Economic growth has slipped to a six-year low of 5 per cent for the June quarter and is expected to turn in lower than that in the September quarter.

Lack of consumption is seen as one of the key factors pulling down growth.

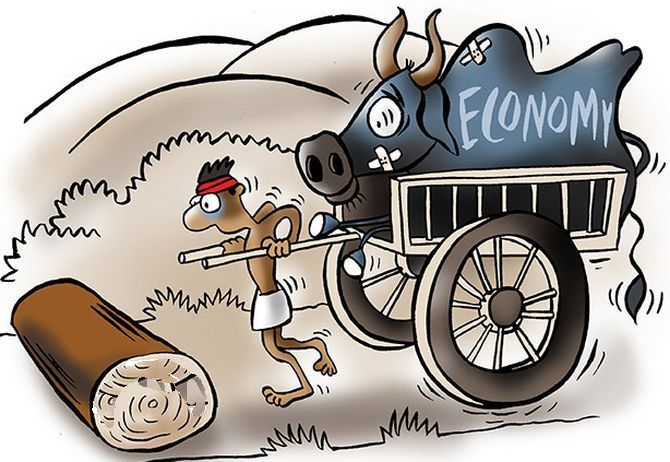

Illustration: Uttam Ghosh/Rediff.com

Despite efforts mounted by the government, demand has been "muted" during the festive time, and this leads to a 0.30 per cent cut in FY20 GDP growth forecast to 5.8 per cent, a foreign brokerage said on Monday.

The Reserve Bank will cut key rates by a further 0.15 per cent in February review, over the 0.25 per cent expected after the December meeting, Bank of America Merrill Lynch said.

Economic growth has slipped to a six-year low of 5 per cent for the June quarter and is expected to turn in lower than that in the September quarter.

Lack of consumption is seen as one of the key factors pulling down growth.

The government and RBI have been in tandem introducing pro-growth policies with a view to revive growth.

The RBI has drastically cut its FY20 real GDP growth projection to 6.1 per cent.

"The bad news is that still-high real lending rates and relatively muted Diwali demand has led us to formalise a 30bp cut to our FY20 GVA growth forecast to 5.8 per cent," analysts at the brokerage said.

They said lending rate cuts are the only way out of the present slowdown.

The only good news, it said, is that the central bank's forex interventions recently have created durable liquidity in the system.

With official data showing that over 92 per cent of the fiscal deficit gap being utilised within the six months of the fiscal, and the 0.8 per cent impact because of the corporate tax cuts, the brokerage said there is a likelihood of 0.5 per cent on the fiscal deficit targets of the government.

Apart from privatisation, which a slew of watchers point out to, the analysts said there can be other ways of grappling with the fiscal situation, which includes higher bond buybacks by the central bank and taking on board the Rs 53,000 crore extra capital from RBI identified by the Jalan committee.

In the event of a fall in foreign portfolio investment flows, the RBI may also look at a cut in the cash reserve ratio, or the amount of deposits parked with RBI by lenders, for boosting the liquidity.