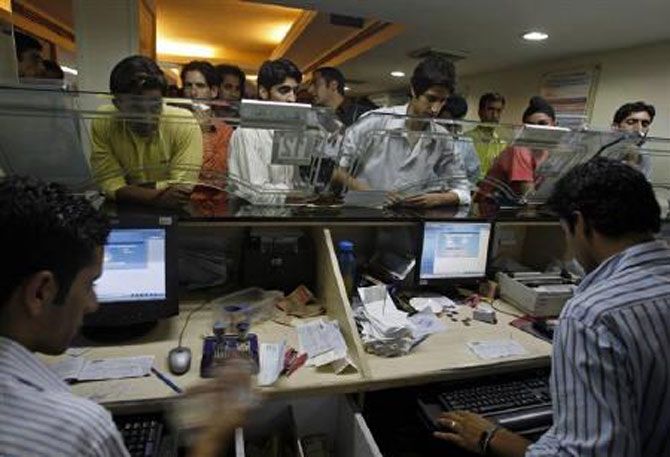

Banks will open additional counters and work extra hours beginning Thursday to help people exchange Rs 500 and Rs 1000 notes that have been declared invalid from midnight tonight.

Anticipating panic and rush at bank counters, the Reserve Bank of India as well as the government has set up control rooms in Mumbai and the national capital to avoid any crisis, Department of Economic Affairs Secretary Shaktikanta Das said.

Banks will remain shut on Wednesday to allow stocking of smaller currency notes and public will be allowed to tender their now invalid Rs 500 and Rs 1000 from November 10.

They can deposit any amount of the invalid currency in their bank account till December 30 and also exchange them for lower banknotes at special counters at banks and post offices till November 24 but with limit of Rs 4,000 in a day.

Bank will however report any unusual transaction to Financial Intelligence Unit and tax authorities for scrutiny.

RBI Governor Urjit Patel said the central bank had ramped up production of the new higher security currency notes of Rs 500 and Rs 2,000 that will replace the notes being taken out of circulation.

The new notes will come into circulation from November 10, he said.

He linked the government decision to use high denomination currency notes for terrorism financing and also for holding black money.

While overall currency circulation had increased by 40 per cent during 2011 to 2016, Rs 500 banknotes in circulation had gone up by 76 per cent and that of Rs 1000 by 109 per cent.

As many as 16.5 billion notes of Rs 500 denomination are in circulation currently while 6.7 billion Rs 1,000 notes are in market.

While the government imposed strict cash withdrawal limits -- Rs 2000 from ATM and Rs 10,000 from bank account in a day and Rs 20,000 in a week, Patel said there will be no impact on liquidity in the markets including financial markets.

The cash withdrawal limits will be relaxed gradually as small currency denomination notes are adequately stocked with banks and ATMs and new currency notes come into wide circulation.

A high-security Rs 1000 currency note will be re-introduced at a later date, Das said.

Das said infusion of Rs 2000 note will be closely monitored and regulated by RBI.