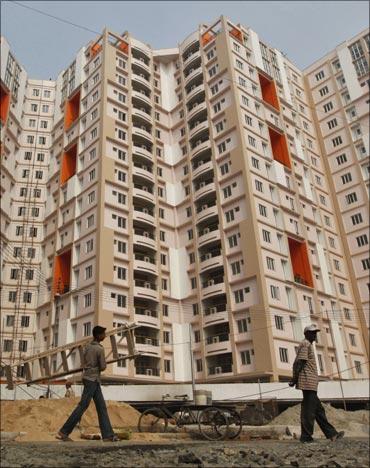

It's been a tough year for home buyers, as well as builders. With property prices continuing to hold steady or even rising for most of the year, the middle and even upper middle class have found themselves out of the market. But there are initial signs of correction.

According to data from the National Housing Bank, in the July-September quarter, prices of residential property fell in 10 of 19 cities.

Three chairpersons of realty firms and the chief executive officers say this shows where builders are going wrong and what lies ahead for the property market in the near future.

The consensus is clear. Builders have to cut prices to attract the latent demand, especially in bigger cities such as Mumbai, Delhi and the NCR.

...

Sanjay Dutt, executive managing director, South Asia, Cushman & Wakefield, says consumers do need respite from high prices of residential units and interest rates.

According to Pranab Datta, chairman at Knight Frank India, reasonably priced properties – Rs 30-75 lakh – continue to sell in big cities.

The solution lies in the re-caliberation of developers' bottom lines, to remain viable as businesses, says Anuj Puri, chairman of JLL.

...

'Freebies won't boost buying'

Anuj Puri

Chairman & Country Head, JLL India

Homes are not selling at the current price points. It is extremely doubtful that freebies and other such incentives would prove much of a booster in the current environment.

Since the only way to catalyse healthier sales at this point is offering buyers tangible financial relief, a certain reduction in rates, coupled with innovative payment schemes, as such schemes have proved effective in the past.

Having said that, no business can survive just on the basis of breaking even and definitely not on a loss-making model. In real estate development, a certain profit margin in required to fuel future projects. Nobody is served if the supply pipeline dries up - this would, in fact, create even more upward pressure on prices.

...

The real estate market in Tier-II and Tier-III cities will be more stable because of lower property rates. And, due to the fact that they tend to be driven by a larger share of end users rather than investors.

Larger cities like Mumbai, Delhi and, to some extent Bangalore and Pune, do have a lot more investor activity. The higher the incidence of such activity is in a city, the sharper the upturns and downturns in the property market.

Much is being said about the fact that residential property prices are currently extremely high in Mumbai. However, ground realities of the development business also need factoring in.

...

While profitability is definitely an objective, builders have also been paying a lot more for developing their projects. To begin with, it can take up to two years to obtain the 60-odd permissions to begin construction of a project.

During this time, the cost of acquisition or even just holding the land for a project rises.

Cost of construction has gone up by 50 per cent. The first two quarters of 2013 will continue to be challenging in all segments of real estate. While there is a lot of inventory (residential) overhang especially in Mumbai and Delhi NCR, residential real estate developers will have to rethink their pricing strategy in these cities.

...

'Speedy approvals will curtail costs'

Sanjay Dutt

Executive Managing Director, South Asia, Cushman & Wakefield

Despite the large housing need, actual sales of residential units have been slow. This is primarily due to the prevalence of high capital values across most major metros, making these unaffordable for the majority of the population that actually needs it.

Capital values in Mumbai, NCR, Chennai and Pune have witnessed high escalation in 2012. Hyderabad and Kolkata have witnessed stable prices.

Classical economics suggests prices should witness a correction due to lower demand. However, with constraints such as high cost of capital, inflation and high input costs, prices are not expected to witness any significant drop in the near future.

...

Residential launches were delayed this year owing to uncertainties over regulations in Mumbai, Hyderabad and NCR. Given that cities such as Mumbai are witnessing high unsold inventories, especially in the Rs 1-3 crore price brackets, joint efforts are required by developers, government and financial institutions to help end this deadlock and bring down prices.

The government needs to look at a single window clearance system for speedy approvals, which would have a big impact on curtailing costs and ensuring timely deliveries.

Faced with slowdown in income rises and persistent inflation due to poor economic conditions, consumers need respite from high costs of units and high mortgage rates as they are finding it difficult to rationalise expenses.

...

'Flats worth Rs 30-75 lakh still selling'

Pranab Datta

Chairman,

Knight Frank India

Some of the principal cities have reported continuous decline in sales registrations. This slowdown was largely contributed by high prices, high interest rates and of course, the overall bearish sentiments compelling consumers to wait and watch. Demand for property in India far outstrips the current supply.

However, the unaffordable prices have resulted in a major chunk of this demand remaining latent. The rise in property prices in the recent years has been significantly higher than the increase in income levels.

...

Real estate market will continue to suffer as long as there is a mismatch in this equation. An analysis of the prominent listed entities in FY 2009-12 show 28 per cent rise in debt and 15 per cent decline in net profits. The problems could escalate in the future due to the slowdown and increasing cost of construction.

With the slowdown in the IT/ITeS sector, demand for residential properties in cities such as Bangalore, Pune, Gurgaon, Noida, Chennai and Hyderabad will be comparatively harder hit .

It must be mentioned that there is still a good demand for properties which are priced appropriately. In metros such as Mumbai, Bangalore, projects for residential flats in the range of Rs 30-75 lakh are doing well. This reaffirms that demand exists at right price.

...

'Slowdown only in certain pockets'

Keki Mistry

Vice Chairman and CEO, HDFC

There has been a slowing in certain pockets. However, barring these few exceptions, the growth in the residential housing sector across the country has been fairly good, especially after 2010.

In my view, we will continue to see a reasonably strong demand over a fairly prolonged period of time. This is largely due to the fact that for a majority of the people, housing in India is a necessity and not an investment.

We have a very under-penetrated market, with a massive shortage of housing in the country (according to a technical group constituted by the ministry of housing and urban poverty alleviation, urban housing shortage during the 11th Plan period is estimated at 26.53 million units). India also has a young population, with 60 per cent being below 30 years of age.

...

The average age of a home buyer in India is the mid-30s and, hence, as long as we can provide jobs to our young people, the demand for housing will remain insatiable.

In the metros, strong demand comes from the NCR, Pune, Bangalore and Chennai.

However, strong sentiment is also seen from Tier-II and Tier-III cities as well. Another important development to boost housing has been addressed by 'affordable housing' catering to a niche in the market, with prominent developers having launched projects in this segment across various cities.