Eighteen months after the economy was battered by the Covid-induced lockdown, employment has not recovered to its pre-pandemic levels, points out Mahesh Vyas.

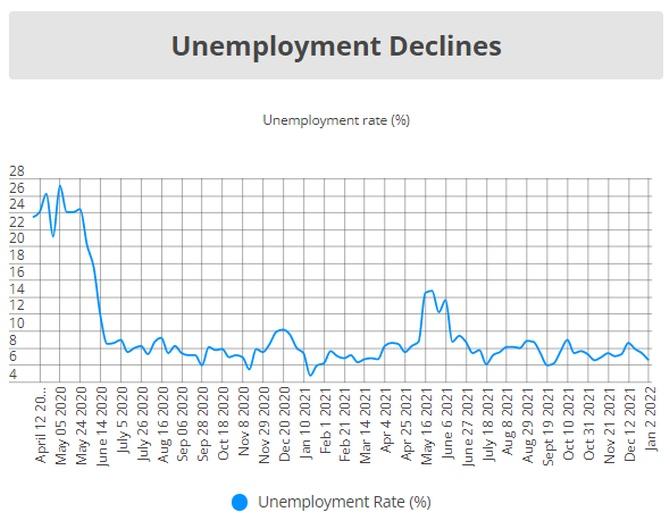

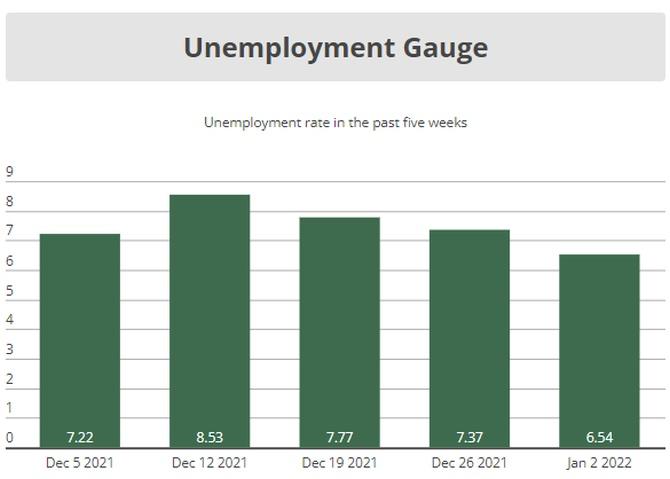

The unemployment rate rose to 7.9 per cent in December 2021. It was 7 per cent in November.

A year ago, in December 2020, the unemployment rate was higher at 9.1 per cent.

The unemployment rate in India is elevated compared to levels experienced in the recent past.

In 2018-2019, the unemployment rate was 6.3 per cent and in 2017-2018 it was 4.7 per cent.

In each of the last three months -- October, November and December 2021 -- the unemployment rate has been at 7 per cent or more.

The unemployment rate during the quarter ended December 2021 was 7.6 per cent. It was 7.3 per cent in the preceding quarter that ended in September 2021.

An unemployment rate in excess of 7 per cent combined with an inflation rate of nearly 5 per cent when the stated policy is to target an inflation rate of 4 per cent makes India look like an economy suffering from both of what could be alternate evils.

Inflation seems poised to rise in the short run but nothing seems to suggest that the unemployment rate would climb down commensurately.

The near term economic outlook therefore looks worse than where India stands today.

Two other factors posture ominously. First, interest rates are rising even though the RBI has not raised policy rates.

While bank lending rates seem to remain flat, market rates are rising.

The base rate, weighted base rate or the MCLR (all reflections of bank lending rates) are all flat or falling in recent times. But, yields on AAA corporate bonds of different maturities have been rising.

Banks are unlikely to keep interest rates where they are for long. In mid-December SBI raised its base rate for the first time in two years.

Second, the rupee has been depreciating through most of 2021. By December 2021 at around 75.5 to a US dollar it had fallen by 3 per cent since January 2021.

A combination of tepid growth in domestic consumer demand and low capacity utilisation levels has already adversely impacted investments in India.

Rising interest rates and a depreciating currency could make it worse.

Without new investments by large business entities India will not be able to generate the kind of employment it needs.

Till investments in new enterprises don't pick up, employment growth will mostly be of poor quality.

Investments into new infrastructure can create jobs in construction but not adequate stable middle-class salaried jobs.

Eighteen months after the Indian economy was battered by the Covid-19-induced lockdown, employment has not recovered to its pre-pandemic levels. In 2019-20, India employed 408.9 million.

Since then, India has only briefly employed about 406 million.

India's working age population has increased but its employment has shrunk since the pandemic. But, this is not the only tragedy.

The recovery has worsened the composition of employment in India.

In 2019-2020, salaried employed people accounted for 21.2 per cent of all employed persons. In December 2021, they accounted for only 19 per cent.

In December 2021, employment was 406 million. This was 2.9 million less compared to the employment in 2019-2020.

The shortfall was not evenly spread at all. The biggest fall in employment was in salaried employees. This class saw a loss of 9.5 million jobs.

Another 1 million jobs were lost among entrepreneurs.

This massive 10.5 million loss of jobs was offset by gains in employment among daily wage labourers and more so among farmers.

An industry-wise break-up of the difference between employment in December 2021 and 2019-20 shows that the manufacturing sector has lost 9.8 million jobs.

But, construction jobs increased by 3.8 million and agricultural jobs increased by 7.4 million.

Services sector lost 1.8 million jobs. Within services industries, hotels and tourism lost 5 million jobs and education lost 4 million jobs but retail trade gained 7.8 million jobs.

With due respect to all kinds of labour it can be argued that manufacturing jobs are usually better quality jobs compared to construction and agricultural jobs.

And, within services, employment in hotels and tourism or education is often of better quality than employment in retail trade which is mostly delivery agents.

India will be able to generate more better quality jobs only if employment is generated either directly in government or in large private enterprises.

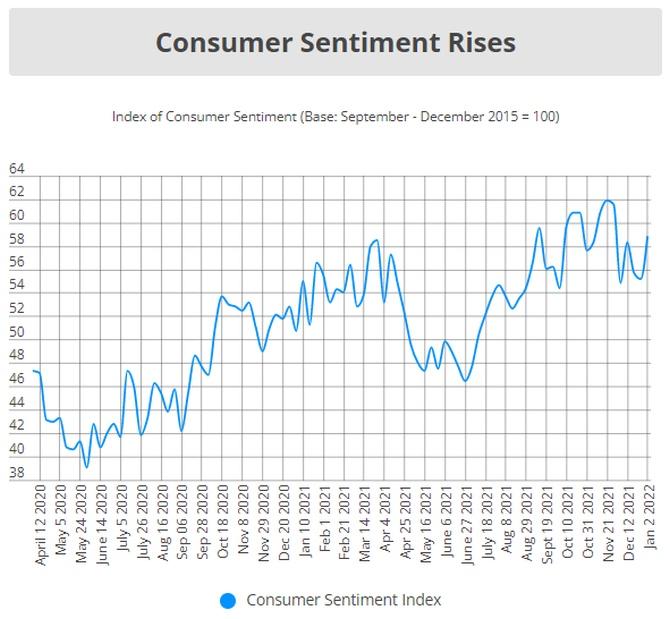

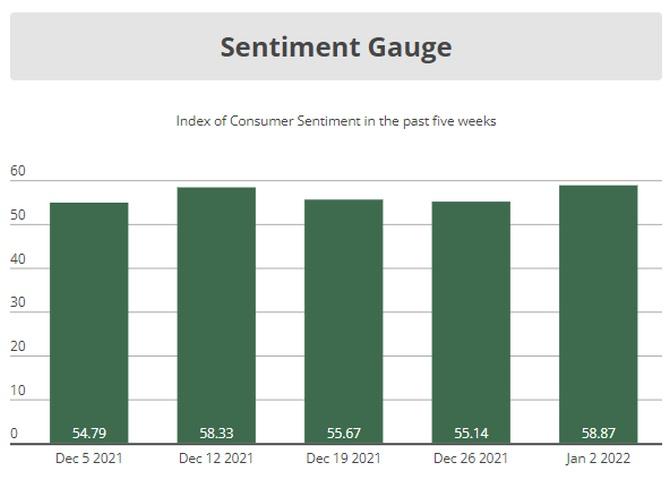

The combination of rising inflation, rising interest rates and depreciating exchange rates along with poor growth in consumer demand, low consumer sentiments and low capacity utilisation do not help create the environment necessary to spur investments by large enterprises required to generate good quality jobs.

It is disappointing to see the sustained weakness in salaried jobs.

These had risen to 84 million in September and October 2021 but have since fallen to 77 million in November and December 2021.

In 2019-2020, there were 86.6 million salaried jobs in India. In December2021, while India added 3.9 million jobs, it did not see any increase in salaried jobs.

Agriculture shed employment in December and employment as daily wage labourers increased.

There were large movements in the informal employment sectors. But, there was no movement in salaried jobs.

It is important to arrest the fall in salaried jobs and increase their share in total employment.

A mere increase in employment, as it happened in December 2021, is not good enough.

Feature Presentation: Rajesh Alva/Rediff.com