With most schemes performing below the index, a few don’ts in the recent rally .

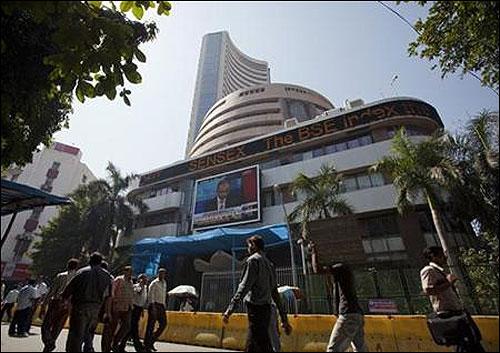

The BSE Sensitive Index, or S&P Sensex, hit an all-time closing high of 21,034 points on Wednesday. And it is fast closing in on its all-time high of 21, 207 achieved in January 2008.

From a retail investor’s perspective, there are a few don’ts. Don’t commit a lump sum into the market.

Even if you want to desperately participate in the rally, invest in parts of 10 or 20 per cent or start a systematic investment plan (SIP). Don’t buy a sector fund or stock aggressively, based on past performance.

...

There may be a completely different set of stocks leading the next rally. Most important, don’t skew your asset allocation in favour of equities by exiting debt.

There are several reasons: One, while the market has risen, there isn’t much euphoria for retail investors in diversified mutual funds. Most large-cap funds, considered the safest way of investing in markets, have performed worse than the benchmark Sensex in the three-year period.

In November 5, 2010, the Sensex closed at 21,005 - an all-time closing high. However, the benchmark index has returned 1.64 per cent annually (as of October 30) in three years.

...

In comparison, the category average return of large-cap fund is 1.23 annually in the same period. The large- and mid-cap category performed worse at 0.02 per cent returns annually, according to Value Research.

Even from a one-year perspective, the category average of large-cap diversified funds has underperformed the Sensex and Nifty. Of course, since these are category average numbers, some funds would have performed better.

Schemes that had loaded themselves with fast-moving consumer goods (FMCG) and pharma stocks are likely to have done much better. Whether it is a three- or five-year period, sector funds like FMCG, pharma and technology have outperformed the Sensex substantially.

...

As a retail investor, it is best you do not get into these nitty-gritties.

Even if you do, look at an exposure of less than 10 per cent of your portfolio.

Says financial planner Gaurav Mashruwala: “Every time when the market goes up the winners are different. However, investors make the mistake of trying to pick stocks or schemes and get into trouble.” He says if you are sitting on profits and the portfolio has shifted in the favour of equities, you could book some profits and get into debt to rebalance the portfolio.

...

Unless you are an investor with the knowledge to pick and choose stocks, stick to index investing, say experts.

“A better idea will be to do it through SIPs in index funds as they have returned a eight-10 per cent in five years.”

That is because in these years, the Sensex hit a low of 8,100 points in March 2009. So, an SIP investor would have benefited from higher units for the same investment amount that is giving him good returns now. Rishi Nathany, certified financial planner, says some investment should go to diversified equity funds, even a multi-cap fund, in a systematic manner.