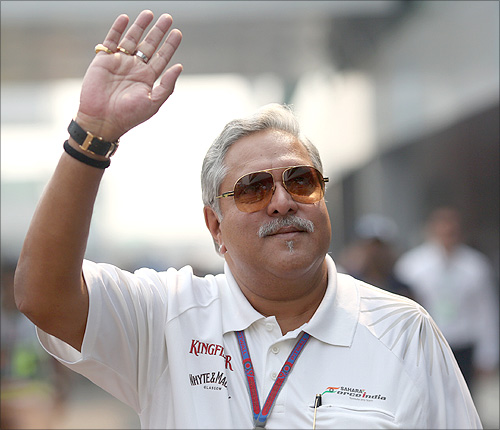

UB Group Chairman Vijay Mallya seems to have another battle in his hands.

In a surprise and hostile move, Pune-based Deepak Fertilisers & Petrochemicals Corporation has bought a 24.46 per cent stake in UB’s Mangalore Chemicals & Fertiliser in block deals worth Rs 180 crore (Rs 1.8 billion) from the stock market.

With Wednesday’s block deals, executed at an average price of Rs 61.75 a share, Deepak Fertilisers emerged as the holder of largest block of shares in MCF.

Mallya’s UB Group had pledged 11 per cent of its 22 per cent stake in MCF with banks to avail of loans to fund its now-collapsed Kingfisher Airlines.

Soon after the block deals were executed in the morning trade, MCF’s shares fell 9.94 per cent to close at Rs 56.20 on BSE.

UB Group, however, said in a statement “there is no takeover battle for MCF and UB Group will retain its control over the firm.”

Adventz Group’s arm Zuari Agro, which owns about 10 per cent stake, purchased in April, is the next biggest shareholder.

Adventz Chairman Saroj Poddar said Deepak was not acting in concert with Zuari.

“They must have seen a solid potential in MCF. That’s why they have bought those shares,” he said.

The shares were purchased by Deepak Fertilisers in the open market from an assortment of shareholders, including mutual funds, the firm said in an announcement to the stock markets.

Deepak Fertilisers is planning to launch an open offer for MCF in the next few days to increase its stake and give other shareholders an exit option, say banking sources.

When contacted, a spokesperson for Deepak Fertilisers declined to comment.

A UB group insider said the company was not selling the stake in the open market.

According to another source, JM Financial was advising Deepak Fertilisers on the transaction.

Deepak will use its own funds to finance the takeover of MCF. Last year, it had put on hold its Australian ammonium nitrate project, worth $350 million, following environmental, technical and economic reasons.

These funds would now be used for MCF's takeover.

But for UB, it's going to be a tough fight, as MCF is a profit-making company for the group.

Mallya had to earlier sell United Spirits to multinational Diageo to help repay loans to banks.

. . .

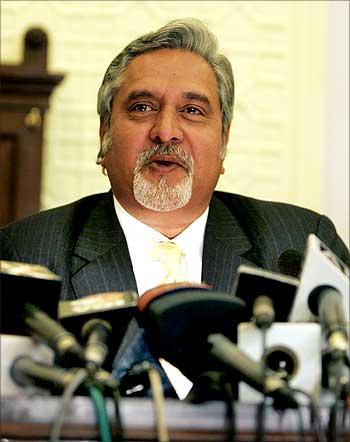

‘I do not think Mallya’s involved’

When Saroj Poddar, chairman, Adventz Group, bought 10 per cent stake in Mangalore Chemicals and Fertilizers in April via the group’s fertiliser arm Zuari Industries, he had told Business Standard he didn’t want any competitor to get the stake.

Now, in a sudden move, Deepak Fertilisers has bought a 24 per cent stake in MCF from the open market.

Shortly after the news, Poddar spoke to Digbijay Mishra on what he makes of the deal. Excerpts:

What do you make of this sudden buying by Deepak Fertilisers?

Well, I can only say they must have thought of MCF as a solid potential. That’s why they have bought those shares.

Is this development a spoilsport, especially when you were so keen to increase stake in MCF?

I can’t say that at this moment. We will sit and decide on what has to be done.

There is a buzz this move is influenced by Vijay Mallya?

I do not think he (Mallya) is involved in it.

After acquiring a 10 per cent stake in April, you were planning to meet Vijay Mallya. Is that happening any time soon?

That is for Mr Mallya to decide and his management will take a call.

What is going to be your next move? Would you try increasing your stake via open market buys?

No. I cannot comment on it as I have no idea what is going to be the next move. Let's wait for some time.

. . .

Not a takeover battle: UB Group

It’s a third-party sale and does not impact the promoter, an MCF insider said, requesting anonymity.

Deepak Fertilisers and Petrochemicals Corp’s acquisition of a 24.46 per cent stake in the UB Group-controlled Mangalore Chemicals and Fertilizers Ltd from the open market has ‘surprised’ the group led by liquor baron Vijay Mallya.

However, it tried to play down the development.

“There is no takeover battle for MCF.

“The UB Group will retain its control over MCF,” a group spokesperson said on Wednesday.

Sources added today’s share purchase would not affect Mallya’s control over the MFC immediately.

In today’s block deal, Guardian Advisors, promoted by the Burman family that owns Dabur, sold majority of its shares in MCF.

Guardian had held a 10.01 per cent stake in the fertiliser company.

Guardian built up its portfolio in MCF over the last two years.

Chennai-based investment company Indian Syntans Investments also sold its shares to Deepak Fertilisers.

It was one of the long-time shareholders in MCF. “It’s a deal that does not involve the promoters.

“The promoter has not sold his shares and continues to hold a 22 per cent stake in the company.

“It’s a third-party sale and does not impact the promoter,” an MCF insider said, requesting anonymity.

After acquiring the 10 per cent stake of Zuari Agro in April this year, Mallya was the single largest shareholder MCF.

After today’s transaction by Deepak Fertiliser, UB Group has become the second largest shareholder.

Of the 22 per cent stake held by the promoter, United Breweries Holdings has 16.07 per cent, United Spirits 0.01 per cent and McDowell Holdings controls 4.92 per cent, while the remaining 1.01 per cent is with Kingfisher Finvest India.

Mallya had pledged 57.38 per cent of the 22 per cent stake.

“It’s a surprise for me when I learnt that Deepak Fertilisers has taken a significant shareholding in MCF.

“Deepak Fertilisers is a respected name in the industry. I haven’t yet thought of whether I will stay further.

"It’s too early and I will have to understand on how today’s development will roll out,” said Deepak Anand, managing director, MCF.

Attempt to take over MCF by the competitors is not a new development.

Earlier, the Chennai-based SPIC had tried to take over the company, but it was not successful.

The company’s employees and trade unions had strongly opposed the move.

Taking control of MCF will be a big advantage for Deepak Fertilisers since MCF is the largest manufacturer of chemical fertiliser in Karnataka and meets 70 per cent of the fertiliser needs of the state.

The balance 30 per cent is sold in neighbouring Tamil Nadu and Andhra Pradesh.

MCF reported a 21.5 per cent decline in net profit at Rs 16.8 crore (Rs 168 million) for the quarter ended March 31, compared to Rs 21.5 crore (Rs 215 million) a year ago.

Net sales during the quarter were down 36 per cent to Rs 649.8 crore (Rs 6.49 billion) against Rs 1,014.7 crore (Rs 10.14 billion) in the year-ago period.