Out of the total FDI inflows of $31 bn received during April-March 2014-15, the services sector accounted for almost 17% of the cumulative inflows.

Despite the government's efforts to increase investments in the manufacturing sector to boost its growth, services sector still continues to attract most foreign direct investment (FDI).

Despite the government's efforts to increase investments in the manufacturing sector to boost its growth, services sector still continues to attract most foreign direct investment (FDI).Out of the total FDI inflows of $31 billion received during April-March 2014-15, the services sector accounted for almost 17 per cent of the cumulative inflows.

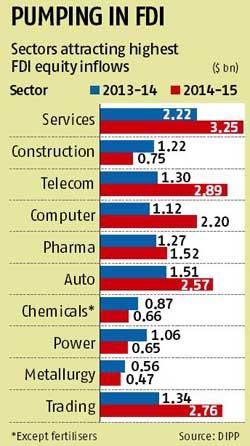

During April-March 2014-2015, the services sector received foreign capital to the tune $3.25 billion compared to $2.22 billion in the corresponding period of 2013-2014, according to data by the Department of Industrial Policy and Promotion (DIPP) under ministry of commerce and industry.

The services sector consists of financial, banking, insurance, non-financial/business, outsourcing, R&D, courier, technology testing and analysis.

The services sector was followed by construction development, telecommunications, computer software and hardware and drugs and pharmaceuticals. The ranking is done in terms of the share of these sectors in the country's total FDI.

Sectors such as telecommunications, automobile industry and computer software and hardware received FDI worth of $2.89 billion, $2.57 billion and $2.20 billion respectively.

According to experts, the manufacturing sector will see a turnaround in terms of FDI inflows only during the last couple of quarters of the present financial year.

"The Make in India programme brought out a positive change

in the sentiment that India is open for business, but not in terms of change in numbers. Some key reforms are needed to go through for the manufacturing sector to be the topmost in terms of the land bill getting passed and the coming of goods and services tax (GST). Steps have been taken in the positive direction," said Prashant Mehra, partner, Grant Thornton India LLP."div_arti_inline_advt">