If a week is a long time in politics, a year must be equivalent to near-eternity and the next year may not be a good time for Indian investors.

The Lanka resolution at the United Nations provoked the exit of the Dravida Munnetra Kazhagam from the United Progressive Alliance (UPA) government.

This signals the likelihood of recurring bouts of political uncertainty until the next general elections at the very least.

Every sign of disagreement between the UPA's coalition partners will now be seen as a possible trigger for a no-confidence motion.

Investors hate political instability and with good reason when it comes to policy-driven, crony capitalistic economies like India.

...

The chances of substantive reform, and even of normal policy implementation, are both reduced in this environment. If the next general elections doesn't result in a stable majority for some coalition, the uncertainty could prevail for an more extended period.

This prospect makes domestic investors, who are bearish anyway, even more reluctant to look at risky assets. It could also spook foreign institutional investors (FIIs) who have supported the stock market in the past 12 months with over $25 billion (Rs 1,35,000 crore) in equity purchases.

The FIIs also bought $4 billion (Rs 22,000 crore) worth of debt in that period. Domestic institutions sold around Rs 23,000 crore of equity in the same period, while buying over Rs 5,00,000 crore of debt.

...

March has seen a reduction in FII buying, down to a net Rs 8,800 crore in the first three weeks, against a net Rs 43,000 crore in January and February combined. It has also seen a reduction in overall trading volumes.

Issues like the Cyprus banking crisis, and US Federal Budget cuts will also influence FII decisions. Both have negative implications since they could reinforce the "risk-off" attitude.

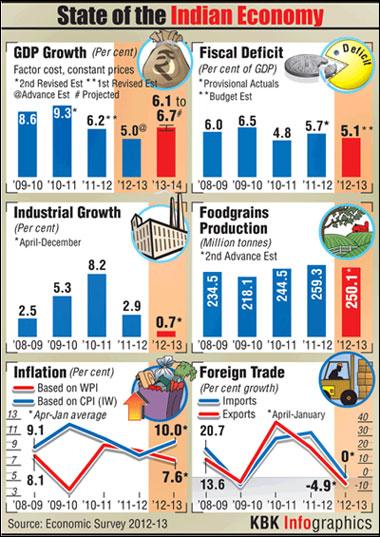

Regardless of what happens in Cyprus or Washington DC, the latest India economic data doesn't make it look like an attractive investment destination. Consumer inflation continued to run at above double-digits in February.

...

Overall wholesale inflation is running at near seven per cent even if "core" has reduced to under four per cent.

The Index of Industrial Production was barely positive for January on a low base. The Reserve Bank of India announced a minimum cut in the repurchase rate and the governor hinted he could do no more in the current circumstances.

The cut isn't likely to be passed onto bank customers since the banking sector is under pressure. Bank balance sheets of public sector undertakings (PSUs) are very stressed.

...

Private sector banks, which have valuations twice as high as their PSU counterparts, are reeling in the aftermath of the Cobrapost sting.

The Bank Nifty is down 10 per cent in the last month and down seven per cent in the five sessions since Cobrapost went public.

The gloomy statement accompanying the credit policy also contributed to the downtrend. The Bank Nifty is below its own 200 Day Moving Averages (200 DMA), which often signals a long-term bear market.

...

Banks are high-beta with respect to the overall economy and banking has the highest weight in the Nifty, Sensex and SX-40. So, this could cause a drawdown across the wider market.

Several other developments indicate that a broad segment of industries are under pressure. The auto industry has started offering discounts to push sales and clear inventory.

Real estate companies are showing increasing signs of desperation and of cash crunch, leading to stalled projects. India Inc has cut back on hiring with most of the Indian Institutes of Management having trouble achieving full placements.

Stocks in the non-precious metals industry (both steel and non-ferrous) are hitting concerted new lows on weak international prices.

...

International gold prices have also fallen almost 15 per cent from all time highs in 2012. This might put jewellers and non-banking financial companies (NBFCs) offering gold loans under pressure.

Manappuram Finance, a pawnbroking NBFC lending against gold as collateral, has announced it will book a Rs 50 crore loss in this quarter owing to defaults that it cannot fully compensate for, by auctioning gold it holds.

Muthoot Finance, which is the largest listed gold loan NBFC, has also seen a sell off on apprehensions of similar problems. Jewellers holding gold bought at 2012 rates may have to write down inventory.

However, lower gold prices should help reduce the current account deficit, assuming the trend lasts. It is possible that the Cyprus situation will lead hedge funds deciding to increase exposure in the precious metal if they fear it will cause more currency instability.

...

Technically speaking, the top-line stock indices are disconnected from the midcaps and small caps.

The midcaps and small caps are unequivocally in a bear market with massive falls through February and March. The ratio of advancing shares to declining shares is negative since January 2013.

The Nifty and the Junior have seen declines of seven per cent and eight per cent, respectively, in the past month.

The Nifty is just above its own 200 DMA, while the junior is at exactly the same levels as its 200 DMA. If the Nifty drops another 50-odd points, it will fall below its 200 DMA.

...

The 200 DMA is a generally reliable indicator of stock market health. It indicates the average prices of the past 10 months.

Since it is a lagged long-term indicator, when current price dips below the 200 DMA, it usually means a strong, persistent downtrend is in force. Purely on valuation terms, top-line stocks are trading at price-earnings of 17-18, while 2013-14 earning growth rates are pegged at 12-15 per cent.

This really doesn't look healthy from an investment perspective. Given the apparent lack of triggers to reverse sentiment, there could be further falls across the entire market.

There will be interim rallies of course, especially if the FIIs are prepared to take risks. But the long-term movement could be southward and a lot of investors will be looking to sell into rallies.