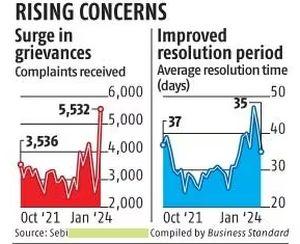

As many as 5,532 complaints were received by the regulator in January, an 80 per cent increase over the number of complaints filed in the previous month.

Complaints made to the Securities and Exchange Board of India (Sebi) have seen a sharp rise in January.

As many as 5,532 complaints were received by the regulator in January, an 80 per cent increase over the number of complaints filed in the previous month.

This is also twice the 2023 low. Sebi had received 2,321 complaints in February 2023, the lowest figure since October 2021.

Complainants lodge their grievances on the Sebi Complaints Redress System (SCORES).

The complaints can be against listed companies as well as intermediaries registered with the regulator.

This, according to the portal, covers 'complaints arising out of issues that are covered under the Sebi Act, Securities Contract Regulation Act, Depositories Act, and rules and regulations made under relevant provisions of the Companies Act, 2013.'

The total number of pending complaints has risen to 5,371. The surge has come despite higher resolutions by the regulator. It closed 3,941 complaints in January.

This is higher than the 3,780 complaints pending at the beginning of the month. New complaints have largely led to the increase in pendency.

Pending actionable complaints had declined in the previous financial year.

In fact, with a little over 2,000 grievances in financial year 2022-23 (FY23), grievances pending resolution were at the lowest in over a decade, most of them for less than 3 months, according to the Sebi annual report 2022-23.

Over 49,000 complaints were pending in FY09. About half of all these complaints during FY23 were received in the Maharashtra head office followed by states in the northern region (including Delhi, Uttar Pradesh, Jammu and Kashmir among others).

Most of the complaints in FY23 were against stock brokers. This was followed by complaints against refunds, allotment, dividend, transfer, bonus, rights, redemption, and interest.

The rise in the number of pending grievances comes despite the fact that there is a decrease in the average resolution time of complaints in January.

The average time taken to resolve a complaint in January was 35 days. This was a substantial decrease in resolution time over the previous months.

It took over 40 days to redress grievances in November and December 2023. The average annual resolution time in 2023 was 35 days compared to 28 days in 2022.

Of the complaints in January, 16 were pending for more than 3-months, six of which were against venture capital funds, four each against investment advisors and alternate investment funds. Two were against research analysts.

The Securities Appellate Tribunal had criticised the functioning of the portal in an order in August 2023, noting that it merely forwards complaints about the intermediary to the concerned entity.

It then forwards the reply to the complainant and treats the complaint as closed.

"Sebi is required to consider whether the complaint infringes any provision of the Sebi Act and its regulations and if it finds that the complaint is genuine... then it is an onerous duty of Sebi to direct the company, registered intermediary or recognized Market Infrastructure Institution to sort out the complaint or initiate proceedings for violation of the securities laws," it noted.

Feature Presentation: Aslam Hunani/Rediff.com