None of the e-commerce companies have managed to handle growth and profitability at the same time

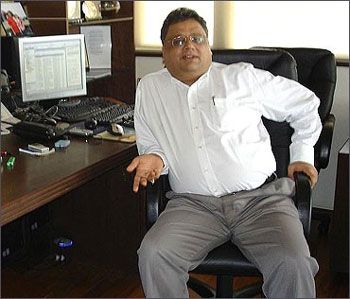

"Where is Flipkart's complete business model? Forget about valuation. I want to know Flipkart’s business model. I want to know how you will be profitable?" thundered Rakesh Jhunjhunwala in an interview to CNBC-TV18 with fellow investors Ramesh Damani and N Jayakumar.

"Where is Flipkart's complete business model? Forget about valuation. I want to know Flipkart’s business model. I want to know how you will be profitable?" thundered Rakesh Jhunjhunwala in an interview to CNBC-TV18 with fellow investors Ramesh Damani and N Jayakumar.

The discussion was on irrational valuations of e-commerce companies. When Jayakumar asked if these valuations is similar to the 2000 dot com party, Jhunjhunwala smirked and replied ‘You have any doubt’.

So why are smart investors shying away from investing in e-commerce companies like Flipkart, while private equity players are willing to bet on them?

In the CNBC interview, Jhunjhunwala raised questions on the completed business model. A business model is complete only when the company posts cash profit and becomes self-sustaining. Flipkart and other e-commerce companies are surviving on private equity money. None of them are profitable and nowhere close to being profitable in the near future. Jhunjhunwala is right in questioning the astronomical valuations commanded by these companies.

Flipkart raised nearly $2 billion in 2014 with the final tranche of $700 million being raised at a valuation of $11-12 billion. Flipkart’s valuation had zoomed in 2014 among the private equity players. The company raised $210 million in May 2014 at a valuation of nearly $3.5 billion, its second funding of $1 billion in July 2014 was done at a valuation of $7billion and the last one in December 2014 was around $11-12 billion. Valuations have jumped 3-4 times in a span of one year.

During this entire period, the company has shown no signs of becoming profitable. However, to its credit the company has grown rapidly in terms of gross merchandise value (GMV). Between 2013 and 2014, Flipkart has grown five times in volume terms and currently does a GMV of $4 billion. The company intends to double this to $8 billion (Rs 50,000 crore) by December 2015.

But does it make money. The answer is a clear no. As per data from the Registrar of Companies accessed by Mint, Flipkart India entities did business of Rs 3,035.8 crore (Rs 30.36 billion) and reported a loss of Rs 719.5 crore (Rs 7.19 billion) for the year ended March 2014. In FY13, these entities had posted a revenue of Rs 1,195.9 crore (Rs 11.96 billion) and loss of Rs 344.6 crore (Rs 3.45 billion).

But for Flipkart, making losses was a conscious decision. In an interview to Business Standard, the company’s promoters said, “Profitability is not a focus area. It’s a strategic decision. We can be profitable from today if we want. We can stop investing in one area and start making profits; it’s definitely possible. But we don’t want to remain as a small profitable company.”

This seems to be easier said than done. The company is now looking at tapping the equity markets for raising money and needs to tighten its belt and turn profitable. For this, the company has recently recruited Sanjay Baweja as its CFO.

This seems to be easier said than done. The company is now looking at tapping the equity markets for raising money and needs to tighten its belt and turn profitable. For this, the company has recently recruited Sanjay Baweja as its CFO.

The former Tata Communications CFO has already got into the cost cutting mode to streamline its operations. In an interview he said that the company is moving in a cost containment mode where their fixed costs will become smaller. The aim being to make most of the cost variable.

A back of the envelope calculation based on the numbers with the Registrar of Companies and the GMV data shows that Flipkart earns around 10-12 per cent of the GMV as revenue. But it’s cost of handling these goods are around 15 per cent. Since volumes are only ensured by huge discounts and high advertisement cost, cutting costs will not be easy.

The company will need serious cost cutting just to turn profitable. As Rakesh Jhunjhunwala said in the interview, the real companies who have given returns to investors had been built by the cash flows generated by the business and not by spending investor’s money. Flipkart has a long way to go.

Unfortunately, none of the e-commerce companies have managed to handle growth and profitability at the same time. The cash burn model of Flipkart is good to raise valuation in the opaque private equity market but in the real world (read equity markets), the company will have to show real profits and give returns to investors to raise more funds.

Since Flipkart’s model is a money guzzler, the real test of the company and the model will be post listing of the IPO. Had Flipkart been listed a few years back, they would not have been able to raise money as frequently as they did last year. Perhaps, we are nearing the doomsday when either the bubble will burst or we will have some rationality and fewer discounts in the e-commerce space.