‘There should not be a shortage of cash. You are instilling the fears into the system by saying that if you handle cash it would be infectious. But, what alternative do the people have?’

The UPA's economic czars C Rangarajan, Montek Singh Ahluwalia and Pronab Sen on what Modi Sarkar should do now.

Economy doctors of the United Progressive Alliance government -- C Rangarajan, Montek Singh Ahluwalia, and Pronab Sen -- had played a pivotal role in fixing the 2008-09 crisis.

They say the present crisis is different from the one then and requires a different prescription.

Indivjal Dhasmana finds out what each one of them has to prescribe.

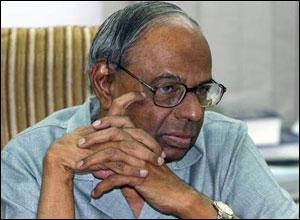

C Rangarajan

Former chairman of the Prime Minister's Economic Advisory Council

The 2008-9 crisis was a typical economic crisis. It started with the collapse of financial institutions, then it affected the overall economic situation and it engulfed the world, including India.

The 2008-9 crisis was a typical economic crisis. It started with the collapse of financial institutions, then it affected the overall economic situation and it engulfed the world, including India.

Currently, external demand is falling, domestic demand is going down, and there are disruptions to the supply chain. It is here that the RBI and the government should take the measures.

A) RBI

i) Banks are going to face a situation where repayments of loans are delayed and so a certain amount of regulatory forbearance becomes necessary. This can be in terms of relaxing the rules of what constitutes non-performing assets. Income recognition norms need to be relaxed. This must apply to bank loans to all sectors and all sizes not only MSMEs but also large corporate.

ii) RBI must supply more liquidity to the banking system. It has already taken some steps. Besides open market operations, it has started long term repos. In 2008, US central bank bought corporate bonds.

That is not legally permissible in India. But banks are holding government securities. So it is possible for them through open market operations and other standard techniques to provide additional liquidity to the banking system.

iii) The policy rate needs to be brought down. But please remember that it is a double-edged sword. Some people are dependent on interest income on deposits.

B) Government

i) It must incur all expenditure necessary to combat virus. Expenditures for testing not only in the government but also private hospitals. There should be additional creation of isolation wards in hospitals, arrangement of more masks, sanitisers. It should also incur costs of importing equipment for testing.

ii) There are industries which are particularly affected -- travel, transport, hospitality industries. Some help needs to be provided to them. The government must defer dues of industries such as excise duty, license fee and others.

iii) It should ensure that business units do not retrench workers. Advice should go from the government that they should not do this. It has already done that. Certainly some people would be thrown out of the employment. There should be cash transfer. Some state governments are doing it.

The government should do what it does at the time of droughts and floods. The government in collaboration with non-government organisations should provide the basic amenities of life like food and clothing and certain other things to the people who are directly affected by the virus.

Montek Singh Ahluwalia

Former Planning Commission deputy chairman

We are facing a health emergency that also has serious economic effects. It is unprecedented and so there is no rule book.

We are facing a health emergency that also has serious economic effects. It is unprecedented and so there is no rule book.

The first priority has to be health and since there isn’t yet a vaccine or curative therapy, the only way of avoiding massive infections is lockdowns and social distancing.

This will be disruptive. We do not really know how long this disruption will last. But it is bound to spill over beyond the end of March.

The economy was limping even before the crisis and it will now do much worse. The usual source of information about the global economy is the International Monetary Fund.

It has not updated its somewhat upbeat forecast made in January before the pandemic but independent analysts now project negative growth for the world for two quarters at least.

The highly adverse negative global environment will depress our performance. To this we have to add the domestic disruption from lockdowns and loss of income and uncertainty about the future … we can try to start recovering in the third quarter of 2020-21.

Health will involve more expenditure and the central government has to help the states. We also need to take steps to expand existing social security to help those in the informal sector who will lose jobs and income.

Business also needs to be supported by expanding credit and regulatory forbearance. Otherwise there will be a string of bankruptcies, which would be a system failure.

The fiscal deficit will exceed the Budget target not just because of additional health expenditure but because revenues will fall short, with gross domestic growth (GDP) growth being very low.

We can worry about bringing the deficit under control through a credible medium-term strategy once the downturn is arrested. For the present, the focus of fiscal, monetary and credit policy must be to limit damage.

Hopefully the group under the finance minister, working along with the Reserve Bank of India, will come up with concrete proposals very soon.

Pronab Sen

Former chief statistician

The 2008-09 crisis essentially originated in the financial sector but it affected the global trade -- the second part is similar to what is happening.

The 2008-09 crisis essentially originated in the financial sector but it affected the global trade -- the second part is similar to what is happening.

However, within the country we were relatively insulated then. So, most of the losses that we took in terms of GDP growth came from exports that time.

Generally, it is believed that exports constitute 20 per cent of GDP. But this is not correct, exports are in the manufacturing sector so you should look at value added and this comes to about five per cent of GDP.

What we are looking at now is that because you have restrictions on everything other than essentials you are looking at industry which are closed and constitute 15-20 per cent of GDP. So, the magnitude of the crisis is much larger on GDP now than in 2008-09. And, then second round effect is going to be there.

The kind of V-shape recovery that we had in the aftermath of the earlier crisis was because of the demand that the government pumped through fiscal measures. Now, the hit that you are essentially witnessing is the supply side problem because you are forcing the industry to shut shop.

So, demand boost measures would not really solve the problem. The only thing we can now do is to focus on the income hit that has taken place.

People who are now unable to buy essentials that we have to focus on. We are trying to prevent possible food riots.

Whatever the government may say, the requirement of cash is not going to go down -- it will go up. You and I can buy essentials through credit or debit cards, but not all. So, liquidity management should be clearly the RBI’s first step.

There should not be a shortage of cash. You are instilling the fears into the system by saying that if you handle cash it would be infectious. But, what alternative do the people have?

The second order issue is force majeure. You have essentially asked industries to shut shops. The revenue flows of these industries have come to a stop. Unless these industries have large retained earnings in their balance sheets, they will simply not be able to service their debts.

It is extremely important for the RBI to go for forbearance of asset recognition, hold it off till it starts counting again. RBI should keep it open ended and not classify any assets as NPAs. It should re-set the zero date from which the clock will again start to tick.

It will lead to lots of pressure on banks because they will have to pay interests on deposit but they will not be able to earn interests on very large chunk of their assets. The RBI should then say I am the lender of the last resort, I would take care of that problem.

Eventually, this will have to come from the fiscal side, the government will have to pump in money.