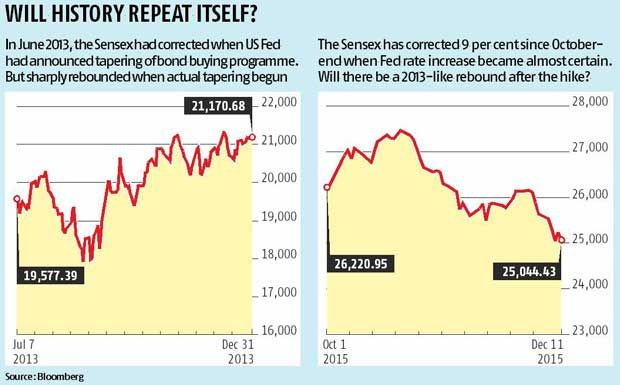

The benchmark Sensex fell about two per cent last week to 25,044, only 150 points above its one-year low.

Indian markets are expected to be on tenterhooks, as the US Federal Reserve is set to raise interest rates for the first time in a decade.

Global markets, which have priced in a 25-basis point rate increase, are keenly eyeing the accompanying forecast on path of future rate increases by the US central bank on December 16.

Increase of interest rates from near-zero levels will mark the end of the easy-money era that provided liquidity for emerging markets like India.

Domestic stocks, bonds and the rupee have already been on a downward slope spurred by sharp outflows from foreign investors.

The benchmark Sensex fell about two per cent last week to 25,044, only 150 points above its one-year low.

Despite central bank's interventions, the rupee declined 0.3 per cent to 66.89, compared to last week's close of 66.69 to a dollar.

The yields on the 10-year government bonds also rose to as much as 7.81, a three-and-a-half month high.

Foreign institutional investors pulled out nearly $2 billion from Indian stock and debt market since November.

"The market has overcorrected. Not only local but global markets, too, have sold off much more than what is the significance of the event. We could see a rally after the event is over," said Raamdeo Agrawal, managing director & co-founder, Motilal Oswal Financial Services.

About 90 per cent economists polled last week expect the US Fed to increase rates. And the market expects two or three rounds of increase in 2016.

"The rate hike has already got factored in. Emerging markets are prepared for a small hike but the future guidance will be more important," said Nirmal Jain, chairman, IIFL Holdings.

Emerging market currencies and stocks have already been bearing the brunt of a stronger dollar.

Fed rate increases is likely to lead to repatriation of capital in the US, which is expected to put further pressure on these markets.

"Different monetary policies of the global central banks in 2016 will likely result in strengthening of the dollar against other global currencies.

"The rupee will also likely depreciate against the dollar and the extent of depreciation will depend on the extent of increases in US Fed funds rates during the course of the year," said Sanjeev Prasad, senior executive director and co-head, Kotak Institutional Equities.

Analysts fear stocks could be de-rated, as increase in cost of capital could constrain expansion in valuations.

"Large liquidity had perhaps led to investors taking a more expansive view about the risks of investing in emerging markets," said Prasad, adding expensive stocks with moderate earnings could face the biggest risk of getting de-rated.

Even though Sensex valuations have come off from their peaks, it still trades at above 15 times its estimated one-year forward earnings estate.

Analysts say there is a risk of valuations coming down further if liquidity dries up amid sluggish earnings growth.

After getting an average $20 billion in the last three calendar years, FII flows this year into stocks have been less than $3 billion. The possibility of foreign flows increasing also look dim, as US is set enter a monetary tightening path.

After getting an average $20 billion in the last three calendar years, FII flows this year into stocks have been less than $3 billion. The possibility of foreign flows increasing also look dim, as US is set enter a monetary tightening path.

On the contrary, risk of outflows from emerging markets is high given the sharp drop in oil prices and possibility of further depreciation in China's yuan next year.

Abhay Laijawala, managing director & head of research, Deutsche Bank believes FII flows are likely to stay volatile at least in the early part of 2016.

"We believe that fears of an EM debt contagion continue to be a risk area and any sharp destabilisation to EM currencies following lift-off could bring back the volatility seen during September 2015," he said in a recent note.

Image: The Bombay Stock Exchange. Photograph: Reuters