2 trillion.

Overseas funds have been net sellers during three out of the previous four financial years.

During FY25, overseas funds pulled out nearly ₹1.3 trillion. Despite that, the benchmark Nifty managed to eke out a gain of over 5 per cent.

Indeed, the interplay between domestic and foreign capital will shape India's equity markets. But for now, DIIs are firmly in the driver's seat, steering the market toward a more resilient future.

Disclaimer: This article is meant for information purposes only. This article and information do not constitute a distribution, an endorsement, an investment advice, an offer to buy or sell or the solicitation of an offer to buy or sell any securities/schemes or any other financial products/investment products mentioned in this article to influence the opinion or behaviour of the investors/recipients.

Any use of the information/any investment and investment related decisions of the investors/recipients are at their sole discretion and risk. Any advice herein is made on a general basis and does not take into account the specific investment objectives of the specific person or group of persons. Opinions expressed herein are subject to change without notice.

Feature Presentation: Rajesh Alva/Rediff