The second quarter results of banks show that net profits for the industry increased 57 per cent annually.

The private sector banks recorded a 64 per cent rise in profits, whereas the net profits of public sector banks jumped 50 per cent in this period.

A significant portion of this increase can be attributed to the rise in credit costs and a decline in non-performing assets (NPAs).

A decline in provisioning coupled with a double-digit credit growth has contributed to the stellar performance, especially for the public sector, which until a few quarters ago was reeling under losses.

Even though Non-Banking Financial Companies (NBFCs) have lost steam, with their share in total lending declining, credit growth has helped them improve their performance as well.

However, a Business Standard analysis found that an increase in credit may not be so fortuitous for public sector banks because it may be accompanied by more loans to the subprime borrowers — people who are more likely to default on loans.

These are high risk borrowers with low credit scores.

Analysis of data from the Reserve Bank of India’s Financial Stability Report shows that until March 2022, the ratio of subprime borrowers to total borrowers had increased for public sector banks.

While subprime borrowers accounted for a 27.1 per cent share in the overall loans disbursed by the industry until March 2022, the share for subprime loans in public sector banks' portfolio was a high 30.5 per cent.

In the case of NBFCs too, 28.9 per cent were disbursed to the subprime segment.

In contrast, in the private banks, the share of subprime borrowers was just 16.1 per cent.

While the share of subprime loans in private banks and NBFCs declined between September 2020 and March 2022, it rose from 29.7 per cent to 30.5 per cent for public sector banks.

This change is also accompanied by a transformation of lending patterns.

Non-food bank credit expanded 18.3 per cent in October compared to a year ago, the rise in the personal loans segment was 20.2 per cent.

Loans to the services sector expanded 22.5 per cent, whereas industrial loans rose by 13.6 per cent.

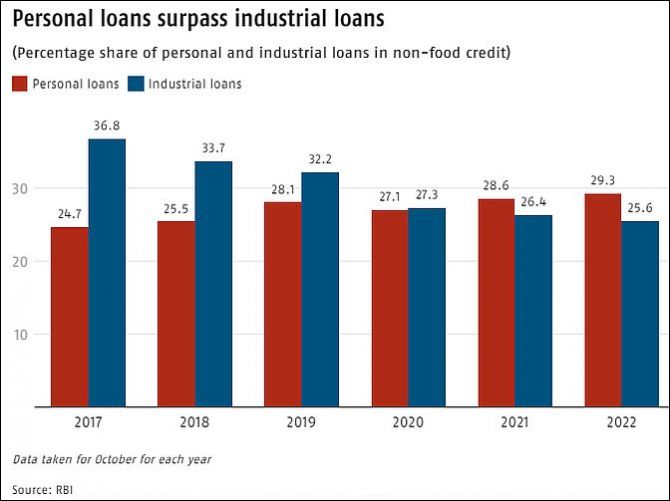

Over the last two years, personal loans have outstripped loans to the industry. Personal loans accounted for a 29.3 per cent share of the total non-food credit, whereas industry’s share was 25.5 per cent.

In October 2020, the ratios for personal and industry segments were 27.1 per cent and 27.2 per cent, respectively. But this trend cannot be just attributed to Covid-19. In 2017, personal loans had a 24.7 per cent share in credit and industry had 36.8 per cent share.

Within the personal loans category, the share of consumer durables and credit card outstanding have increased.

They registered a growth of 35.3 per cent and 45.4 per cent over the last two years, whereas housing and education loans have declined.

The gross NPA ratio in the credit card segment was 10.3 per cent for public sector banks, compared to 7.6 per cent across all loan categories.