Rising oil prices and diminishing cash pile to limit capacity in 2018-19

The Union government may have to settle for lower dividend income from public sector undertakings (PSUs) in the next fiscal year, as most large companies have already paid hefty interim dividends during the first 11 months of the current fiscal year.

Moreover, some state-owned companies dipped into their cash reserves to make payments in 2017-18.

Analysts said these two instances left little room for PSUs to step up dividend payment in the next fiscal year.

“Indian Oil and Oil and Natural Gas Corporation (ONGC) have been very generous with their dividend payouts in the current fiscal year, in line with a sharp rise in their profitability due to lower crude oil prices.

"This upside may not be present next fiscal year as crude oil prices are rising and electoral compulsions may force oil PSUs to defer raising fuel prices,” said Dhananjay Sinha, head of research, Emkay Global Financial Services.

Oil and gas PSUs such as Indian Oil, ONGC, Bharat Petroleum, Hindustan Petroleum and GAIL (India) have paid Rs 328 billion as interim dividend during the first 11 months of 2017-18, 22 per cent higher than their full-year dividend in 2016-17.

Indian Oil topped the dividend list with a total interim dividend payout of Rs 18,400 crore, more than twice its full-year dividend in 2016-17.

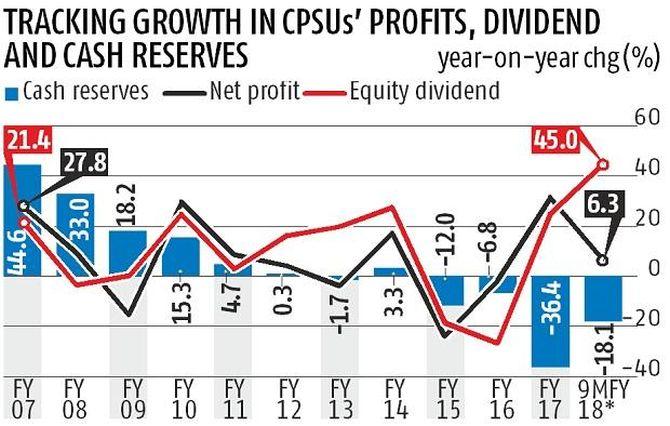

Overall, 18 non-financial central PSUs (CPSUs) have together declared Rs 506 billion worth of interim equity dividend during the current fiscal year, about 45 per cent more than the dividend paid by all 36 non-financial CPSUs during 2016-17.

Non-financial PSUs had paid equity dividend of around Rs 35,000 crore last fiscal year.

This cushioned the blow from a sharp cut in the dividend payout by the Reserve Bank of India (RBI) in 2017-18, down nearly 50 per cent from a year ago, which experts attributed to an increase in costs due to demonetisation.

“The next year is likely to be normal for the RBI and it may restore its dividend payout to its previous level.

"This should cushion a likely shortfall in dividend from commercial enterprises such as oil marketing companies and banks,” added Sinha.

The RBI is the single-largest source of dividend for the government, followed by energy firms such as Coal India and power utilities companies such as NTPC and Power Grid Corporation.

This is the second successive year of a sharp rise in dividend payout by oil CPSUs.

In 2016-17, the combined dividend payout by oil PSUs was up 355 per cent, while non-oil PSUs reported a 20 per cent decline, year on year.

So far, oil PSUs account for two-thirds of all dividends paid by non-financial PSUs in 2017-18, against 44 per cent in 2016-17 and 12 per cent in 2015-16.

Analysts said oil PSUs could find it difficult to raise dividend payouts next year.

“A fall in international crude oil prices provided an earnings bonanza for state-owned oil marketing companies and the government gained through hefty dividends.

"This bonanza may now dissipate, given the rise in crude oil prices in the last 12 months and the companies’ high dividend payout ratio,” said G Chokkalingam, managing director, Equinomics Research & Advisory.

The total dividend payout by oil PSUs during the current fiscal year was equivalent to 72 per cent of their net profits during the first nine months of 2016-17, making it tough for them to raise the ratio in 2017-18.

The ratio of dividend to net profit is called the dividend-payout ratio.

Growth in interim dividend in FY18 compared to full-year dividend in FY17; Change in cash reserves during H1FY18 over the corresponding period a year ago Compiled by BS Research Bureau ' Source: Capitaline

The government’s dividend income is also constrained by from poor profitability and declining cash reserves of large non-oil CPSUs such as Coal India, National Mineral Development Corporation, NTPC and Power Grid Corporation.

The combined cash reserves of 36 listed non-financial CPSUs were down 18 per cent during the first half of 2017-18 over the corresponding period a year ago.

Cash balances were down 36.4 per cent, year on year in 2016-17.

The trend is likely to continue in 2018-19 as large dividend payers are making the payments by depleting their cash reserves rather than from their higher profits.

For instance, Coal India declared an interim dividend of Rs 123 billion for 2016-17, more than twice its net profit during the first nine months of 2017-18.

The company’s cash balances were down 24 per cent during the first half of 2017-18 over the corresponding period a year earlier, and have halved from an all-time high of Rs 62,300 crore in March 2013.

NMDC’s cash balances were down 27 per cent during the first half and down from a record high of Rs 21,000 crore at the end of 2012-13.

In all, non-financial PSUs reported total cash balances of Rs 1.04 trillion at the end of September 2017, down from a record high of Rs 2 trillion at end of 2013-14.

Analysts said there could be greater reliance by the government on stake sales in non-strategic and smaller CPSUs to plug the revenue shortfall.

“To make up for lower dividend income from big CPSUs, the government is likely to accelerate divestment and stake sales in smaller and non-strategic companies,” said Chokkalingam.

Photograph: Reuters