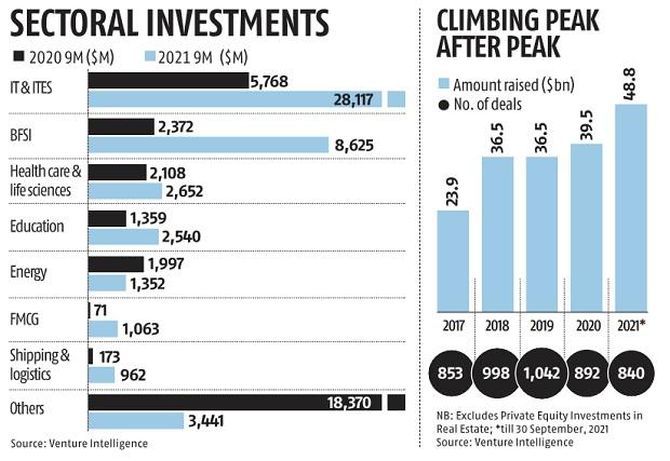

IT and ITeS companies accounted for $28.1 billion of the total investment pie during the first nine months of 2021.

Ashley Coutinho reports.

Private equity and venture capital (PE-VC) firms invested a record $49 billion across 840 deals in Indian companies during the first nine months of 2021, 23 per cent higher than the $39.5 billion invested in the previous calendar year.

Investments worth $20 billion in unicorns -- VC-funded startups valued at $1 billion or more -- account for close to 41 per cent of the value pie in 2021 so far, which has seen the addition of 29 unicorns, data from Venture Intelligence shows.

The July-September quarter (Q3) saw over $10 billion invested in such companies across 28 deals.

PE-VC investments in the third quarter totalled $20.1 billion across 368 deals, 35 per cent higher than the previous quarter and 69 per cent higher than the same period last year.

The quarter saw 40 mega deals of $100 million plus totalling $15.9 billion compared with 15 such investments worth $9.9 billion in the same period last year.

"The PE/VC juggernaut continues to roll, propelling both investments and exits to life-time highs. Deal activity has been dominated by pure play PE/VC investments, especially in the start-up space, unlike in earlier years which had witnessed significant investments in real estate and infrastructure asset classes as well," says Vivek Soni, Partner and National Leader - Private Equity Services, EY India.

According to Arun Natarajan, founder of Venture Intelligence, the highlight of the latest quarter was the successful IPOs of the Indian consumer market focused Zomato and the global enterprise SaaS focused Freshworks.

"Such exemplary liquidity events will expand the share of the asset allocation pie that PE-VC investing in India commands from both domestic and foreign investors," he says.

IT and ITeS companies accounted for $28.1 billion of the total investment pie during the first nine months of 2021.

The tech industry witnessed 58 deals of over $100 million during the period totaling $21.8 billion, of which 22 deals were announced during the third quarter.

The BFSI (banking, financial services and insurance) industry attracted $8.6 billion in the first 9 months of 2021, a 3.6x jump from the $2.4 billion raised during the same period last year.

Investments in the industry were led by two mega buyouts: The $5.2 billion Piramal Enterprises-DHFL deal in Q1 and the $1 billion Blackstone-ASK Group deal in Q3.

The Healthcare and Life Sciences industry has attracted about $2.6 billion this year, a 26 per cent increase compared to the same period last year.

The education industry came in fourth attracting $2.5 billion, dominated by Byjus' $1.5 billion fundraise and Eruditus' $650 million fundraise.

"While the e-commerce sector has dominated investor interest in 2021, financial services has quickly caught-up after a lull post the pandemic to emerge as the top sector during the year," says Soni.

As the percentage of vaccinated population rises, hopes of economic activity returning to pre-pandemic levels have increased.

This augurs well for the PE/VC investments.

"Downside risks," adds Soni, "include a possible pandemic resurgence due to new virus variants, inflation and any hawkish action by the US Federal Reserve to contain it and a potential spike in commodity prices, especially oil."

Feature Presentation: Aslam Hunani/Rediff.com