Facebook Inc's purchase of fast-growing messaging startup WhatsApp for an eye-popping $19 billion largely won approval from analysts, who said the deal made strategic sense as it will solidify the social network's position as a leader in mobile.

Facebook shares closed up 2.3 per cent at $69.63 after falling as much as 3 per cent in early trading as investors got over the initial sticker shock of the deal value.

At least two brokerages downgraded their recommendations on Facebook to "hold" but the overwhelming majority of analysts remain positive on the stock.

Facebook is paying more than double its annual revenue for a chat program that has little revenue. The purchase price is slightly more than the market value of Sony Corp.

But analysts noted that WhatsApp has over 450 million users and boasts a higher level of engagement than Facebook.

…

"Facebook is the leading global social-sharing utility. Now, it has a significant opportunity to be the leading global communications utility," RBC Capital Markets said in a note.

WhatsApp is much stronger than Facebook Messenger in Europe, Latin America, Africa and Australia and has attracted users at a time when it appears that young people are turning away from Facebook.

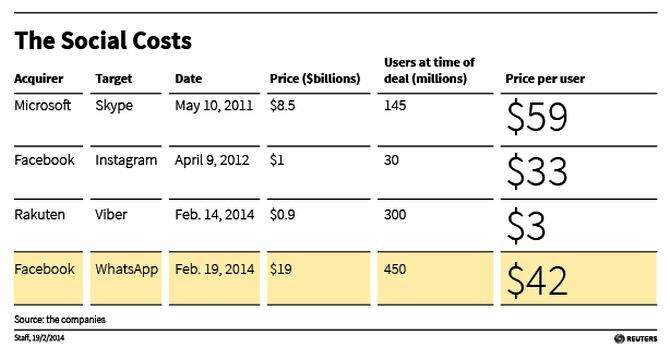

Analysts said the price tag for WhatsApp, founded in 2009 by former Yahoo Inc employees Jan Koum and Brian Acton, seemed reasonable from the point of view of value per user.

Facebook is paying $42 per user, compared with a market value per user of $170 for Facebook and $212 for Twitter, Deutsche Bank's Ross Sandler said.

…

WhatsApp's user base is less than half that of Facebook's 1.2 billion but the chat program's users are more active.

On any given day, 70 per cent of WhatsApp users are active, compared with 62 per cent for Facebook. WhatsApp's users are expected to reach 1 billion by 2015, according to many analysts.

"Looking past the sticker shock of $19 billion ... We view (the deal) as an offensive move to gain additional share of the consumer's time spent," Credit Suisse analysts said, noting that Facebook was paying about 11 percent of its market value to gain a 30 percent rise in engagement.

Have Scale, Will Make Money

Of the 44 analysts who cover Facebook, 37 have a "buy" or a "strong buy" rating on the stock, according to Thomson Reuters data. None has a "sell" rating.

…

Analysts have commended Facebook's ability to make money from its mobile app. Now they will want to see how it will earn money from the chat app's huge number of users.

"While we don't expect messaging to be a meaningful near-term or even long-term revenue driver, the real value could be the evolution of the platform to incorporate new functionality such as payments, app distribution, social features ...," Macquarie Equities Research analyst Ben Schachter said.

Facebook has fallen behind in mobile phone messaging apps in emerging markets, where many are accessing the Internet on fast-growing 3G mobile networks for the first time on smartphones.

Asian rivals such as Tencent Holdings Ltd's WeChat, Naver Corp's Line and Rakuten Inc's Viber are well ahead of Facebook messenger across much of Asia.

…

Facebook has been buying apps with large numbers of young users as part of Chief Executive Officer Mark Zuckerberg's strategy of helping users share any kind of content with anyone.

The company's $1 billion deal to buy photo-sharing application Instagram in 2012 and its recent $3 billion failed overture to buy SnapChat - used by teenagers to send texts and photos that disappear after a few seconds - followed unsuccessful attempts to develop rival apps.

"Large-scale networks like WhatsApp are rare and provide (a) significant monetization opportunity (i.e. YouTube) justifying valuation over time," SunTrust Robinson Humphrey's Robert Peck said in a note.

…

Analysts estimate WhatsApp users share 19 billion messages, 600 million photos, 200 million voice messages, and 100 million video messages per day.

Still, some analysts said Facebook was paying a high price to keep WhatsApp from being snapped up by a rival such as Google Inc.

"Facebook shares would have been pressured by more than single-digit percentages in after-market trading if Google had purchased WhatsApp instead," Stifel analyst Jordan Rohan said in a note.

Pivotal Research's Brian Wieser, who downgraded his rating on Facebook shares to "hold" from "buy," said he expects Facebook shares to face pressure in the near-term as investors come to terms with the risk of future acquisitions.