The Supreme Court on Wednesday directed DLF, the country’s largest real estate player, to deposit Rs 630 crore (Rs 6.3 billion) in the registry within three months.

The Supreme Court on Wednesday directed DLF, the country’s largest real estate player, to deposit Rs 630 crore (Rs 6.3 billion) in the registry within three months.

The court rejected the company’s request for a stay on the Competition Commission of India’s order in a case related to abuse of market dominance.

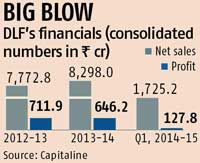

The penalty is a little less than the company’s annual net profit of Rs 646.21 crore (Rs 6.46 billion) in 2013-14.

The final court order is yet to come.

Following a petition by flat buyer associations of two DLF projects in Gurgaon — DLF Park Palace and The Belaire -- CCI had in 2011 found DLF abusing its dominant position.

The competition watchdog had imposed a penalty on the company and asked it to modify apartment buyers’ agreement.

The buyers had alleged delays in project completion and claimed there was an increase in the number of floors over that planned earlier.

Subsequently, DLF had moved the Competition Appellate Tribunal (Compat) and got a stay order on the penalty.

But Compat recently dismissed the DLF plea and the case was challenged in the Supreme Court.

Responding to Wednesday’s court order, DLF said in a statement that it had been directed to deposit Rs 630 crore in an interest-bearing fixed deposit for the duration of the appeal proceedings.

The entire deposit is subject to the Supreme Court’s final decision.

“DLF will take all steps to comply with the directions of the Supreme Court and remains confident of the merit of its case,” the company said.

Meanwhile, in another case, DLF has again come under CCI’s scrutiny for allegedly drafting a one-sided agreement with buyers of its flat in Gurgaon’s New Town Heights project.

CCI has not yet taken a decision in this matter.

For the April-June quarter this financial year, DLF reported a 29 per cent decline in its consolidated net profit to Rs 127.77 crore (Rs 1.27 billion).

At this rate, the company’s profit for the full year might be close to the fine it has to pay.

Its total income from operations in the quarter declined 25 per cent to Rs 1,725.17 crore (Rs 17.25 billion).

The realty firm’s shares on Wednesday declined 4.44 per cent on BSE to close at Rs 183.05 apiece.

The Supreme Court Bench, presided over by Ranjana Desai, asked the company to deposit Rs 50 crore (Rs 500 million) within three weeks and the rest within three months.

The Supreme Court Bench, presided over by Ranjana Desai, asked the company to deposit Rs 50 crore (Rs 500 million) within three weeks and the rest within three months.

The court also asked the company to file an affidavit undertaking to pay interest at the nine per cent rate, as ordered by Compat, or the amount determined by the Supreme Court, ultimately.

The interim order was passed on three appeals moved by DLF. These appeals were admitted and the final decision will be taken after hearing all sides.

Analysts see the court order encouraging more buyers to stand up against real estate developers in a market where delays in delivery, along with loopholes in buyer-developer agreements, are rampant.

In a recent case, the Allahabad High Court had ordered demolition of two towers in Supertech’s Emerald Court project on a petition filed by resident welfare associations alleging the company increased the number of floors without taking the required permission from the existing owners and violating the UP Apartments Act by not keeping the mandatory 16-meter distance between two towers.

The case is pending with the Supreme Court.

Also, last week, Parsvnath was directed by a consumer forum to pay Rs 700,000 to a buyer for unfair trade practices.

In the DLF case, senior counsel Harish Salve argued in the Supreme Court on Wednesday that the company was not a dominant entity attracting the provisions of the Competition Commission Act, so the penalty was excessive, and the agreement between the builder and the flat buyers were entered into before the law came into force.

CCI’s counsel Amit Sibal objected to a stay on the CCI order, arguing that a message needed to be sent that all builders abusing their dominant position will be visited with deterrent orders.

If DLF was shown any leniency, 117 other real estate companies in the country would also violate agreements with disadvantaged consumers in the same manner, he said.

Sibal argued DLF had brazenly continued its unfair practices and not made any payment so

He also submitted that three authorities below the court had found the company guilty.

The penalty would also be a big blow to DLF’s financial health.

The company has been selling its non-core assets to reduce its debt, which stood at over Rs 19,000 crore (Rs 190 billion) at the end of June this year.

It recently sold luxury hotel chain Aman Resorts and got a refund from Delhi Development Authority earlier this year.

On the Supreme Court order, Sanjay Sharma, managing director of Qubrex, a real estate consultancy firm, said: “Buyers are active like never before.

With such a strong online medium, an increasing number of buyers is joining hands to protest against developers’ tyranny, especially when the developer has no explanations for delayed deliveries.”

Given a rise in consumer agitation, many developers are making changes to their agreements with buyers.

They now arm themselves by stipulating longer delivery deadlines than earlier, a step that they expect will minimise their legal liabilities. Now, instead of two or three years, the developers promise delivery of flats in five years in the case of skyscraper residential buildings.

The purchase agreements also include revised penalty norms against failure to deliver on time, aimed mainly at instilling confidence among buyers.

| CCI IN ACTION Cases where big firms allegedly abused market dominance |

| August 12, 2011 FIRMS INVOLVED: Realtor: DLF ISSUE: Home buyers associations allege DLF is abusing its dominant market position to delay Gurgaon projects FINE: Rs 630 crore June 20, 2012 FIRMS INVOLVED: Cement firms: ACC, UltraTech, Grasim (now part of UltraTech), Jaypee Cements, Lafarge India, JK Cements, India Cement, Madras Cement, Century Cement, Binani and Ambuja ISSUE: The companies were found guilty of price cartelisation (industry body Cement Manufacturers Association also fined) FINE: Rs 6,307 crore* October 10, 2012 FIRMS INVOLVED: Tyre makers: J K Tyre, Apollo Tyres, Birla Tyres, Ceat Tyre, MRF, Dunlop India, Goodyear India, Bridgestone India, Michelin India Tyres ISSUE: Information sought from companies over allegations of cartelisation FINE: No fine imposed as the charge was not proved August 25, 2014 FIRMS INVOLVED: Car makers: Maruti Suzuki, Tata Motors, Honda Siel Cars India, Volkswagen India, Fiat India, BMW India, Ford India, General Motors India, Hindustan Motors, Mahindra & Mahindra, Mercedes-Benz India, Nissan Motor, Skoda India and Toyota Kirloskar Motor ISSUE: Anti-competitive practice and abuse of dominant position in the after-sale service market FINE: Rs 2,544.64 crore |