Investors, however, need to understand their prospects before deciding to raise their exposure to these export-oriented sectors, suggests Sanjay Kumar Singh.

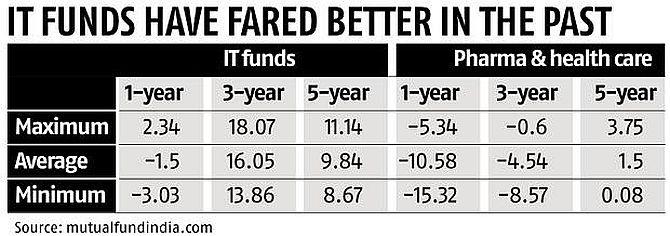

At a time when most categories of equity funds are giving negative returns, technology funds (up 4.2 per cent on an average) and pharma funds (up 2.2 per cent) have managed to remain in the positive territory over the past few months.

Investors, however, need to understand their prospects before deciding to raise their exposure to these export-oriented sectors.

Several factors are responsible for the recent upswing.

One, is the depreciation of the rupee.

"Over the past six weeks, the rupee has depreciated from around 66-67 to about 71-72 against the dollar. Whenever there is rupee depreciation, it provides a short-term boost to the profitability of information technology (IT) and pharma companies," says Harsha Upadhyaya, chief investment officer-equity, Kotak Asset Management Company.

Two, domestic markets have been volatile due to economy-related concerns.

Hence, experts say investors may have shifted some money to these export-oriented sectors.

The IT sector is experiencing some tailwinds.

According to Meeta Shetty, assistant fund manager at Tata Mutual Fund (manages Tata Digital India Fund): "The sector has shown a jump in deal wins over the past few quarters.

"Most companies are experiencing above-25 per cent growth in the digital segment."

Shetty adds that mobility, internet of things, and cybersecurity are areas where Indian IT majors have considerable headroom for growth.

Upadhyaya expects large-cap IT companies to deliver better performance than mid-caps.

"Some amount of support to stock prices could also come from buybacks, or expected buybacks, in this cash-rich sector," he adds.

As for the risks, globally, banking, financial services and insurance, manufacturing, and retail sectors are facing issues, which could lead to them slashing their IT spending.

Shetty informs that the manufacturing and financial sector account for 45-50 per cent of the revenue of most IT majors.

Due to visa-related issues, most companies have seen an increase in their sub-contracting expenses, affecting their margins.

Finally, valuations are not cheap.

Currently the BSE IT index is trading at around 18x its one-year forward earnings -- higher than its 10-year average.

The outlook for pharma is also improving.

"Most pharma companies have reported that their US businesses have started stabilising. On the domestic side, there were headwinds arising from the goods and services tax implementation, national list of essential medicines implementation, and so on. But now growth is coming back. Companies' efforts to rationalise costs have also begun to show results," says Vrijesh Kasera, fund manager, Mirae Asset Healthcare Fund.

He adds that pharma companies have not seen earnings downgrade during this quarter.

Over the past few years, pharma players have been investing heavily in research and development to develop complex generics and specialty drugs.

These products have begun to get approvals in the US.

On the domestic front, the fear of the list of medicines whose prices are controlled by the government being expanded has not materialised.

Among risks, plants of pharma players exporting to the US will continue to be monitored intensively by the US Food and Drug Administration.

In the domestic market, an expansion of the list of medicines under price control would hamper profits.

Kasera is of the view that investors with a three-five-year horizon may bet on this sector.