Appreciation against other world currencies erodes export competitiveness

Appreciation against other world currencies erodes export competitiveness

The rupee has been remarkably resilient over the last 18 months. Most emerging market currencies have depreciated in double-digits against the dollar, while the rupee has managed to hold its own.

With the Reserve Bank of India strengthening India’s foreign exchange reserves, the rupee’s stability was almost taken for granted.

But with the People’s Bank of China unexpectedly devaluing its currency for successive days, the rupee’s strength is being tested.

The rupee’s strength might be good for markets and foreign investors but a resilient rupee has impacted export competitiveness, which will deteriorate further if the yuan continues to weaken.

The Chinese currency is expected to continue its downward journey, as it is overvalued by 30 per cent, despite this week’s depreciation.

The weighted average exchange rate of the Chinese yuan against a basket of 61 currencies is at 130.08, which suggests it will depreciate further, if the PBoC wants the currency to be more reflective of market forces.

When a currency trades above 100, then it is considered to be overvalued and if it trades below 100, it is considered under-valued.

UBS Global Research is of the opinion that the decision to devalue its currency signals Beijing’s willingness to let the yuan slide more against the dollar than previously.

Currency strategists now expect USD/CNY to trade at about 6.5 by 2015-end instead of 6.3, as previously envisaged and 6.6 at end-2016.

In contrast, India's rupee is overvalued by 10 per cent. The rupee depreciated by 4.5 per cent last financial year, due to higher capital flows.

However, the rupee has appreciated against all other major world currencies such as the euro, sterling pound and Japanese yen.

Jay Shankar, chief India economist and director, Religare Capital Markets, says: “The rupee appreciated against all other major currencies but the US dollar. It also means Indian exports have started becoming uncompetitive. Policy-makers in India might allow it to depreciate gradually by five per cent to 67 level.”

India's widening trade deficit with China is also a matter of concern, despite the rupee’s weakness. Ideally, a weak rupee should have deterred imports but India’s trade deficit with China has ballooned to $48.5 billion in FY15 from $2 billion in FY05, explains Nomura.

The deficit has deteriorated as India continues to import machinery and electronics, iron & steel and chemicals from China.

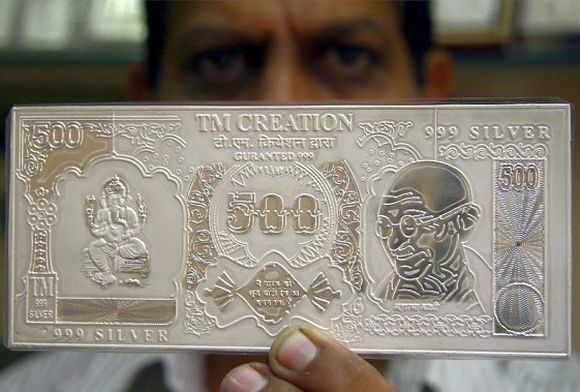

Image: A 500-rupee note made of silver. Photograph: Ajay Verma/Reuters